April 28, 2023

On April 20, 2023 two bills passed out of committee in the Illinois House of Representatives that would increase pension benefits for Chicago firefighters hired after 2010. Senate Bills 1629 and 1630 are now on second reading in the House after passing unanimously in the Senate earlier in the session.

The Civic Federation is concerned about these and other proposals that would enhance benefits for Tier 2 government employees (those hired since January 1, 2011) without any analysis completed first to understand the extent to which of these proposals are necessary and how much they would cost the responsible governments and taxpayers. Reinstating benefits without analysis showing they are sufficient to address potential issues with Tier 2 could substantially reverse much of the work the State has done to reduce massive pension liability costs.

The Civic Federation is on record advocating for a comprehensive, statewide analysis of Tier 2 benefits before any further changes are implemented. It is important to balance the need to ensure pension benefits under Tier 2 are sufficient to meet IRS Safe Harbor guidelines (see more on this below) with the negative impact enhancements would potentially have on pension funds’ funding levels and on the amount of money governments would need to pay into the funds through tax-funded government contributions.

While these two bills in particular would only impact the Chicago firefighters’ pension fund, one-off changes implemented individually like this are inefficient and likely to be more expensive than taking the time to find and implement a comprehensive change. The Federation opposes such pension changes without the benefit of any publicly available actuarial analysis as to their financial impact and without showing a pressing immediate need to change benefits.

This blog post will explain what Tier 2 benefits are and why they were implemented, describe the potential “safe harbor” issue and summarize the Civic Federation’s concerns about the bills pending in Springfield that would enhance Tier 2 benefits.

What Are Tier 2 Public Pension Benefits?

In 2010 the Illinois General Assembly created a separate tier of pension benefits for government employees hired on or after January 1, 2011 in an effort to reduce the State’s overwhelming pension obligations by significantly lowering benefits for new workers. Tier 2 pension benefits were enacted in legislation introduced and passed by the legislature in March 2010 and signed by the Governor in April 2010. The new tier applied to most State and local public pension funds in Illinois, with the exception of police and fire pension funds and the Chicago Transit Authority, which already had a second tier added in legislation passed in 2008. Additional legislation passed in December 2010 extended Tier 2 to the hundreds of police and fire funds that were not included in the first bill.

Tier 2 benefits differentiated between existing government employees (Tier 1) and new employees hired as of the effective date, January 1, 2011 (Tier 2). The changes to benefits for new Tier 2 employees increased the retirement age to qualify for full benefits and reduced annual automatic benefit increases. Tier 2 workers receive annual benefit increases upon retirement of 3% or one-half of the rise in the Consumer Price Index (CPI), whichever is less, on a simple-interest basis. The increase for most workers hired before 2011 (but not Chicago police officers, fire fighters and some other employees) is 3% on a compounded basis.

Additionally, Tier 2 reduced the final average salary on which a pension is based from the average of the highest four of the last five years of service to the average of the highest eight of the last ten years of service. A limit was also imposed on the amount of earnings used to calculate final average salary, with a salary cap starting at $106,800, the Social Security wage base in 2010. This salary cap increases at the rate of the lesser of 3% or half of the annual increase in CPI.

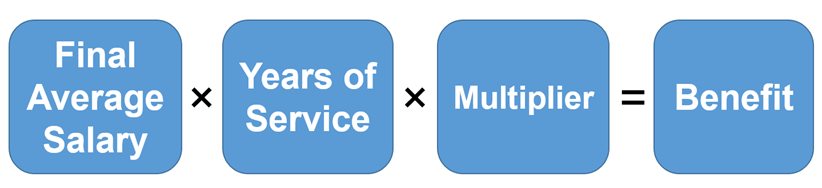

Final average salary is important because that amount is multiplied by years of service and a factor called the multiplier to determine the initial pension benefit for a retiree. The multiplier is the percentage of final average salary earned per year of service. The three main parts of the pension benefit formula are illustrated below.

Despite the reduction in benefits for Tier 2 employees, the lower Tier 2 benefits were not matched by lower employee contributions. Tier 2 employees contribute the same percentage of their salary as Tier 1 employees. It should be noted that the lower benefit structure coupled with the lack of a reduction to the amount employees pay into their pensions may not be sustainable due to legal and equity issues.

It is also important to note here that some public pension funds in Illinois have a third tier of benefits. However, this blog post will not examine those changes.

Why Tier 2 Benefits?

The purpose of enacting a significantly less generous tier of benefits for new employees was to curb unsustainable growth in pension costs. The estimated amount of unfunded pension liabilities across all State and local pension funds in Illinois is over $210 billion based on the most recent actuarial reports for each fund. This represents the amount of pension obligations that must be paid down over time based on a retirement system’s projected future benefit obligations due to past service by employees and retirees. The five State retirement funds alone currently have a combined $140 billion in total unfunded liabilities, which represents an increase of more than 150% over the past fifteen years.

Tier 2 benefits were created to rectify Illinois’ worst-in-the-nation pension crisis and assist local governments in distress who are ultimately responsible for funding their employees’ pensions. The reduced benefits are expected to slow the growth in unfunded liabilities as new employees are hired and fewer members remain in the old benefit tier. As the number of Tier 1 employees hired before 2011 continue to age and retire and as Tier 2 employees hired since 2011 continue to represent a larger share of the workforce, governments’ pension costs are expected to decline over time.

The new tier of pension benefits was also necessary because benefits already earned by workers are protected by the “pension protection” clause in Article XIII, Section 5 of the Illinois Constitution, which states that pension benefits cannot be diminished or impaired. In 2015 the Illinois Supreme Court struck down legislation that would have reduced the benefits of existing State employees and retirees. Thus, the creation of Tier 2 benefits enabled the State to reduce pension benefits for future employees who had not yet accrued retirement benefits.

