July 02, 2021

On June 24, 2021, Cook County Board President Toni Preckwinkle issued a preliminary budget forecast for fiscal year 2022. The fiscal year begins December 1, 2021 and ends November 30, 2022. The report provides end-of-year estimates for the current 2021 fiscal year and a forecast for the upcoming 2022 fiscal year in the County’s operating funds. The operating funds include the General Fund, which accounts for administrative and public safety operations, and Health Fund, which accounts for the health and hospitals system run by the County. The forecast indicates the financial condition in which Cook County government will be entering the next fiscal year, and identifies any budget deficit that must be closed through corrective action.

FY2021 Year-End Forecast

The year-end forecast for the current 2021 fiscal year anticipates much better results than originally anticipated. The County currently forecasts a year-end FY2021 surplus of $59.7 million in the General Fund and $30.6 million in the Health Fund, for a total positive budget balance of $90.3 million. At this same time last year, Cook County projected a $220 million budget deficit in the General Fund and a $60.6 million deficit in the Health Fund, for a total budget deficit of $280.6 million. During the course of the year, the County’s FY2021 outlook improved through a number of measures including increased fee revenue, federal reimbursements, savings in salaries due to delayed hiring, and increased revenue associated with CountyCare.

The economic impact of COVID-19 caused significant declines in revenue for Cook County in FY2020, resulting in a budget deficit of $409.5 million that year, including $222.2 million in the General Fund. The County lost nearly $260 million in non-property tax revenue supporting General Fund operations compared to budgeted revenue for FY2020. Revenue losses related to COVID-19 were anticipated to continue in the 2021 fiscal year.

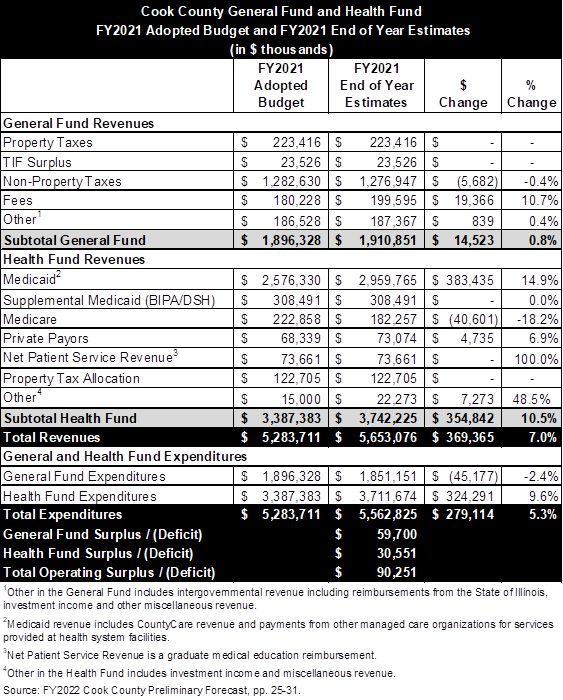

The table below shows the anticipated revenues and expenditures within the General Fund and Health Fund at the end of FY2021 compared to adopted budget figures. In the General Fund, the $59.7 million surplus is the result of revenues exceeding budget expectations by $14.5 million and expenditures coming in $45.2 million below budget. Property taxes and tax increment financing (TIF) surplus are expected to end the year on budget. Non-property taxes will fall slightly below budget, while fee revenue is anticipated to be $19.4 million, or 10.7%, above budget, largely due to an increase in recording fees in the County Clerk’s Office due to a strong housing market.

The Health Fund budget surplus of $30.6 million is due to revenues exceeding budget by $354.4 million, which is partially offset by expenditures also exceeding budget by $324.3 million. The much higher than anticipated revenues and expenditures within the Health Fund are due to an increase in membership in Cook County’s own managed care plan, CountyCare, and associated patient fee revenue and health plan claims. Cook County Health anticipates monthly CountyCare membership to average approximately 388,000 in FY2021 compared to the original projection of 326,000 due to economic factors caused by COVID-19, the State’s temporary suspension of the redetermination process and more Medicaid auto-assignments to CountyCare. Medicaid revenue from both CountyCare and payments from other managed care organizations for healthcare services provided at Cook County facilities is projected to be $383.4 million, or 14.9%, higher than budgeted. In addition to the increase in health plan claims associated with higher CountyCare enrollment, expenses are partially driven by a $16.1 million increase in overtime compared to budget. However, Cook County Health also expects to save $96.2 million on personnel salaries due to the timing of personnel hiring.

