February 28, 2020

Illinois Governor JB Pritzker’s second budget proposal avoids many of the pitfalls of his initial budget recommendation. The proposed budget for the fiscal year that begins on July 1, 2020 makes the full pension contribution required by State law and does not depend on one-time revenues that will not be available in future years.

Instead, the FY2021 budget relies on revenue that will only be available upon approval of a constitutional amendment in November 2020. If voters reject the shift from a flat-rate income tax to a graduated rate structure, then the budget proposes spending cuts and revenue holdbacks that would affect schools, public universities, healthcare providers and funding for local governments.

The recommended $42.0 billion general operating budget, which was presented on February 19, is $2.0 billion, or 5.1%, above estimated FY2020 spending of $40.0 billion. The proposed spending increase is supported by an estimated $1.4 billion in revenues from the graduated tax, as well as by projected growth in existing revenue sources. The $1.4 billion estimate assumes that the new income tax structure takes effect midway through the fiscal year, on January 1, 2021.

Although the Civic Federation has not completed its analysis, there are questions about whether the proposed use of potential graduated income tax proceeds is appropriate in light of the State’s severe financial pressures. There are also concerns about the long-term cost of the alternative measures proposed in the event that the constitutional amendment does not pass.

If the graduated tax is approved, the Governor’s budget would use only a small portion of the proceeds—$100 million in FY2021 and $200 million in FY2022—to reduce the State’s massive unfunded pension liability, which recently totaled about $137 billion. The proposed budget would not make a dent in the backlog of unpaid bills, which stood at close to $7 billion at the end of January. Without the new revenue from a graduated tax, the FY2021 budget proposes certain actions that could increase the bill backlog.

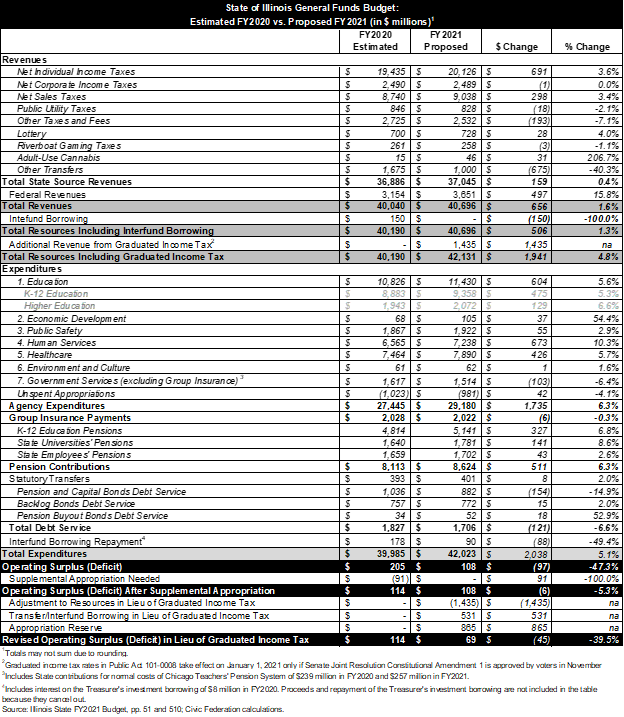

The following table compares the Governor’s proposed budget plan for FY2021 with estimated budget results for FY2020.

Revenues

Without a graduated income tax, FY2021 General Funds revenues are budgeted at $40.7 billion, an increase of $656 million, or 1.6%, from $40.0 billion in FY2020, not including interfund borrowing. Total resources will increase by $1.4 billion, or by a total of 4.8%, to $42.1 billion in FY2021 if the graduated income tax is approved.

Illinois has had a flat tax rate—currently 4.95% for individuals—since the State’s income tax was instituted in 1969, but Governor Pritzker has made it a priority to amend the Illinois Constitution to allow a graduated income tax. Last year, at the Governor’s urging, the General Assembly approved an amendment to be placed on the November 2020 ballot, as well as a new graduated rate structure that will take effect only after passage of the constitutional amendment.

The new rates start at 4.75% and increase to a maximum of 7.99% for single filers with taxable incomes over $750,000 and joint filers with taxable incomes over $1 million. Above those income levels the graduated tax structure is no longer applied—all taxable income is assessed at the highest rate. The legislation would also increase the corporate income tax rate from 7.0% to 7.99%. The graduated rate structure is projected to generate an additional $3.6 billion for a full fiscal year.

