November 07, 2025

by Daniel Vesecky

Note: This summary was prepared in advance of the November 10, 2025, hearing to serve as an easy reference for City Council members, media, advocates, and Chicago residents.

With the City of Chicago (Chicago or the ‘City’) facing a nearly $1.2 billion deficit heading into the 2026 fiscal year, potential spending reductions are and should be a top priority for stakeholders in the budget process.

In May 2025, the City commissioned the consulting group EY – formerly known as Ernst & Young – to create a report on possible efficiencies the City could implement in future budgets. The City released that report (the EY “report”) on October 15, 2025, after the administration issued its proposed FY2026 budget. In addition, in the spring of this year, the Mayor issued an executive order, creating a working group, called the Chicago Financial Future Task Force (CFFTF), composed of business, finance, civic, policy, and labor organizations and experts, to provide recommendations on cost-saving measures and potential revenues. EY was assigned to support the CFFTF efforts and was principally responsible for generating the resulting report that the group issued on September 15, 2025. The EY report is more extensive than the Financial Future Task Force’s report, identifying a broader range of efficiency options and estimated cost savings. Only a few CFFTF recommendations are not included in the full EY study and are not discussed here, as the CFFTF report provides few details on their potential savings.

In aggregate, the two reports present hundreds of millions of potential efficiencies and savings that the City might immediately implement. Many require few to no layoffs or service reductions. Others require additional input from operating departments and the development of implementation plans.

The City’s decision to hold back the release of the EY report has hindered the City Council’s ability to analyze and pose questions regarding the potential efficiencies during the budget hearings conducted to date. This piece aims to help City Council members use the EY report to its fullest potential in advance of a Council hearing scheduled for November 10 on the report itself.

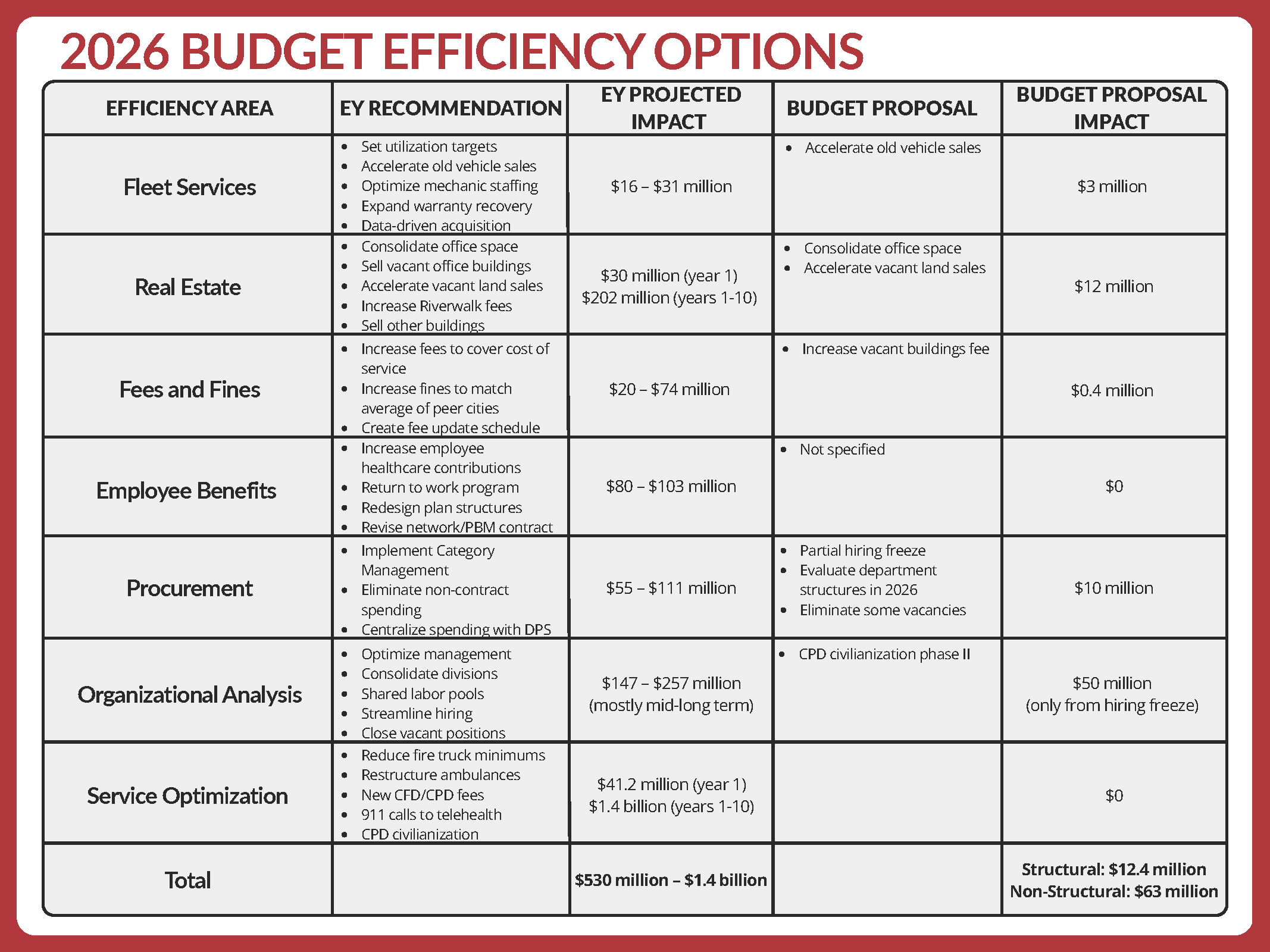

Below, we summarize some of the biggest items on the list.

