March 13, 2013

After the City and leadership of the Chicago Police Sergeants’ union agreed to a tentative contract that included pay raises and significant pension reforms, rank-and-file union members rejected the contract by a vote of 876-134 earlier this week. The contract would have been the first significant implementation of Mayor Emanuel’s outline of pension reforms from last spring and a first step toward reducing the enormous costs of the City’s pension system.

The rejected contract included 9% salary raises over four years. Some of the pension reforms of the proposed contract included the following changes to Tier 1 employees (police sergeants hired before January 1, 2011):

• Increasing the maximum annuity to 80% of final average salary from the current limit of 75% (2.5% per year for an extra two years of service);

• Increasing retirement age by three years to 53 years of age;

• Modifying cost of living adjustments (COLA) for current retirees from 3.0% simple to 2.5% simple and freezing COLA in 2014, 2016 and 2018);

• Modifying COLA for future retirees from 1.5% simple to 2.5% simple and freezing every other year until the fund is 60% funded, after which COLA will remain at 2.5% simple but be frozen every third year until the fund is 80% funded, at which point COLA will be increased to 3.0% simple and will no longer freeze; and

• Increasing the employee contribution by 3% (1% each year from 2013-2015) from the current 9% of salary.

According to the City, in addition to the reforms above, the City and the union leadership agreed to seek legislation that would allow the City to increase its contributions to the sergeants’ retirement over a seven-year period and extend the date by which the sergeants’ retirement must be 90% funded to 2055. This would lower the amount the City would have to pay toward sergeants’ retirement in the near term, but would increase the amount over the longer term. The “ramp” would additionally allow the City to gradually increase funding to meet its statutorily required contribution amount. Under current law, as established by Public Act 96-1495 (passed in 2010), in 2015 the City will be required to begin making contributions that will be sufficient to bring the funded ratio of the Police and Fire funds to 90% by the end of 2040. The City has estimated that its total contributions to all four pension funds will increase by $730.1 million in FY2015, due mostly to the increase required by P.A. 96-1495.

It is important to note that the sergeants only make up a small portion of the membership of the Policemen’s Annuity and Benefit Fund of Chicago. Similar or greater reforms would need to be applied to the whole Police Fund and the three other City pension funds to make a significant impact on the unfunded liabilities as a whole.

Condition of Chicago Pension Funds

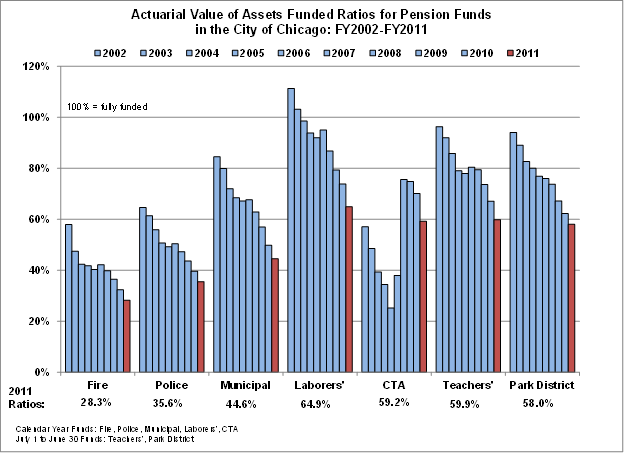

The following exhibits compare the financial condition of the City’s four pension funds (the Municipal, Laborers’, Fire and Police funds) and the pension funds of three of the other Chicago-area governments, including the Chicago Transit Authority, Chicago Public Schools and the Chicago Park District.

Funded Ratio

The Police and Fire pension funds have the lowest actuarial funded ratios of the selected pension funds at 35.6% and 28.3%. The funded ratio shows the percentage of pension liabilities covered by assets. The lower the percentage, the more difficulty a government may have in meeting future obligations. Although their funded ratios are very low and continue to fall, the Police and Fire funds no longer face imminent collapse because of the state law that will require significant increases in employer funding from the City starting in 2015. However, as noted above, the $730.1 million increase that the City faces in order to comply with the law will place a significant burden on the City’s budget. The Municipal and Laborers’ funds, however, still face insolvency in 2030 and 2031, respectively. (Click to enlarge chart.)

Unfunded Actuarial Accrued Liabilities

Over the ten years between FY2002 and FY2011, the unfunded liabilities of the four Chicago pension funds increased by $12.6 billion, or 303.9%. The aggregate unfunded liabilities of the selected funds in the Chicago area grew by $19.1 billion, or 325.1%. Unfunded actuarial accrued liabilities (UAAL) are those accrued liabilities not covered by actuarial assets. Unfunded liability is calculated by subtracting the actuarial value of assets from the actuarial accrued liability of a fund. The UAAL reflects investment gains and losses smoothed over a five-year period.

A summary of the ten-year changes in unfunded liabilities by fund is shown below:

• Park District Fund: 776.4% or $314.1 million increase;

• Teachers’ Fund:1,573.1% or $6.4 billion increase;

• CTA: 11.8% or $153.7 million decrease [Note: the CTA is the only government where unfunded pension liabilities decreased over the ten-year period. The decrease is due to reform measures enacted by Public Acts 94-0839 and 95-0708 that restructured the CTA’s employee pension system, implementing benefit reforms and issuing a pension obligation bond to bring the fund back to a healthy state. For more information on these measures, see the Civic Federation’s Status of Local Pension Funding Fiscal Year 2010];

• Laborers Pension Fund: 540.6% or $943.2 million increase [Note: the Laborers’ Fund had a surplus, or negative unfunded liability, until FY2003];

• Municipal Pension Fund: 488.5% or $5.7 billion increase;

• Police Pension Fund: 176.2% or $4.0 billion increase; and

• Fire Pension Fund: 218.2% or $1.9 billion increase.

(Click to enlarge chart.)

.png)