April 03, 2020

States are currently facing monumental fiscal challenges posed by the economic and revenue impacts of the coronavirus pandemic. However, their ability to use fiscal policies to address these challenges is quite limited due to structural and capacity issues. Only the federal government has the resources and capacity to implement meaningful countercyclical fiscal policies that might mitigate severe economic and fiscal disruption in the states.

This blog post first provides a basic discussion of the monetary and fiscal policies that the federal government can use to stabilize the economy in times of serious disruption, using examples from the Great Recession, before addressing the limitations that states face in implementing fiscal policies in times of economic distress.

Monetary vs. Fiscal Policy

Governments seek to stabilize the economy, mitigate unemployment, control inflation and improve economic opportunity by means of monetary and fiscal policies.

Monetary policy is conducted by the Federal Reserve Bank of the United States. It involves manipulating the money supply and setting the terms under which credit may be provided.[1] Monetary policy can be either expansionary or contractionary.

Expansionary monetary policy is designed to increase the money supply, injecting liquidity into the economy. The Federal Reserve Bank implements monetary policy by reducing interest rates on the premise that the ability to borrow funds at lower rates will spur increased business investment and consumer spending. Another tool is the use of quantitative easing, which involves the Bank purchasing long-term securities in order to increase the money supply and encourage both lending and investment.[2]

Implementing expansionary monetary policy is made complex by the fact that the Federal Reserve Bank has a dual mandate: to maintain stable prices and to achieve maximum sustainable employment. The Fed has adopted a 2% target for inflation as the goal for price stability.[3] The Bank does not have a definitive target for maximum employment; rather it seeks to implement policies that can lead to the lowest unemployment rate that is consistent with its inflation goal. [4] The Bank estimated this rate to be 4.1 percent recently.[5]

Contractionary monetary policy is designed to slow the rate of growth in the money supply or decrease it in order to combat high rates of inflation. This is achieved by the Federal Reserve Bank increasing interest rates. This type of action can trigger a recession.[6]

As an independent government agency, the Federal Reserve Bank can work quickly to stabilize the economy. It does not have to work through political approvals by the executive and legislative branches. During the Great Recession of 2008-2009, the Federal Reserve Bank took a number of actions to inject liquidity into the economy in an effort to stabilize it, including:[7]

- Reducing the federal funds rate from 5.25% in September 2007 to a range of 0.0-0.25% by December 2008. The federal funds rate refers to the interest rate that banks charge other banks for lending excess cash from their reserve balances on an overnight basis;[8]

- Using credit easing programs to facilitate credit flows and reduce the cost of credit;

- Implementing large-scale asset purchase programs that included the purchase of mortgage-backed securities and the debt of housing-related U.S. government agencies such as Fannie Mae, Freddie Mac and the Federal Home Loan bank. These actions reduced the cost and increased the availability of credit for the housing market; and

- Purchasing $300 billion of longer-term Treasury securities.

Altogether, the Federal Reserve Bank purchased about $1.75 trillion worth of long-term assets.[9]

Fiscal Policy

Fiscal Policy involves changing tax burden and/or levels of spending to influence aggregate demand in the economy. It is primarily based on the economic theories of John Maynard Keynes, who argued that these types of policies could stabilize the business cycle in times of economic stress. The federal government as well as state and local governments develop and implement fiscal policy on a regular basis.

When there is an economic downturn, government spending on programs such as infrastructure or healthcare directly helps increase demand in the economy. The increase in government spending functions as a stimulus, compensating for the decrease in private sector spending.

Reducing taxes indirectly influences demand by letting taxpayers keep more of their income, which they in turn can spend in the economy. It also allows businesses to have additional funds to maintain or expand operations.

The impact of fiscal policy can be relatively slow because: 1) it requires government action, such as legislative approval, and 2) once the policy is approved, it takes time for implementation to occur.

The 2009 federal American Recovery and Reinvestment Act (ARRA) is an example of fiscal policy. The U.S. government provided approximately $831 billion in stimulus for the following programs:

- Income tax withholding reductions up to $800 per family;

- A $70 billion extension of the federal alternative minimum tax;

- Approximately $80 billion for infrastructure projects;

- $87 billion in assistance to states to help cover recession-related Medicaid costs; and

- Over $100 billion in education spending, including teacher salary support and Head Start programs.[10]

Similarly, the $31 billion Illinois Jobs Now! capital program inaugurated by Governor Pat Quinn and the Illinois General Assembly in 2009 was intended to help alleviate the negative impacts of the Great Recession.[11]

There are several potential downsides to fiscal policy solutions that employ increased spending or tax cuts. They can generate large budget deficits which may be difficult to stabilize in the long-term. Rapid increases in public spending can trigger inflation. Government spending may also crowd out private investment. Finally, once stimulus programs are operational, it may be extremely difficult politically to reduce or rescind them.[12]

Countercyclical vs. Procyclical Fiscal Policies

Fiscal policy can be either procyclical or countercyclical.

