November 08, 2019

For more than a decade, the Civic Federation has strongly supported consolidation of hundreds of police and fire department pension funds across Illinois to improve investment returns and reduce administrative costs. The step is now being considered by the General Assembly following recommendations in October 2019 by Governor J.B. Pritzker’s task force on pension consolidation. Senate Bill 616 would consolidate the assets of Illinois’ 649 public safety funds, not including those in Chicago, into two new funds, one for police and one for fire.

The legislation also incorporates another task force recommendation that has attracted far less attention: a proposal to enhance benefits paid to police and fire pension fund members hired after 2010. The increases are designed to fix a legal issue related to these relatively low Tier 2 benefits, but so far little information has been made available about the long-term cost of the proposed solution or the urgency of implementing the changes.

What is Tier 2?

The General Assembly created Tier 2 in 2010 to reduce the State’s overwhelming pension obligations by significantly lowering benefits for new workers. The initial legislation, which affected most public pension funds in the State, was introduced on March 24, 2010 and passed the same day. A separate law passed in December 2010 extended Tier 2 to public safety funds.

Tier 2 applied to employees hired on or after January 1, 2011. Benefits for new workers were not protected by a provision of the Illinois Constitution that bans impairment of pension benefits for existing Tier 1 retirement system members. In 2015 the Illinois Supreme Court struck down subsequent legislation that would have reduced the benefits of current State employees and retirees.

In general, the main Tier 2 benefit changes were an increase in the retirement age to qualify for full benefits and a reduction in annual automatic benefit increases. Tier 2 workers receive annual benefit increases upon retirement of 3% or one-half of the rise in the Consumer Price Index (CPI), whichever is less, on a simple-interest basis. The increase for most workers hired before 2011 (but not Chicago public safety and some other employees) is 3% on a compounded basis.

Additionally, Tier 2 reduced the final average salary on which a pension is based from the average of the highest four of the last five years of service to the average of the highest eight of the last ten years of service. A limit was also imposed on the amount of earnings used to calculate final average salary.

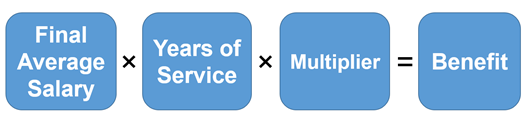

Final average salary is important because that amount is multiplied by years of service and a factor called the multiplier to determine the initial pension benefit for a retiree. The multiplier is the percentage of final average salary earned per year of service. The three main parts of the pension benefit formula are illustrated below.

When Tier 2 was created, public attention was focused on rectifying Illinois’ worst-in-the-nation pension crisis and assisting local pension funds in distress. Over time, the reduced benefits are expected to slow the growth in unfunded liabilities as new employees are hired and fewer members remain in the old benefit tier. The State was able to book immediate savings on its statutorily required pension contributions, which depend on future benefit levels.

Tier 2 and Social Security Safe Harbor Concerns

Some pension experts warned as early as 2010 that the new benefit structure was so low that it might force certain government employees to participate in the Social Security system. In Illinois most public employees, including teachers and public safety workers (but excluding most members of the State Employees’ Retirement System), do not have to pay into Social Security. To qualify for exemption from Social Security coverage, government workers must receive a retirement benefit from their public pension plan that is at least equal to the benefit they would receive under Social Security.

The IRS has issued rules, known as safe harbors, for determining if plans meet the minimum benefit standard. If Tier 2 benefits do not meet the safe harbor tests, either the benefits might have to be increased or employees might have to pay 6.2% of their salary to Social Security, matched by an equal employer contribution.

Unions and other Tier 2 critics are also concerned about the relatively low benefits provided to new employees. Tier 2 members of the Teachers’ Retirement System, which covers public school teachers outside of Chicago, pay 9% of their salary for pension benefits, the same as Tier 1 members. However, the cost of the Tier 2 benefit in FY2019 was 7.1% of salary, compared with 21.6% for Tier 1 benefits. As a result, Tier 2 members paid about 1.9% of their salary to subsidize Tier 1 benefits.

Senate Bill 616’s Proposed Tier 2 Changes

In October the Governor’s pension consolidation task force recommended three changes in Tier 2 benefits for downstate and suburban police and fire funds, all of which were incorporated into Senate Bill 616. The task force report said the following changes were intended to address concerns about the fairness of Tier 2 and to avoid running afoul of IRS regulations:

- Surviving spouse benefit: Tier 2 eliminated pension benefits for spouses of public safety workers whose deaths occurred before the end of the ten-year period for pension benefit vesting and whose deaths were not duty-related. Senate Bill 616 reinstates the Tier 1 benefit for these surviving spouses.

