January 15, 2013

A new three-year budget projection for the State of Illinois by Governor Pat Quinn’s administration shows that significant spending reductions will be needed to balance the State budget in FY2015 and FY2016, when temporary income tax rate increases start to be phased out.

Even with the projected spending cuts, the State is not expected to be able to make much progress in reducing its enormous backlog of unpaid bills. Due to the reduced income tax revenue and continued growth in pension contributions, the backlog is projected to exceed $7.4 billion at the end of FY2016.

The State temporarily raised income tax rates in January 2011 from 3% to 5% for individual taxpayers and from 4.8% to 7.0% for corporations (9.5% including the Personal Property Replacement Tax or PPRT). On January 1, 2015, individual income tax rates are scheduled to roll back to 3.75% and corporate tax rates are scheduled to decline to 5.25% (not including the PPRT). Since the State budget year begins on July 1, the first full-year impact of the partial rollbacks will be in FY2016.

The projection by the Governor’s Office of Management and Budget (GOMB), issued on January 11, 2013, shows a $4.7 billion decrease in State income tax revenues from $18.6 billion in FY2014 to $13.9 billion in FY2016. An Economic and Fiscal Policy Report issued along with the projection explains the revenue forecast.

To balance the general operating budget in the face of the decline in revenues, total agency appropriations would be cut by 5.4% in FY2015 and 13.6% in FY2016, according to the analysis.

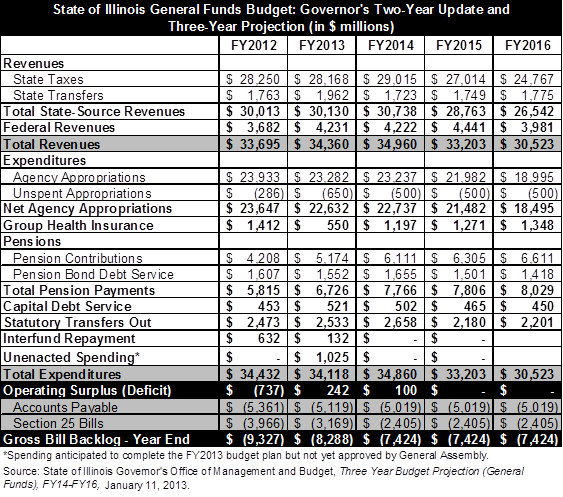

The table below summarizes GOMB’s projection for the General Funds budget from FY2014 to FY2016. The three-year projection also includes updated results for FY2012 and FY2013. (Click to enlarge.)

In FY2014 State-source revenues are expected to increase by about $600 million. That additional revenue will be consumed, however, by an increase of nearly $1 billion in statutorily required pension contributions. Although total expenditures in FY2014 are expected to increase to $34.9 billion from $34.1 billion in FY2013, the projection shows a reduction of nearly $400 million in education funding, excluding teachers’ pensions.

Agency appropriations (excluding spending on pensions and group health insurance) are projected to decline by $4.2 million, from $23.2 billion in FY2014 to $19.0 billion in FY2016. Total expenditures, including pension contributions, health insurance payments, debt service and transfers to other State funds, are projected to decline by $4.3 billion, from $34.9 billion in FY2014 to $30.5 billion in FY2016.

The State’s backlog of unpaid bills is projected to decline to $7.4 billion at the end of FY2014 from $8.3 billion at the end of FY2013. Due to the revenue reductions in FY2015 and FY2016 and continued growth in pension contributions, the backlog is expected to remain at $7.4 billion at the end of FY2016. The unpaid bills backlog includes both General Funds accounts payable and Section 25 liabilities, which consist mainly of Medicaid and group health insurance bills.

The three-year budget projection and accompanying report are required under a law enacted in July 2010. More details about Governor Quinn’s budget plans for FY2014 will be available when he issues his recommended budget.

The State Budget Law requires the Governor to deliver a budget address for the next fiscal year by the third Wednesday in February, unless otherwise directed by law. Although the General Assembly’s schedule shows that this year’s budget address will be delayed until March 6, 2013, the legislature has not passed a law authorizing the change. If no action is taken by the General Assembly, then the Governor will be required to present his FY2014 budget recommendation on February 20, 2013.