September 13, 2013

In recent years, the State of Illinois’ financial woes had been complicated by a massive backlog of unpaid income tax refunds. When the backlog was paid off by the end of FY2013, the State reaped a surplus of diverted funds that will boost revenues by $397 million in FY2014.

Income tax revenues are diverted to the Income Tax Refund Fund to pay tax refunds owed to individuals and businesses. The Illinois Income Tax Act requires that any surplus in the Refund Fund must be transferred to General Funds in the following fiscal year.

The Governor’s General Funds revenue projection of $35.6 billion for FY2014 included a transfer of $155 million to General Funds from the Refund Fund based on midyear FY2013 estimates. As discussed here, the original revenue estimate used by the General Assembly to develop its budget for FY2014 did not include the surplus transfer from the Refund Fund. However, an updated estimate of $35.4 billion passed in a House resolution in the final week of the legislative session included an estimated $300 million transfer from the Refund Fund.

If not enough revenue is set aside to pay for refunds, the State accumulates a backlog of unpaid refunds, however, the State has additional revenues available for General Funds purposes and for local governments, which also receive a portion of income tax revenues. All refunds, both personal and business, are paid out of the Refund Fund. The Illinois Department of Revenue makes it a priority to pay personal income tax refunds to individuals, so when there is a shortfall in the fund, unpaid business refunds increase.

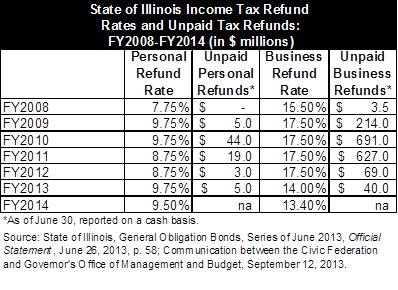

Separate diversion rates—known as Refund Fund rates—are established for individual income taxes and business income taxes. Despite experiencing a large increase in unpaid refunds in FY2009 and FY2010, the State set its individual Refund Fund rate lower by one percentage point to 8.75% from 9.75% in FY2011 and FY2012. The rate was increased in FY2013 for individuals to 9.75% and lowered for corporations from 17.5% to 14.0%. The enacted budget for FY2014 includes an individual Refund Fund rate of 9.5% and a business Refund Fund rate of 13.4%.

The following chart shows the Refund Fund rates and backlog of unpaid refunds from FY2008 through FY2014.

The Revenue Department is required to report refunds owed at the end of the fiscal year on a cash basis, so the table above includes amounts that were approved but unpaid at the end of the last business day of the month. There is an expected lag between approval of refunds and when they are paid even if there is adequate funding in the Refund Fund. However, due to the requirement that the $397 million Refund Fund surplus be transferred into General Funds based on the year-end cash balance, the $45 million in unpaid FY2013 refunds will be paid using resources from FY2014 diversions to the fund.

The Revenue Department is required to report refunds owed at the end of the fiscal year on a cash basis, so the table above includes amounts that were approved but unpaid at the end of the last business day of the month. There is an expected lag between approval of refunds and when they are paid even if there is adequate funding in the Refund Fund. However, due to the requirement that the $397 million Refund Fund surplus be transferred into General Funds based on the year-end cash balance, the $45 million in unpaid FY2013 refunds will be paid using resources from FY2014 diversions to the fund.

Refund Fund rates in the chart above were set by Illinois General Assembly as part of the annual budget process. If the rates are not set legislatively prior to each year they are determined by statutory formula. The formula calls for total refunds paid to be added to the refunds approved but unpaid at the end of the year and divides that sum by the gross receipts. The last time the rates were set using the formula was FY1998.

Due to the anticipated surplus, the Governor’s recommended budget proposed lowering the Refund Fund rates from 9.75% in FY2013 to 9.0% in FY2014 for individual income taxes and from 14.0% to 12.0% for business income taxes. The General Assembly enacted rates of 9.5% and 13.4%. According to data from the Revenue Department, the rates would have been set at 8.4% and 14.5% under the statutory formula.

Although the enacted Refund Fund rate for individual income taxes is much higher than the statutory rate, officials from the Revenue Department say the enacted rate is reasonable. According to the Department, the formula is skewed in FY2013 due to abnormally high gross receipts in April 2013. The revenue surge, often referred to as the “April Surprise,” was related to taxpayers’ avoidance of higher federal tax rates in 2013. Individual income tax receipts were $1.0 billion higher than projections for the month. These payments did not greatly increase the demand for refunds but inflated the denominator in the statutory formula.