Excluding graduated income tax revenues, FY2021 individual income tax revenues are projected to increase by $691 million, or 3.6% from FY2020. The growth rate is above the 3% growth rate included in a five-year forecast issued by the Governor’s Office in October 2019. The higher projection boosts projected revenues by about $106 million. Revenue from the State sales tax is budgeted at $9.0 billion in FY2021, an increase of $298 million, or 3.4%, from FY2020 estimates and is somewhat more favorable than the 3.1% increase in the five-year forecast. The more optimistic revenue increase projections for income and sales tax revenues in FY2021 are due to a somewhat more favorable economic outlook by the forecasting firm HIS Markit, with lower near-term recession risk than was projected last fall.

Sales tax revenues are also higher in both FY2020 and FY2021 due to a number of bills that were signed into law in recent years. Public Act 100-0587 expanded use tax collections requirements for remote retailers beginning October 2018, Public Act 101-0009 extended use tax collection requirements for marketplace facilitators beginning January 1, 2020 and Public Act 101-0604 will require remote retailers and marketplace facilitators to remit state and local retailers occupation tax rather than state use tax beginning January 1, 2021. There was also a limit placed on the trade-in credit for small passenger vehicles to the first $10,000, which is projected to generate $15 million in FY2020 and $40 million in FY2021.

In FY2021 the sale of adult-use cannabis is projected to generate $46 million in General Funds revenue. This is an increase of $31 million from a partial year of sales in FY2020. The sale of adult-use cannabis began on January 1, 2020. As with all new sources, the amount of revenue produced is more speculative than with established sources. The budget projections for FY2020 and FY2021 are “informed by growth and market characteristics of other legal adult-use cannabis states,” and do not include advancing revenues from future years, as proposed in the Governor’s first budget. On February 24, 2020, after the release of the Governor’s budget, the Illinois Department of Revenue announced that the sale of adult-use cannabis exceeded projections by generating $7.3 million in cannabis tax revenue and $3.1 million in sales tax revenue for the first full month of sales.

Other transfers will see the largest decline over the two-year period, dropping by $675 million or 40.3%. This is largely due to a $447 million reduction in transfers from the Income Tax Refund Fund. Income tax revenues are diverted to the Income Tax Refund Fund to pay tax refunds owed to individuals and businesses. The Illinois Income Tax Act requires that any surplus in the Refund Fund must be transferred to General Funds in the following fiscal year.

Federal revenues are budgeted to increase by $497 million, or 15.8% above FY2020 estimates to $3.7 billion in FY2021. Federal revenues are largely related to reimbursements for State Medicaid spending and depend on the timing of the State’s payments of Medicaid bills.

The FY2019 and FY2020 budgets diverted 5% of sales and income taxes that are supposed to be statutorily transferred to local governments and transit funds in order to increase State revenues and help balance the budget. The proposed FY2021 budget maintains only the 5% hold back for local governments and the Downstate Public Transportation Fund and Public Transportation Fund if the graduated income tax is passed.

Unlike Governor Pritzker’s proposed FY2020 budget, the FY2021 budget proposal does not rely on one-time revenues or new taxes, aside from the graduated income tax. Most of these FY2020 ideas were not included in the enacted FY2020 budget. The Governor’s FY2020 proposal included a tax amnesty program that was projected to bring in $175 million in General Funds revenue in FY2020 that otherwise would have been collected over several years. The amnesty program, which was enacted and ended in mid-November, brought in about $144 million based on the most recent figures (net of tax refund deposits and distributions to local governments), although receipts are still being verified and the total is expected to increase.

Expenditures

Proposed FY2021 General Funds spending of $42.0 billion represents an increase of $2.0 billion, or 5.1%, from $40.0 billion in FY2020. The FY2020 expenditure figures do not include the administration’s requested supplemental appropriations of $91 million related to costs of the Departments of Children and Family Services (DCFS) and Human Services (DHS) and the State Board of Education.

Agency spending—excluding pension contributions, group insurance payments and required transfers for debt service and other purposes—increases by $1.7 billion, or 6.3%, to $29.2 billion from $27.4 billion in FY2020. Proposed FY2021 net agency spending is $350 million higher than the $28.3 billion net agency spending shown in the October 2019 forecast, mainly due to increased funding for human services.

Pensions

General Funds contributions to the State’s five retirement systems increase by $511 million, or 6.3%, to $8.6 billion in FY2021 from $8.1 billion in FY2020. The State’s FY2021 contributions fully satisfy the State’s 50-year pension-funding plan, which requires 90% funding by FY2045. Total General Funds pension costs—including debt service on pension-related bonds—is $9.4 billion, or 25.3% of projected State-source revenues.

