March 27, 2020

This blog post presents information about the different types of individual income taxes imposed by state governments in the United States.

In 2020 forty-one states levied individual income taxes. States currently use flat rate or graduated rate models for their individual income tax rate structures. Three states use a variation of the graduated income tax structure, employing “recapture” rates that combine both graduated and flat rate features. Every state has numerous exemptions, deductions and credits that alter the effective tax rate, the actual percentage of income paid in taxes. A future blog post will present information about effective tax rates and sample tax bills in different states.

Seven states do not impose any individual income taxes. They are Alaska, Washington, Nevada, Wyoming, South Dakota, Texas and Florida.[1] Two additional states imposed income taxes only on interest and dividend income.

Flat Rate Individual Income Taxes

Nine states in 2020 used flat rate individual general income tax structures, imposing the same rate on all taxpayers regardless of income[2]. The rates range from 3.07% in Pennsylvania to 5.25% in North Carolina. These states tax all individual income.[3] On January 1, 2020, the individual income tax rate in Massachusetts fell from 5.05% to 5.0%, fully implementing a multiyear rate reduction approved by the voters in a 2000 ballot initiative.[4] Illinois currently has a 4.95% flat rate individual income tax. Information on why Illinois has a flat rate income tax can be found here.

The following chart shows state flat rate income tax rates as of January 2020.

Graduated Individual Income Taxes

A total of 32 states levied graduated individual income taxes in 2019.[5] Twenty-nine states impose graduated rates with different brackets. The brackets are income ranges taxed at the same rate. Within each bracket taxpayers pay the same rate. This means that taxpayers pay the same rate on income earned in the first bracket; after that they pay an increased rate up to a threshold amount per each bracket. The marginal rate is the tax rate applied to the last taxable dollar earned and is the top rate paid by each taxpayer. There may be different brackets for single and married taxpayers. Eleven states have very low top brackets – less than $38,000 - meaning their income tax structure is only marginally progressive.[6]

Each state applies various exemptions deductions and credits to the income tax base. This alters the effective tax rate, which is the actual percentage of income paid in taxes. The divergent tax treatments in various states make precise comparisons of income tax burden difficult.

Graduated tax bracket rates in 2019 varied from a low of 0.33% on individual income up to $1,638 in Iowa to a high of 13.30% in California on individual income over $1.0 million. The number of tax brackets employed ranged from three in Alabama, Kansas, Maine, Mississippi and Rhode Island to twelve in Hawaii.[7] In contrast, federal individual income tax rates range from 10% to 35% in six brackets.[8]

Three states currently structure their graduated income taxes with a “recapture” feature: New York, Connecticut and Arkansas. This type of rate structure combines both graduated and flat rate features with brackets that impose graduated rates on income earned up to a certain threshold amount and then a flat rate tax on all income earned if the total is above that amount.[9]

Arkansas has seven income tax brackets with rates ranging from 0.90% to 6.0% for residents earning up to $79,300. All earned income of more than $79,300 is taxed at a flat rate of 6.9%.

Connecticut has seven income tax brackets with rates ranging from 3.0% to 6.99% for individuals earning up to $500,000 and married filers earning up to $1.0 million. All earned income if it is above those thresholds is taxed at a flat rate of 6.99%.

New York has eight tax brackets with rates ranging from 4.0% to 6.85% for individuals earning up to $1.077 million and married filers earning up to $2.15 million. All earned income if it is above those thresholds is taxed at a flat rate of 8.82%.

The Illinois legislature has approved a recapture graduated income tax structure in enabling legislation (Public Act 101-0008) for a constitutional amendment authorizing a graduated income tax that will be decided by voters in the November 2020 general election. The Illinois individual graduated income tax structure is discussed here.

In the legislation, individual graduated rates start at 4.75% for incomes up to $100,000 and then increase up to 7.85% for single filers reporting between $350,000 and $750,000 in income, and for joint filers from $500,000 to $1 million. Single filers earning more than $750,000 and joint filers earning more than $1 million would be taxed at a flat rate of 7.99%. [10]

Recent Changes in Individual Income Tax Rate Structures

No state since 2000 has switched from a flat rate individual income tax structure to a graduated structure. However, three states have switched from a graduated individual income tax rate structure to a flat rate tax.

- Utah changed from a six-bracket tax structure with rates ranging from 2.3% to 6.98% to a flat rate 5.0% tax. The flat rate was further reduced to 4.95% in 2019.[11]

- North Carolina moved from a three-bracket graduated income to a 5.80% flat tax in 2014.[12] As of 2019, the rate was reduced to 5.25%.