Fleet Services

The EY report found startling inefficiencies in the City’s vehicle fleet. The average City vehicle was driven only 7,000 miles per year, less than a third of the rate of vehicle usage in Chicago’s peer cities. The City owns one vehicle for every 17 full-time equivalent (FTE) positions, far in excess of the industry equivalent of one per 65 FTE. The report contained recommendations for establishing metrics for fleet utilization, optimizing maintenance of City vehicles, and accelerating resale of old vehicles. Although some of the reforms recommended by EY will take time to implement, the report identified several that are immediately doable, including improving the City’s warranty recovery capabilities, optimizing the Department of Fleet and Facility Management’s operating model, implementing multi-shift and seasonal flex labor, analyzing mechanic labor distribution, and accelerating the vehicle disposition process. The report estimated between $16 million and $31 million in cost savings from optimizing the City’s vehicle fleet management.

The proposed budget only seeks to generate $3 million in savings by accelerating the sale of end-of-life vehicles.

Real Estate

Chicago owns and leases over 500 properties and over 10,000 vacant parcels of land. EY found that between the City’s ten largest office buildings, the amount of workspace exceeds the number of employees by 33%, indicating substantial room for downsizing. In addition to notable one-time revenue, the City could garner operational and maintenance savings by selling three or more of these large buildings.

The report also points out that the City makes far less on licenses for businesses on the Riverwalk than peer cities do for comparable high-traffic locations. The City earned $2.5 million in license fees from riverwalk businesses in 2024, and aligning this policy with peers could generate an estimated $13 million over ten years.

Finally, the report recommends that the City accelerate its efforts to sell industrial buildings and land parcels in neighborhoods with high levels of development. These sales would generate significant one-time revenue for the City and would have the added impact of increasing property tax revenue in the long term, as private holders of the land would be required to pay taxes, whereas the City is not.

Overall, the report identifies $157-$202 million in real estate savings over the course of ten years, with approximately $30 million generated in the first year. The proposed budget aims to generate $12 million in savings by accelerating vacant land sales and exiting two office building leases.

Fees and Fines

The EY report itemized a variety of fees and fines across many City departments and compared them to benchmark fees in peer cities. The total potential revenue from raising existing fees and fines varies widely based on which fees are raised. Some of the largest revenue options included storage, towing, driveway permits, business licenses, and canopy permits, all of which are below peer averages and currently generate above $4 million each in annual revenue. The report also raises the idea of drastically increasing the vehicle sticker tax, which currently generates $119 million per year and is higher than most peer cities. However, that revenue only covers one-third of road maintenance expenses, and raising the fee would help to offset these costs. Raising the Vehicle Sticker Tax alone could generate over $100 million in revenue. In addition, the report projects $20-$74 million in annual revenue through increases to other fees and fines.

The EY report excludes a handful of additional fees identified by the Financial Future task force, including an increase in the garbage fee, which could raise nearly $300 million if matched to service delivery costs. The CFFTF working group report also recommends indexing most fees and fines to inflation so that the City Council does not regularly have to raise dozens of fees that no longer cover the cost of providing services or fines that have fallen behind peer averages.

The 2026 proposed budget seeks to raise only one fee – the vacant building mortgage renewal fee. The proposal argues that this will disincentivize landlords who hold long-term vacant properties and will incentivize development. The fee is projected to raise an additional $400,000 in 2026.

Employee Benefits

Chicago’s employee benefits expenses are far higher than those of its peer cities, Cook County, and the State of Illinois. EY identified $80-$103 million in savings the City could realize from moving itself to align its benefit structure with its peers. The City could save $33 million by increasing employee medical contributions, and $10 million by raising copays and other out-of-pocket costs for employees. The City could also save $10 million by instituting a formal return-to-work program, recouping costs from employees who take extended leaves of absence.

In addition, the City could realize significant savings through more efficient healthcare plan design and negotiations with Pharmacy Benefit Managers (PBMs). The report estimates $15-$24 million in annual savings from refining PBM contracts, commissioning a claims and fee integrity study, refining carrier networks, and expanding the City’s use of Centers of Excellence for cancer care.

Many of these proposals will require negotiation with organized labor. The proposed budget contains none of these ideas, and the Mayor’s Office has shown no inclination to open negotiations with local public unions.