Procyclical fiscal policy is expansionary in good economic times and contractionary in economic downturns. In short, it is directly correlated with changes in business cycles. During an economic expansion, governments may increase spending and cut taxes. This can boost economic performance but also dramatically increase budget deficits. In a recession, a cash-strapped government would take the opposite action, cutting spending and increasing taxes, which could make the impact of the recession worse by reducing government services when residents need them most or harm businesses and individuals by requiring more in taxes when they have less in revenue and income. [13]

Countercyclical fiscal policy moves in the opposite direction of the business cycle. In boom times, government spending would decrease or be diverted into budgetary reserves, and taxes would be increased in an effort to achieve budgetary balance. In recessionary times, government would pursue stimulus programs that increase spending and cut taxes in order to increase demand, prevent reductions in public services and stabilize employment.[14]

Countercyclical Fiscal Policies in the American States

The following discussion outlines the limitation states face in implementing countercyclical fiscal policies and the primary tool they do use, which is spending reserve funds.

The states are limited in what they can do to address a significant fiscal crisis or recession. These limitations include:

- Balanced budget requirements;

- Borrowing limitations; and

- Insufficient revenue capacity to deal with serious economic disruptions.

The federal government, in contrast, does not in theory have to deal with these limits. It is able to respond to economic downturns by using countercyclical fiscal policy tools such as deficit spending using borrowed funds, though in practice the federal government’s response is limited by political considerations.

Balanced Budget Requirements

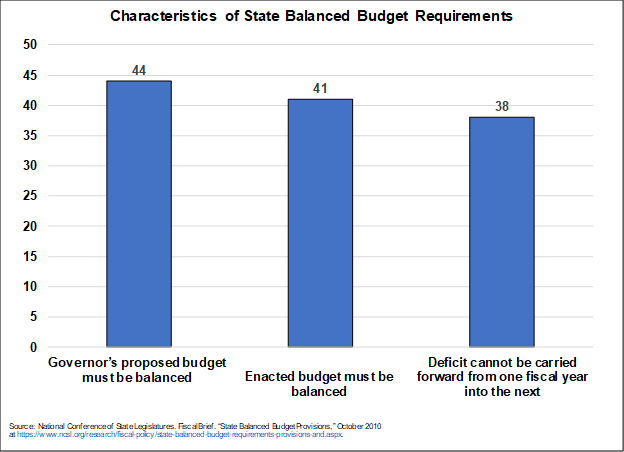

Most state constitutions and/or statutes include balanced budget requirements. However, there is no uniformity regarding the meaning of a “balanced budget” requirement. Some states have very explicit requirements as to what constitutes a balanced budget while others do not, and the state’s political culture is important to whether the limits are reinforced. The National Conference of State Legislatures has identified three distinct elements of balanced budget requirements. The exhibit below shows the results of that survey:

- 44 states require that the governor’s proposed budget must be balanced;

- 41 states require the enacted budget must be balanced; and

- 38 states require that no deficit can be carried forward from one fiscal year into the next.[15]

The NCSL study counted Illinois’ Constitution as requiring both a gubernatorial balanced budget and an enacted balanced budget. However, Illinois is one of only 12 states that does allow a deficit to be carried forward to the next fiscal year.

Borrowing Limitations

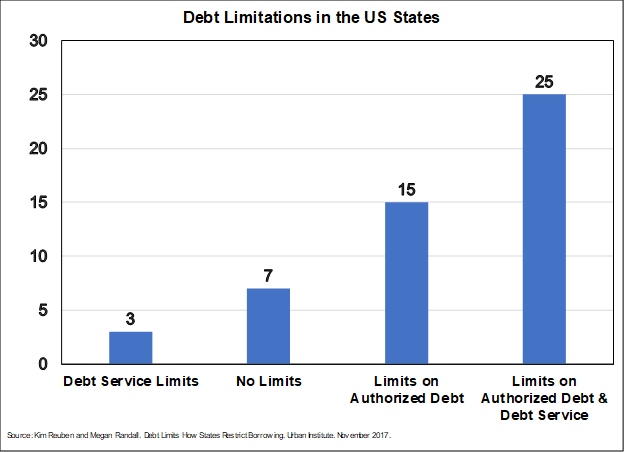

Most states have constitutional and/or statutory limitations on the issuance of new debt or debt service. These restrictions may limit the dollar amount of debt that can be issued, cap the issuance of debt to a certain percentage of revenues, limit the use of debt, prohibit the use of debt for operations or detail the method of debt repayment. In some states, voter approval is required for new debt. States may circumvent debt limits by issuing other forms of debt such as revenue or taxable debt or by creating public authorities or other dependent governments authorized to issue debt.