FY2022 Preliminary Budget Forecast

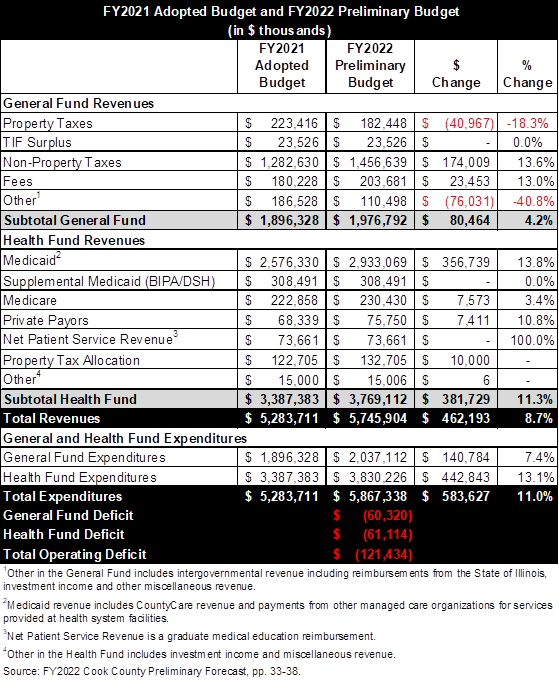

Cook County projects a budget deficit of $121.4 million that will need to be closed in FY2022, consisting of a $60.3 million deficit in the General Fund and a $61.1 million deficit in the Health Fund.

The County expects General Fund revenue to increase by $80.5 million from the adopted FY2021 budget, largely driven by continued economic recovery after the lifting of COVID-19 restrictions. Many economically-sensitive tax sources are expected to recover including the sales tax, amusement tax, use tax and hotel tax. Overall non-property tax sources are expected to increase by $174.0 million, or 13.6%, in FY2022 over the prior year adopted budget. Property tax revenue supporting the General Fund is expected to decline by $40.9 million, or 18.3%, compared the prior year due to a larger allocation of $63.0 million in property taxes being directed to the Election Fund in FY2022. Fee revenue is projected to increase by $23.5 million, or 13.0%, in FY2022 from the prior year. The increase is mainly due to a $20.0 million increase in County Clerk fee revenue caused by a strong real estate market increasing real estate transactions, and an increase in Clerk of the Circuit Court fees of $7.4 million driven by increased court activities with the courts reopening. Other revenue will decline by $76.0 million from FY2021 because the County allocated fund balance reserves to mitigate the FY2021 budget gap. According to the forecast, the County does not plan to use reserves in FY2022 and instead will close the budget gap through structural measures.

While the General Fund revenue outlook is positive, expenditures are expected to rise by $140.8 million above the FY2021 adopted budget. The increase is due in part to higher personnel spending, including overtime expenses increasing by $62.0 million and salaries and wages increasing by $2.7 million due to annual step increases.

The $61.1 million projected deficit in the Health Fund is driven by a $442.8 million increase in expenditures over the prior year adopted budget, partially offset by a $381.7 million increase in revenue. The expenditure increase is the result of increases in medical claims costs of $338.2 million related to higher projected CountyCare enrollment. Other spending increases include an $8.1 million increase in salaries and wages and a $7.1 million increase in overtime expenses.

The projected increase in revenue is also related to an increase in CountyCare enrollment. Average membership in FY2022 is estimated at 390,000 members per month. The primary driver for changes in the FY2022 revenue budget is a projected increase in Medicaid Public Assistance Revenue, which includes CountyCare revenue, is expected to increase by $356.7 million over the prior year adopted budget, but will be down slightly from FY2021 year-end projections. Medicare Patient Fees are also expected to increase by $7.5 million from the adopted budget.

The County will need to identify measures to close these projected deficits in the General and Health Funds before releasing the recommended FY2022 budget in October.

A public hearing on the preliminary forecast is scheduled for July 7 at 6 p.m., and the Cook County Board will also hold departmental budget hearings beginning July 19. President Preckwinkle’s final budget recommendation will be presented in October 2021. Members of the public can submit budget questions through the County website.

Related Links:

Cook County’s FY2020 and FY2021 Budget Forecasts Significantly Impacted by COVID-19

Cook County Preliminary Year-End Budget Results for FY2020

Cook County FY2020 Executive Budget Recommendation: Analysis and Recommendations

Cook County April Revenue Estimates Show Early Impact of COVID-19