Governor Pritzker’s FY2020 budget attempted to reduce pension costs through a seven-year extension of the schedule for paying down pension debt. The proposal was the most controversial aspect of a five-point plan that was budgeted to save $1.1 billion and included the sale of pension obligation bonds. The Governor cancelled the FY2020 pension holiday and the pension bond sale after an unexpected surge in income tax revenues in April 2019 allowed the administration to boost revenue projections for FY2020.

Another part of the FY2020 proposal involved evaluating the feasibility of transferring State assets to the pension funds to improve their funding levels. In February 2019, the Governor created two pension-related task forces: one to identify potential assets to shift to the funds’ books and another to consider the consolidation of local and State funds. The consolidation task force’s report in October 2019 resulted in a law requiring consolidation of the assets of the State’s 649 public safety pension funds, excluding Chicago’s, to improve investment returns and reduce administrative costs. This action is not expected to have a direct impact on the State budget. The asset transfer task force has not yet issued a report, although the FY2021 budget book says the group’s recommendations are pending.

Although pension contributions for FY2021 meet statutory requirements, it should be noted that they fall far short of the amounts recommended by the funds’ actuaries, as well as the contributions needed to keep the State’s unfunded liability from growing. The retirement systems were 40.3% funded as of June 30, 2019, and the total unfunded liability is expected to continue increasing through FY2028.

Education

The FY2021 budget proposes an increase of $604 million, or 5.6%, in General Funds appropriations for education to $11.4 billion from $10.8 billion in FY2020. The budget includes an additional $475 million for preschool to secondary education, which covers a $50 million increase for early childhood education and a $350 million increase for the State’s evidence-based funding formula, the minimum target amount established in the 2017 school funding reform law.

Higher education funding increases by $129 million, or 6.6%, in the FY2021 budget to $2.1 billion from $1.9 billion in FY2020. The proposed increases include $55.6 million for public university operations, $14.9 million for community college operations and $50 million for Monetary Award Program tuition grants for low income college students.

The FY2021 budget for higher education also includes $27 million to begin stabilizing College Illinois!, the State’s prepaid tuition program operated by the Illinois Student Assistance Commission (ISAC). The program had an unfunded liability of $317.5 million as of June 30, 2019, according to the budget, and ISAC has not entered into new prepaid tuition contracts since the 2017-2018 academic year because of the program’s financial problems.

Human Services and Medicaid

Proposed General Funds appropriations for human services increase by $673 million, or 10.3%, to $7.9 billion from $7.5 billion in FY2020. The appropriation increase of $147 million for the troubled DCFS (net of reductions in funding from other State funds) covers expanded staffing, caseload growth and higher reimbursement rates for outside child welfare agencies. DHS receives an additional $381.3 million, including more funding for community care for the developmentally disabled, home services for those with severe physical disabilities and subsidized child care for working families. General Funds appropriations for the Department on Aging increase by about $100 million, mainly for higher reimbursement rates for senior caregivers in the Community Care Program.

General Funds appropriations for the State’s main Medicaid agency (shown as Healthcare in the table) increase by $426 million, or 5.7%, to $7.9 billion in FY2021 from $7.5 billion in FY2020. The additional costs reflect minimum wage and provider reimbursement rate increases and the first full year of the reduced 90% federal matching rate for the Affordable Care Act’s Medicaid expansion. Additionally, State funding increases by $42.5 million for Integrated Health Homes Services, a care coordination program for individuals with chronic conditions that is 90% funded by the federal government for the first two years.

Medicaid appropriations cover spending from both State resources and federal matching funds. It is important to understand that most Medicaid appropriations are from other State funds rather than General Funds. In FY2021 total appropriations for the Department of Healthcare and Family Services are nearly $27 billion, of which less than 30% are from General Funds. As discussed here, the State collected $1.1 billion in additional federal revenues in FY2020 due to a new tax on managed care organizations that will continue to provide recurring federal receipts.

Other Areas

Funding for Government Services, excluding group insurance, declines by $103 million, or 6.4% to $1.5 billion in FY2021 from $1.6 billion in FY2020. The decrease partly reflects an additional State payment of $150 million to the State Employees’ Retirement System in FY2020 to address a shortfall in FY2019 contributions to the system. Government Services appropriations in FY2021 include a supplemental State contribution of $38 million to the College Insurance Program (CIP), which provides health insurance for community college retirees outside of Chicago. The additional funding is part of a plan to reduce the program’s backlog of unpaid bills by increasing contributions from active employees, employers and the State over the next six years.