Three states place limits on debt service, fifteen place caps on authorized debt and another 25 limit the issuance of authorized debt and debt service payments. Only seven states have no constitutional or statutory limits on debt issuance.[16] Illinois is one of the fifteen states with limits on authorized debt.

The bond markets also place limits on how much states can borrow. If a state attempts to borrow in excess of its financial capacity, its debt issuances will likely face costly credit downgrades and it may not be able to identify willing purchasers.

In sum, because of these legal and market limitations, states are not able to borrow funds for operations to the same degree as the federal government. They generally cannot rely on deficit spending to stimulate the economy.[17]

It is important to note that the practice in some states such as Illinois of creating a bill backlog by pushing off the payment of bills into the next fiscal year is not the same as deficit spending; it is simply a tool to make it appear as if the fiscal year budget is balanced.[18] Funds are not being spent, but rather payment is being delayed and can be considered borrowing from vendors. In a recent report from the State Comptroller’s Office, the State’s bill backlog was estimated at $7.3 billion.[19]

Insufficient Revenue Capacity to Deal with Major Economic Disruptions

In periods of economic disruption such as recessions or the current coronavirus pandemic, states face severe revenue shocks as tax and fee receipts plummet. For example, in a recent report the Illinois Commission on Governmental Forecasting and Accountability estimated that the state’s general operating revenues could fall between almost $2 billion and more than $8 billion over several years, depending on the severity of the virus-triggered recession.

The states’ response to revenue shocks is constrained because they are only authorized by statutory or constitutional provisions to utilize a limited number and amount of taxes and fees. Many types of revenue heavily relied upon by states such as income and state taxes are economically sensitive, which means that they fluctuate in response to upswings and downswings in the economy. In an economic downturn, these types of revenues will fall as individuals reduce consumption and workers lose their jobs. Finally, states are also limited in how much revenue they can raise by tax capacity, which is the ability of residents and businesses to pay taxes. In an economic downturn, that capacity is severely strained.

States may attempt to mitigate revenue shocks with an austerity-based regime of raising taxes and/or cutting spending in an effort to balance the budget. However, these are forms of procyclical action at a time when countercyclical action is likely needed. In addition, deep cuts in spending can have an extremely negative impact on delivering core public services in a time of the greatest need.[20]

Spending Reserves is the Major Countercyclical Fiscal Policy Tool States Use

States tend to rely on fiscal reserves, often called “Rainy Day” funds, as the primary tool they use to cushion revenue shocks in economic downturns and avoid steep budget cuts or tax and fee increases. Reserves can be structured as General Fund balances or Budget Stabilization funds. General Fund balances are discretionary funds that can be used at any time while Budget Stabilization Funds are reserved for use only in emergencies.[21] Research suggests that $100 in reserves can reduce unplanned budget cuts by $5 or $6 and it can reduce tax hikes by $12 to $18.[22

Fiscal reserves are a useful fiscal tool. However, when an economic downturn is severe, they are woefully inadequate to meet those challenges. The National Association of State Budget Officers reports that in fiscal year 2020, state Rainy Day funds totaled $69.6 billion. This amount was 8.4% of all state expenditures.[23] While individual states may have enough in their reserve to weather a moderate recession, it is clear that no state will be able to deal on its own with impact of the revenue shock that the coronavirus epidemic will bring in the coming months and especially if a lengthy recession follows the pandemic.

Illinois does not maintain a functional rainy day fund, even though a law was enacted in 2004 to build such a fund. The law established a goal of maintaining 5% of General Funds revenues in an existing account called the Budget Stabilization Fund.[24] The fund was created to help reduce the need for future tax increases or short-term borrowing, maintain high credit ratings and address budgetary shortfalls. However, the fund has never received significant resources, in large part because annual revenue projections have not met the threshold requirement to trigger deposits into the fund.[25] As part of a stopgap spending plan passed in June 2016 during the State of Illinois’ budget impasse, the Fund’s entire balance was appropriated to pay for State operations in FY2017 and it was subsequently folded into General Funds.

Conclusion

States are very limited in their ability to use fiscal policies to address major economic disruptions such as the current coronavirus pandemic. Structural restrictions such as balanced budget requirements and debt limits as well as revenue capacity limitations make it nearly impossible for states to continue to provide key public services when faced with severe revenue shocks. The federal government has the financial resources and the fiscal capacity to implement meaningful countercyclical fiscal policies that can mitigate these pressures and assist state and local governments, some of which are already contemplating budget cuts.