After the creation of Tier 2, the State of Illinois was able to book immediate savings on its statutorily required pension contributions, which depend on future benefit levels. Based on current projections and the State’s 50-year funding formula, the State’s unfunded pension liabilities are expected to begin to decrease by 2030 and the five State-level pension funds will reach the goal of 90% funding levels by 2045.

Number of Tier 1 vs. Tier 2 Employees

The number of people enrolled in Tier 1 and Tier 2 pension benefits differs by pension fund across the State. Using the City of Chicago’s four pension funds as an example, approximately 50.5% of the 51,978 active employees participating in the four pension funds belonged to Tier 1 and 49.5% belonged to Tier 2 or 3 as of FY2021. (A third tier of benefits was added to certain Chicago funds in 2017.) However, there is some variance when looking at individual funds: 54.2% of employees participating in the Municipal Employees’ Fund were in Tier 2 or 3 in FY2021; 39.1% of employees of Laborers’ Fund members were part of Tier 2 or 3; 41.7% of Police Fund members were in Tier 2; and 42.3% of the Fire Fund were in Tier 2. The percentage depends on the age of the fund’s workforce and how much hiring each government entity has done since 2011.

Social Security Safe Harbor Concerns

In Illinois most public employees and their employers, including teachers and public safety workers, do not have to pay into Social Security. A few exceptions are employees of the Chicago Transit Authority and most members of the State Employees’ Retirement System, who do contribute to Social Security. To qualify for exemption from Social Security coverage, government workers must receive a retirement benefit from their public pension plan that is at least equal to the benefit they would receive under Social Security.

Some pension experts warned as early as 2010 that the new benefit structure was so low that it might force certain government employees to participate in the Social Security system. The IRS has issued rules, known as safe harbors, for determining if plans meet the minimum benefit standard. If Tier 2 benefits do not meet the safe harbor tests, either the benefits might have to be increased or employees might have to pay 6.2% of their salary to Social Security, matched by an equal employer contribution.

Unions and other Tier 2 critics are also concerned that Tier 2 members could be paying more into pension funds than their benefits are worth due to their relatively low benefits. Using the Teachers’ Retirement System as an example, which covers public school teachers outside of Chicago, both Tier 1 and Tier 2 members contribute 9% of their salary into the pension fund. However, the cost of Tier 1 pension benefits in FY2020 was 19.66% of salary, whereas the cost of the Tier 2 benefit in FY2020 was 7.25% of salary. As a result, Tier 2 members paid about 1.75% of their salary to subsidize Tier 1 benefits.

Tier 2 Benefits Should Not Be Enhanced Without a Fiscal and Actuarial Analysis

As noted above, there are several proposals pending in Springfield to enhance Tier 2 benefits, but with little information about the long-term cost of the proposed solutions and without an analysis showing a failure to meet Safe Harbor guidelines is imminent. SB1629 would change the calculation of final average salary from the highest 8 consecutive years within the last 10 years of service to the highest 4 consecutive years during the last 10 years of service. SB1630 would change the limitation on pensionable salary to one that increases based on inflation from one that changes by the lesser of 3% or one-half of the inflation rate. The legislative sponsors and supporters of these proposals argue that the benefit enhancements are needed to preemptively solve the concerns about Tier 2 benefits failing to meet Safe Harbor rules. But there has been no comprehensive, statewide evaluation done to determine if or when Tier 2 benefits will violate Safe Harbor rules. It is critical that an actuarial analysis be conducted before making benefit enhancements because once pension benefits are provided, they become protected under the Illinois Constitution and cannot be reduced later.

Benefit enhancements additionally leave State and local government entities on the hook for funding the added costs, creating additional fiscal hardship for already struggling governments. Given the strong and growing impact of Tier 2 on reducing the growth rate of pension obligations across the State of Illinois, it is important that its effect not be nullified by significant increases to benefits that are not tied directly to Safe Harbor concerns. Some union representatives have argued that there should not be two tiers of benefits at all. However, it is clear that such an outcome would jeopardize the hard-won financial stability attained over the last several years by Illinois and the City of Chicago and could potentially result in the reversal of recent bond rating upgrades for both governments. For the City of Chicago and other local governments, this could lead to large property tax increases, further burdening homeowners and businesses as Illinois enters into a recession.

The Civic Federation is concerned that the State legislature continues to propose legislation that would enhance Tier 2 pension benefits with no evidence that Tier 2 benefits will violate the Safe Harbor rules anytime soon and with no evaluation of the cost. The State of Illinois in 2019 passed Tier 2 enhancements that were promoted as a potential “fix” to the Safe Harbor issue as part of landmark downstate and suburban public safety pension consolidation legislation. The changes in the bill allowed salary caps to grow at a faster rate (3% or the inflation rate, whichever is less) than the previous formula (3% or one-half of the inflation rate, whichever is less) and restored the Tier 1 calculation of final average salary. For more about the 2019 changes, read this Civic Federation blog post.

Benefit enhancements are likely necessary to meet Safe Harbor requirements, but the solution should be thoroughly vetted, actuarially sound and the most cost effective of all possible options. The Civic Federation urges legislators and the Governor to demonstrate the need for the specific Tier 2 enhancements before taking any binding legislative action. The State cannot afford to take a step backward by unnecessarily increasing Tier 2 pension benefits. The Illinois General Assembly must ensure that the financial impact of any proposed Tier 2 changes is fully evaluated by pension actuaries and publicly disclosed before any action is taken. Until a complete analysis is done, there should be no urgency to pass these supposed Safe Harbor “fixes.”