The FY2021 budget proposes an increase of 1,646, or 3.0%, in authorized agency headcount to 57,137 from 55,491 in FY2020. The administration recommends significant staffing increases at human services and public safety agencies, which account for 76% of State employees, as well as at the Department of Employment Security to improve administration of the unemployment insurance program. Headcount has fallen from a peak of 69,970 in FY2001 due to retirements, attrition and layoffs without replacements.

Group insurance, which mainly covers State employee and retiree health insurance, remains virtually flat in FY2021 at about $2 billion. Savings on group health insurance under union contracts account for $175 million of the more than $225 million in government efficiency savings announced by the administration shortly before the FY2021 budget was released. However, it was not immediately clear how much of the $175 million savings related to other State funds rather than to General Funds. Additionally, it could not be determined how much salary increases under collective bargaining agreements offset health insurance savings in FY2021.

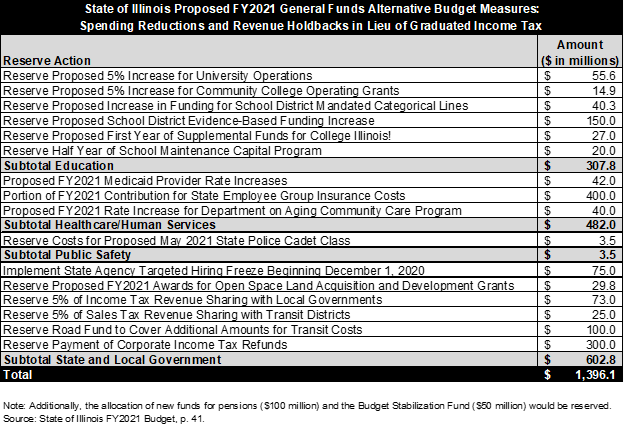

Alternative Measures in Lieu of Graduated Income Taxes

If the graduated income tax amendment is not approved, the Governor proposes to reduce General Funds spending by $865 million and divert to General Funds $531 in revenues that would have been distributed to other State accounts. These appropriations and revenues would be held in reserve pending the outcome of the November 2020 election. The alternative plan would also eliminate the $100 million supplemental pension contribution in FY2021 and a proposed $50 million payment to the State’s nearly depleted rainy day fund.

The following table shows the alternative measures presented in the FY2021 budget.

The largest item in the alternative plan is a $400 million reduction in group insurance payments, which represents nearly one-fifth of budgeted FY2021 General Funds group insurance spending. The unpaid costs would add to the State’s backlog because health insurance payments are required under State law and union contracts. Even if the payment is made, the budget projects $1.2 billion in unpaid health insurance bills at the end of FY2021.

Without the graduated income tax, $300 million in income tax revenues would be kept for General Funds purposes rather than being used to pay for corporate tax refunds. The diversion could result in the accumulation of unpaid corporate tax refunds for the first time in several years, depending on the amount of refunds owed by the State.

A similar revenue holdback would apply to income tax distributions to local governments and sales tax distributions to public transit districts. Additional diversions of 5% to General Funds in the second half of FY2021 would amount to estimated revenue reductions of $73 million for local governments and $25 million for transit districts. The State’s Road Fund would also cover $100 million in payments to local transportation agencies that otherwise would have come from General Funds.

The most controversial aspect of the alternative plan among advocates and legislators is the proposed reduction of $150 million in school funding, which would cut the projected increase in formula-based funding in FY2021 to $200 million. Even if the funding is ultimately released, school administrators have expressed concern about how to make budget and staffing decisions in the face of uncertainty about State distributions in the upcoming year.

Budget Deficit and Bill Backlog

The Governor’s proposed FY2021 budget has an operating surplus of $108 million if the graduated income tax is approved and $69 million if the graduated tax is not approved.

That compares with a projected FY2021 operating deficit of $1.8 billion in the October 2019 forecast. The projected gap was closed mainly with graduated tax revenues (or alternative measures), as well as increased base revenue projections. Additional agency spending was offset by lower than projected debt service transfers, partly due to the availability of video gaming revenues to cover those expenses.

The backlog of bills is virtually unchanged at the end of FY2021 at about $7.5 billion on a budgetary basis. There is statutory authority to sell an additional $1.2 billion of bonds to reduce the backlog, on top of the $6 billion issued in late 2017, and the administration had planned to go to market in March 2020. However, there are no current plans to issue the bonds, which also reduced projected debt service transfers in FY2021 from the October 2019 forecast.