[1] John L. Mikesell, Fiscal Administration, 10th edition. p. 17.

[2] Investopedia, Monetary Policy at https://www.investopedia.com/terms/m/monetarypolicy.asp.

[3] Federal Reserve Bank of Chicago, The Federal Reserve’s Dual Mandate at https://www.chicagofed.org/research/dual-mandate/dual-mandate.

[4] Chad Stone. What’s The Fed to Do? The central bank is navigating through uncharted waters, US News And World Report, July 28, 2017, at https://www.usnews.com/opinion/economic-intelligence/articles/2017-07-28/the-fed-struggles-with-the-unemployment-inflation-trade-off.

[5] Federal Reserve Bank of Chicago, The Federal Reserve’s Dual Mandate at https://www.chicagofed.org/research/dual-mandate/dual-mandate.

[6] Investopedia, Monetary Policy at https://www.investopedia.com/terms/m/monetarypolicy.asp.

[7] This discussion is drawn from Robert Rich, The Great Recession: December 2007–June 2009, Federal Reserve History at https://www.federalreservehistory.org/essays/great_recession_of_200709.

[8] Investopedia, Federal Funds Rate at https://www.investopedia.com/terms/f/federalfundsrate.asp.

[9] Robert Rich, The Great Recession: December 2007–June 2009, Federal Reserve History at https://www.federalreservehistory.org/essays/great_recession_of_200709.

[10] Investopedia, American Reinvestment and Recovery Act at https://www.investopedia.com/terms/a/american-recovery-and-reinvestment-act.asp.

[11] Illinois Jobs Now!, Illinois Public Act 96-35 at http://governorquinnportrait.org/illinois-jobs-now.html.

[12] Investopedia, The Roots of Fiscal Policy at https://www.investopedia.com/terms/f/fiscalpolicy.asp.

[13] Alberto Alesina, Filipe R. Campante and Guido Tabellini, Why is Fiscal Policy Procyclical? Journal of the European Economic Association, September 2008, pp. 1-2.

[14] Emanuele Baldacci, Sanjeev Gupta and Carlos Mulas-Granados, How Effective is Fiscal Policy Response in Financial Crises?, International Monetary Fund, 2012, p. 3 at https://www.imf.org/external/np/seminars/eng/2012/fincrises/pdf/ch14.pdf.

[15] National Conference of State Legislatures, Fiscal Brief: State Balanced Budget Provisions, October 2010 at

https://www.ncsl.org/research/fiscal-policy/state-balanced-budget-requirements-provisions-and.aspx, pp. 1-2.

[16] Kim Reuben and Megan Randall, Debt Limits: How States Restrict Borrowing. Urban Institute, November 2017.

[17] Yilin Hou and Donald P. Moynihan, The Case for Countercyclical Fiscal Capacity, Journal of Public Administration Research and Theory, Volume 18, Issue 1, January 2008, p. 141 at https://doi.org/10.1093/jopart/mum006.

[18] Civic Federation, Measuring the State of Illinois’ Bill Backlog, February 8, 2019 at https://www.civicfed.org/iifs/blog/measuring-state-illinois-bill-backlog.

[19] Illinois State Comptroller. Debt Transparency Report Summary at https://illinoiscomptroller.gov/comptroller/assets/file/DTA/current/DTAReport.pdf.

[20] Yilin Hou and Donald P. Moynihan, The Case for Countercyclical Fiscal Capacity, Journal of Public Administration Research and Theory, Volume 18, Issue 1, January 2008, p. 141 at https://doi.org/10.1093/jopart/mum006.

[21] Yilin Hou and Donald P. Moynihan, The Case for Countercyclical Fiscal Capacity, Journal of Public Administration Research and Theory, Volume 18, Issue 1, January 2008, p. 141 at https://doi.org/10.1093/jopart/mum006.

[22] Yilin Hou and Donald P. Moynihan, The Case for Countercyclical Fiscal Capacity, Journal of Public Administration Research and Theory, Volume 18, Issue 1, January 2008, p. 141 at https://doi.org/10.1093/jopart/mum006.

[23] The National Association of State Budget Officers, The Fiscal Survey of States, Fall 2019, p. 67.

[24] Illinois Public Act 93-660, enacted on February 2, 2004.

[25] Institute for Illinois’ Fiscal Stability, State of Illinois FY2020 Budget Roadmap: State Of Illinois Budget Overview, Projections and Recommendations for the Governor and the Illinois General Assembly February 13, 2019, pp. 28-29 at https://www.civicfed.org/sites/default/files/illinoisroadmapfy2020.pdf.a