Procurement

EY found a wide variety of stunning inefficiencies in Chicago’s procurement systems. The City’s procurement is highly decentralized, with 49% of total spending not managed by the Department of Procurement Services (DPS). This leads to frequent duplication of contracts across departments and a large amount of non-contract spending, which increases costs and risks. Additionally, the City concentrates 80% of its spending with only 182 vendors, while the remaining 20% is handled by a massive roster of 5,312 vendors. This misallocation of resources leads the City to miss opportunities for cheaper bulk purchasing and often leads to small contracts with unfavorable payment terms. Additionally, decentralized procurement prevents the City from leveraging its power as a large purchaser to negotiate better deals with vendors. EY also found that DPS did not provide sufficiently detailed policies to prevent fraud, waste, or abuse, and that DPS and the Department of Finance (DOF) have unclear roles in vendor assessment and management.

Because of these findings, the report recommends implementing Category Management (CM), a strategic approach to procurement that would centralize spending, planning, forecasting, vendor management, performance management, and other strategic roles with DPS. Category Management would eliminate the duplication issue and allow DPS to fully manage all procurement spending, leveraging the City’s size to secure the most advantageous contracts. EY estimates $55-$111 million in savings based on the 2024 budget, although the report cautions that a complete shift to CM will likely take three to five years.

Although the proposed budget does not mention procurement reform, a budget presentation provided by the Office of the Mayor indicates that the City will aim to save $10 million through procurement modernization in FY2026. However, no further details are available.

Organizational Analysis

The organizational structure of Chicago’s bureaucracy is top-heavy and redundant. Many back-office functions, such as payroll and HR, are spread across each department instead of being centralized within a single administrative body, leading to inefficiencies and duplication of effort. Recruitment and onboarding processes are prolonged, causing service delays and loss of high-talent potential recruits. Additionally, Chicago has thousands of vacant positions, many of which the EY report deemed non-critical. Consolidating overlapping divisions, labor pools, and back-office support is estimated to save $67-$157 million annually. Streamlining hiring could generate $25 million in revenue by quickly filling revenue-generating positions.

Additionally, many departments are poorly structured, with unusually high numbers of managerial positions, with some departments averaging as few as three direct reports per manager, rather than the leading practice of six to eight. A handful of departments, such as DOF, have a high number of layers, leading to a distance between strategic objectives and implementation. EY projects $37 million in savings from optimizing managerial spans of control.

The proposed budget does not include any implementation of the organizational recommendations outlined in the report. Instead, it saves $50 million by implementing a hiring freeze and promises to conduct an organizational analysis in 2026, with the goal of generating savings in 2027. It is worth noting that although this $50 million is billed as an efficiency, it is not a structural saving. Chicago has leaned on hiring freezes over several of the last budget cycles. Each freeze reduces the City’s ability to fill vacant positions and attract top talent, and although freezes provide short-term budget patches, they can result in many positions going unfilled for years. This creates inefficiency in government operations, potentially leading to higher costs in future years.

Service Optimization

EY identified significant inefficiencies in the structure of Chicago’s public safety apparatus. Though many of the reforms needed would take multiple years to implement, there are options for up to $41 million in first-year savings and over $1.4 billion in savings over ten years.

First and foremost, the report recommended civilianizing sworn positions at the Chicago Fire Department (CFD) and the Chicago Police Department (CPD). Both departments have significantly lower civilianization rates than their peers, resulting in an environment where sworn officers are assigned to desk jobs that non-officers could perform. Meanwhile, slow hiring creates understaffing problems for deployed officers, leading to overspending on overtime. Together, the two departments could save approximately $7.5 million in the first year of civilianization and over $150 million over ten years. Additional savings of $84 million over ten years could be generated by replacing overtime CPD officers on traffic management and parking enforcement duty with Office of Emergency Management and Communications (OEMC) employees.

The report also recommends implementing new fees for CFD and CPD responses to certain situations, including false alarms, inspections, and hazmat usage. It also recommends raising existing fees for DUIs, pyrotechnics, and sprinkler review to cover the cost of service delivery. Although many of these fees may not be implemented immediately, they could raise a total of over $200 million over ten years.

Restructuring the fire department could yield $650 million in savings over the next ten years. This would require reducing the minimum manning requirements for fire engines from 5 to 4, in line with many peer cities, as well as converting some of the City’s 80 advanced life support ambulances to basic life support. Reducing manning requirements would require negotiation with the firefighters' union, which refused pressure for this reform during its last contract negotiations, which ended recently.

Restructuring the police department could generate over $100 million in savings over ten years. This would include disbanding the CPD mounted division and implementing an early warning system to detect problematic officers, thereby reducing future settlement costs.

The report identified a grab-bag of smaller savings opportunities as well, including utilizing chatbots for the City’s 311 call center, diverting 911 calls to telehealth, adding part-time 911 dispatchers to reduce overtime, adding cameras to CFD and CPD vehicles to increase accountability, and accelerating hiring of timekeepers through the Office of Public Safety Administration. Helpfully, the report provides a one-page tear sheet for each proposed reform.

The proposed 2026 budget commits to proceeding with phase II of civilianization within CPD, but does not provide projected savings from civilianization in 2026. The budget projects $100 million in civilianization savings over ten years. The budget also aims to implement overtime controls on CPD, capping overtime expenditures at $200 million and requiring approval from the City Council to allow CPD to spend past that cap. None of the other public safety service optimization proposals advanced by EY are included in the budget.