- Pensionable salary cap: The Tier 2 pensionable salary cap currently increases at one-half of CPI or 3%, whichever is less. The legislation raises the formula to the lesser of full CPI or 3%.

- Final average salary: Senate Bill 616 restores the higher Tier 1 level based on the average of the highest four of the last five years, instead of the average of the highest eight of the last ten years.

The first change, involving benefits paid to surviving spouses, is not expected to affect many individuals and reportedly holds great significance for first responders. The other two changes are designed, at least in part, to address the safe harbor concerns.

According to a legal analysis commissioned by the Illinois Municipal League, Tier 2 does not satisfy the safe harbor rules because the pensionable salary cap has not increased as fast as the Social Security wage base. The Social Security wage base is the maximum amount of salary subject to Social Security tax. The wage base is adjusted each year by the change in the national average wage index. The salary cap under Tier 2 and the Social Security wage base were the same in 2011—$106,800—but the Tier 2 cap for 2019 is $114,952, while the Social Security wage base is $132,900. That is because the average wage index increased faster than the CPI-based formula used to calculate the Tier 2 cap.

However, the Municipal League’s analysis points to an alternative IRS rule for retirement systems that do not satisfy the safe harbor rules. That provision compares the employee’s actual accrued pension benefit with the accrued benefit under a safe harbor formula. The police and fire funds satisfy this test because of the relatively high multiplier of 2.5% that is applied to final average salary to determine the pension benefit. At some point, even with the high multiplier, Tier 2 police and fire benefits might not meet the alternative IRS standards, but the analysis does not suggest the timing of any potential violation.

Questions about Proposed Tier 2 Changes

As indicated by the discussion above, determining when or if Tier 2 benefits will violate IRS rules is not simple. The analysis must consider the pension multiplier as well as the growth in the pensionable salary cap. Supporters of Senate Bill 616 have not as yet shown whether the proposed changes are needed to satisfy legal requirements and, if they are needed, whether they must be implemented immediately.

To the extent that growth in the pensionable salary cap is an issue, it remains to be seen whether Senate Bill 616 solves the problem. The legislation proposes that the salary cap grow by 3% or the inflation rate, whichever is less. This is clearly a faster rate than the current formula of the lesser of 3% of one-half of the inflation rate, but it does not match the national average wage index used to calculate growth in the Social Security wage base. The difference might be accounted for by the proposed change in the calculation of final average salary, which lowers the required multiplier under IRS rules.

Up to now, neither the Governor’s task force nor supporters of Senate Bill 616 have publicly provided actuarial reviews showing the cost of the Tier 2 changes for the affected police and fire funds. In the task force report, the cost is estimated at $70 million to $95 million over five years, or $14 million to $19 million per year, but there is no supporting documentation for the estimate.

The task force also noted that these estimated costs are minor compared to increases in investment returns projected to be earned by the consolidated funds compared with the 649 existing police and fire funds. The task force estimated that the consolidated funds could generate an additional $820 million to $2.5 billion in investment returns over five years, or $164 million to $500 million per year.

However, it should be noted that these increased returns are not guaranteed. Any increase in actual returns will be partly due to the consolidated funds’ ability to invest in riskier investments. State law restricts the securities that the existing police and fire funds are allowed to hold. In addition, because the assumed rate of return is used as the discount rate for pension liabilities, an increase in the expected return rate by the consolidated funds would also reduce statutorily required annual pension contributions. Senate Bill 616 requires that contribution changes due to changes in actuarial assumptions be phased in over three years.

Since Tier 2 applies to nearly all pension funds across the State, there could be a move to simply apply the same changes to all funds statewide, also without first determining whether the changes are the minimum necessary so as not to impose additional fiscal hardship on already struggling governments.

In recent years, the State has frequently rushed to enact pension changes without actuarial evaluation and public disclosure of their financial impact. The latest example involved pension buyouts, which were budgeted to reduce General Funds contributions by more than $400 million in FY2019 but ended up saving about $13 million that year. The original savings estimate was based largely on a different buyout plan; the enacted plan surfaced in the last days of the spring 2018 legislative session and was not vetted by pension actuaries before being approved by lawmakers.

The Civic Federation urges the Governor’s Office and sponsors of Senate Bill 616 to demonstrate the need for the specific Tier 2 enhancements in the legislation. In addition, they must ensure that the financial impact of any proposed Tier 2 changes is fully evaluated by pension actuaries and publicly disclosed before any action is taken by the General Assembly.