March 09, 2012

In the last week, both houses of the Illinois General Assembly approved a General Funds revenue projection for FY2013 that is lower than the amounts included in the Governor’s recommended budget.

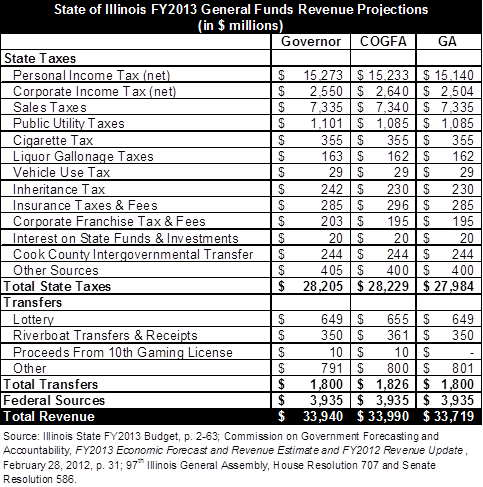

In two parallel resolutions, House Resolution 707 and Senate Resolution 586, legislators agreed that the State’s FY2013 budget should be based on an expectation of $33.7 billion in General Funds revenues, which is $221 million less than the Governor’s projected total of $33.9 billion. The approved revenue resolutions are also $271 million less than the most recent projections published by the General Assembly’s bipartisan financial oversight body, the Commission on Government Forecasting and Accountability (COGFA). In FY2012 the Senate and House based their appropriations on separate revenue projections, which were more than $1 billion apart, leading to some difficulty in consolidating their bills into one budget. The consensus revenue estimate among the chambers of the General Assembly is seen as an improvement over last year’s budget process and was a recommendation of the Governor’s Budgeting for Results Commission.

The largest reduction in the revenue projections made by the General Assembly from the Governor’s recommended FY2013 budget, which was published on February 22, 2012, is the lower expectation for income taxes. Personal income tax revenues in the General Assembly’s projections are $133 million lower than the Governor’s and corporate income taxes revenues are $46 million lower.

The following table compares the revenue projections approved by the General Assembly (GA) to the estimates published by Governor and COGFA in the last month.

According to the resolutions, both chambers will now proceed with crafting spending plans that are not to exceed the approved revenue estimates. This will necessitate additional cutting from the Governor’s recommended budget for FY2013, which already includes cuts to many agencies and programs.

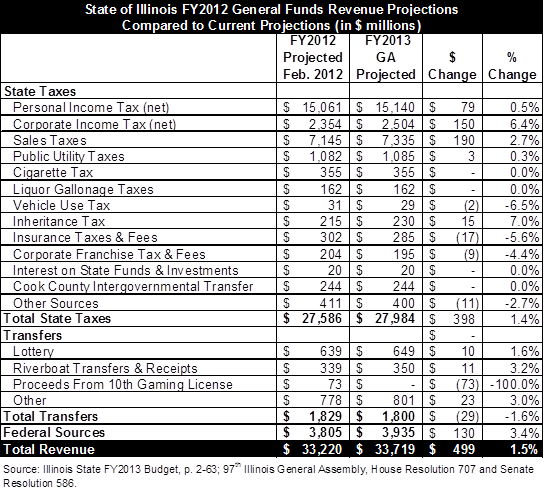

The projections for FY2013 General Funds revenues approved by the General Assembly, although lower than COGFA and the Governor’s budget, are $499 million more than the FY2012 total of $33.2 billion and represent a total increase of 1.5%. The largest year-to-year growth in State revenues is projected for sales taxes, which increase by $190 million from $7.1 billion to $7.3 billion. As shown in the table above, the legislature’s sales tax total matches the Governor’s projection.

The General Assembly adopted a projection for personal income tax revenues totaling $15.1 billion, growing by only $79 million from FY2012, which is less than 1.0% year-to-year growth. The legislature’s projections for growth in corporate income tax revenues in FY2013 are more optimistic. Projections approved in the resolutions show an increase of $150 million, or 6.4%, from $2.3 billion in FY2012 to $2.5 billion in FY2013.

FY2013 will mark the second full budget year of the State’s higher income tax rates that were increased from 3.0% to 5.0% for individuals and 4.8% to 7.0% for corporations in January 2010 (the State also collects a 2.5% Personal Property Replacement Tax on corporate income that is passed on to local governments, making the effective corporate tax rate 9.5% in Illinois).

The following table compares the current projected revenues for FY2012 to the projections for FY2013 approved by the General Assembly.

As noted above, the legislature’s decision to reduce revenue expectations for FY2013 may necessitate additional reductions in the budget appropriations process. As proposed, the Governor’s FY2013 budget already called for cuts to many agencies and programs, while underfunding expected Medicaid costs by $2.7 billion.

The next step for both chambers will be to assign proportions of the budget that will be spent on each area of State operations and then to craft the specific spending for each agency and department in the appropriations committees and subcommittees. The ensuing appropriations bills are negotiated and consolidated throughout the spring session, which runs through the end of May. The General Assembly is tasked with finalizing its FY2013 budget and sending it to the Governor for approval before the current fiscal year ends on June 30, 2012.