- In 2018 Kentucky abandoned its six-bracket tax structure with a top rate of 6.0% for a 5.0% single rate tax.[13]

Corporate Income Tax Rates

In 2019 a total of 44 states imposed corporate income taxes. Four of these states taxed net corporate income, while four states – Texas, Nevada, Ohio and Washington – taxed gross receipts. Fourteen states used a graduated tax structure and the remaining 30 imposed a flat rate tax.[14]

The Illinois legislation that establishes a graduated structure for individual income taxes also raises the State’s existing flat corporate income tax rate if the constitutional amendment passes. The tax rate on corporate net income would increase to 7.99% from the current rate of 7.0%.[15] Illinois corporations also pay a personal property replacement tax (PPRT) of 2.5% on net income, which effectively will push the total Illinois corporate tax rate to 10.49%.[16]

Comparison of Illinois Individual Income Tax Rates Versus Other States

The exhibit below compares Illinois’ current flat and proposed graduated individual income tax rates with those in the most populous states imposing an income tax as well as the state’s Midwestern neighbors. Currently, Illinois has one of the lowest individual income tax rates of the 17 states reviewed at 4.95%. Only Indiana, Michigan and Arizona have lower rates. If the graduated individual income tax is approved by voters in 2020, Illinois would have one of the higher rates. Only five states – New York, Iowa, Minnesota, New Jersey and California – would have top rates higher than Illinois’ top rate of 7.99%.

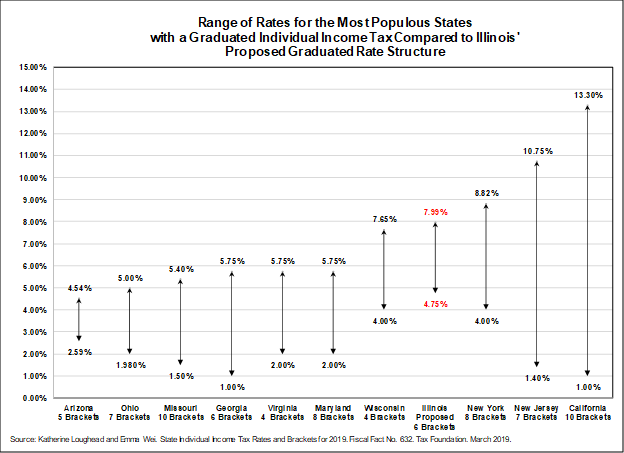

The exhibit below shows the range of income tax rates for the most populous states levying graduated individual income taxes. Of these ten states, Arizona had the lowest top rate of 4.54% while California had the highest top rate at 13.30%.

[1] Alaska repealed its income tax in 1979.

[2] In addition, two states, New Hampshire and Tennessee, tax only interest and dividend income. Tennessee began phasing out its income tax in 2017. That process will be completed in 2021 and Tennessee will join the group of states without an income tax. See Katherine Loughead and Emma Wei, State Individual Income Tax Rates and Brackets for 2019, Fiscal Fact No. 632, Tax Foundation, March 2019.

[3] Katherine Loughead and Emma Wei, State Individual Income Tax Rates and Brackets for 2019, Fiscal Fact No. 632, Tax Foundation, March 2019. Illinois and Pennsylvania do not tax any retirement income.

[4] Ballotpedia, “Massachusetts reduces state income tax to final rate set by 2000 ballot initiative,” December 23, 2019 at https://ballotpedia.org/Massachusetts_Income_Tax_Rate_Reduction_Initiative,_Question_4_%282000%29.

[5] Katherine Loughead and Emma Wei, State Individual Income Tax Rates and Brackets for 2019, Fiscal Fact No. 632, Tax Foundation, March 2019.

[6] These states are Alabama, Arkansas, Idaho, Georgia, Mississippi, Missouri, Montana, New Mexico, Oklahoma, South Carolina and Virginia. Katherine Loughead and Emma Wei, State Individual Income Tax Rates and Brackets for 2019, Fiscal Fact No. 632, Tax Foundation, March 2019.

[7] Katherine Loughead and Emma Wei, State Individual Income Tax Rates and Brackets for 2019, Fiscal Fact No. 632, Tax Foundation, March 2019.

[8] Internal Revenue Service at https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2019.

[9] Katherine Loughead and Emma Wei, State Individual Income Tax Rates and Brackets for 2019, Fiscal Fact No. 632, Tax Foundation, March 2019.

[10] Shelby Bremmer, “Illinois’ Graduated Income Tax Plan: What You Need to Know,” NBC Chicago, May 28, 2019 at https://www.nbcchicago.com/news/local/illinois-income-tax-rates-progressive/131673/.

[11] Tax Foundation, State Individual Income Tax Rates, 2000-2014, April 1, 2013 at https://taxfoundation.org/state-individual-income-tax-rates/, and Katherine Loughead and Emma Wei, State Individual Income Tax Rates and Brackets for 2019, Fiscal Fact No. 632, Tax Foundation, March 2019.

[12] Lyman Stone, State Personal Income Tax Rates and Brackets 2014 Update at https://taxfoundation.org/state-personal-income-tax-rates-and-brackets-2014-update, Tax Foundation, March 21, 2014.

[13] Morgan Scarboro, Kentucky Legislature Overrides Governor’s Veto to Pass Tax Reform Package, April 16, 2018. Tax Foundation at https://taxfoundation.org/kentucky-tax-reform-package/.

[14] Janelle Cammenga, State Corporate Income Tax Rates and Brackets for 2019, Fiscal Fact No. 639, Tax Foundation, February 2019.

[15] Public Act 101-0008 at 35 ILCS 5/201(b)15.

[16] Illinois Department of Revenue at https://www2.illinois.gov/rev/QuestionsAndAnswers/pages/242.aspx.