July 14, 2025

by Lily Padula

Please note: This report reflects the most current information available as of July 10, 2025. For more details on how Medicaid works and information on previous proposals, please refer to our Medicaid Explainer, published in May 2025.

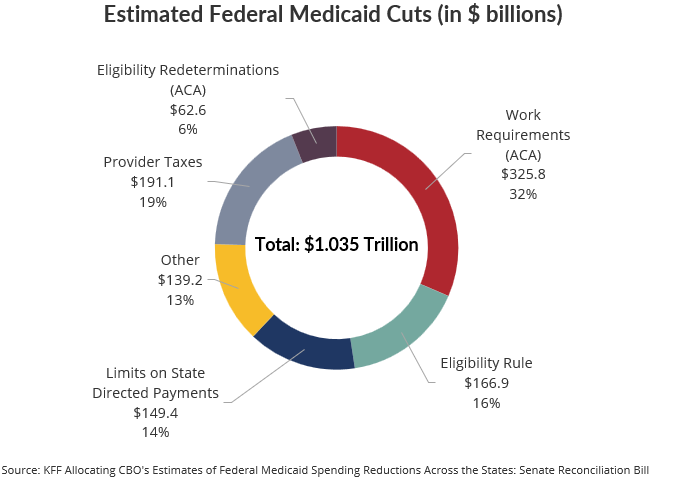

On July 4, 2025, President Trump signed into law a major budget reconciliation bill that significantly reduces federal Medicaid spending, surpassing the cuts proposed in the House version passed in May. Narrowly approved by both chambers of Congress (51-50 in the Senate and 218-214 in the House), the law reduces federal Medicaid expenditures by an estimated $1.035 trillion over ten years, or approximately 15%. This marks an increase from the 12% reduction in the initial House version. The most substantial cuts target states that adopted the Affordable Care Act (ACA) Medicaid expansion, which accounts for an estimated $526 billion of the total reductions. It is estimated that up to 11.8 million enrollees nationally will lose coverage.

The Impact on Illinois

In Illinois, the law is expected to result in a $48 billion (20%) reduction in federal Medicaid funding over ten years. The state anticipates millions in administrative costs to comply with the new mandates, and state officials estimate that roughly 330,000 Illinois residents will lose Medicaid coverage as a result of the changes.

Major Medicaid Provisions

Five key policy changes account for 87% of the total Medicaid cuts:

1) The law imposes new work and reporting requirements on able-bodied adults ages 19 to 65, mandating at least 80 hours per month of employment, job training, education, or community service. Exemptions apply to children under 19, parents of children under 14, individuals with disabilities, Medicare enrollees, and others. This provision alone is projected to reduce federal Medicaid spending by $325.8 billion over the next decade and is expected to result in millions of individuals losing coverage. The requirement for individuals to comply takes effect on December 31, 2026. States must begin enforcement by that same date, although they may request a delay through December 31, 2028, if they meet certain hardship conditions. The U.S. Department of Health and Human Services is required to issue implementation guidance by the end of 2025.

2) The bill repeals federal rules designed to streamline eligibility for Medicaid, the Children’s Health Insurance Program (CHIP), and the Medicare Savings Program. It imposes a ten-year moratorium, through fiscal year (FY) 2034, on enrollment simplification efforts. This includes rolling back policies that eliminated waiting periods and coverage lockouts for CHIP, limited how often states could reassess eligibility, prohibited in-person interviews for certain applicants, and encouraged the use of electronic data instead of paperwork. It also halts efforts to make it easier for people to move between Medicaid and CHIP. These changes are projected to save the federal government $166.9 billion.

3) The law reduces the allowable provider tax rate from 6% to 3.5%, phasing in gradually between fiscal years 2028 and 2032. This change is projected to cut $191.1 billion in federal funding that states would have received under the current formula.

4) The legislation revises rules for state-directed payments to providers by capping reimbursements at 100% of Medicare rates for ACA expansion states and 110% for non-ACA expansion states. These changes will take effect on January 1, 2028, and are expected to reduce federal expenditures by $149.4 billion.

5) To further control costs, the law mandates more frequent Medicaid eligibility redeterminations. Beginning October 1, 2026, states must verify eligibility for ACA Medicaid expansion adults every six months, with a two-year phase-in period. This policy is estimated to cut an additional $62.6 billion based on a combination of eligibility reductions and drop-offs due to administrative burdens or complexities.

Other provisions included in the legislation, totaling $139.2 billion in federal spending cuts, introduce a range of administrative and eligibility changes. States are required to implement a federal data system to prevent duplicate enrollment in Medicaid or CHIP across multiple states, begin using U.S. Postal Service and managed care data for address verification, and fully participate in the federal data system. States must also conduct quarterly checks against the federal Death Master File to remove deceased enrollees and providers. Beginning in fiscal year 2030, states that exceed a 3% payment error rate or fail to provide adequate documentation of eligibility will face reductions in their federal matching funds.

The legislation resets the federal matching rate for Emergency Medicaid to each state's standard Federal Medical Assistance Percentage (FMAP). Additionally, it caps state-directed supplemental payments at Medicare-rate equivalents and phases down excess payments. These changes are expected to have a disproportionate impact on rural and safety-net hospitals, particularly those serving undocumented populations.

The law imposes new restrictions based on immigration status, denying Medicaid coverage to many lawfully present immigrants unless they fall into narrowly defined categories, such as U.S. citizens, lawful permanent residents, Cuban or Haitian entrants, or COFA migrants.

The legislation includes a one-year ban on Medicaid payments to providers that perform abortions, except in cases of rape, incest, or when the life of the pregnant person is endangered. This ban applies to all entities, including affiliates and subsidiaries, effectively disqualifying large reproductive health providers such as Planned Parenthood.

Finally, a limited number of offsetting provisions are included. The bill creates a $50 billion Rural Health Transformation Fund over five years to support hospital system investments in qualifying areas. It also expands waiver authority for states to customize Home and Community-Based Services (HCBS), although no new funding is provided. Lastly, modest increases in the federal Medicaid match are also directed to Alaska and Hawaii.

The Civic Federation will continue to monitor the impact of these Medicaid cuts on the State of Illinois and its residents.