June 16, 2025

By Daniel Vesecky

The Chicago Public Schools District (CPS, or the ‘District’) has over 45,000 employees, all of whom are guaranteed a pension after retirement if they have met service time requirements. The teachers and some administrators participate in the Chicago Teachers’ Pension Fund, while most non-teacher employees of CPS are members of the City of Chicago’s Municipal Employee Annuity and Benefit Fund. Both pension funds are substantially underfunded. Controversy over who bears the responsibility of meeting legally mandated pension payments to the two CPS employee pension funds has been a major feature of public discourse and dispute in recent years. This issue brief aims to provide a foundational factual understanding of the pension plans at issue, who they serve, and their current financial condition.

Teachers

The Chicago Teachers’ Pension Fund (CTPF) had 33,089 active members, or current employees paying into the system, and 27,359 retirees and beneficiaries receiving benefit payments as of June 30, 2024. CTPF membership is made up of teachers, principals, superintendents, and other employees employed by CPS or approved Chicago charter schools whose positions require teaching certification. The CPTF was created by the Illinois State legislature and is governed by a 12-member board of trustees, ten of whom are elected to represent active or retired members of the fund—six elected by active teachers, three by current pensioners, one by active principals—and two of whom are appointed by the Chicago Board of Education.

The health of a pension fund can be measured by comparing its total assets to its total liabilities. The assets are simply the total amount of money in the pension fund, including investments and cash, and amounts contributed annually through employer contributions, employee contributions, and investment earnings. The liabilities are amounts owed in current and future benefits, refunds, and administrative expenses.

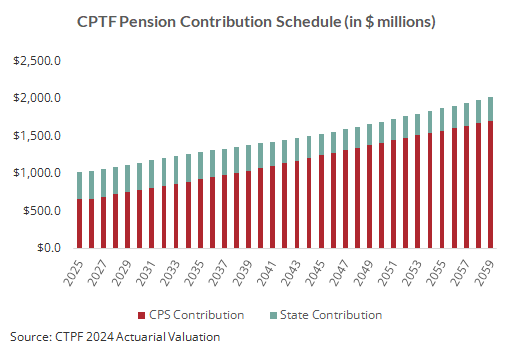

Best practice suggested by the Government Finance Officers Association calls for pension funds such as the CTPF to have a target funded ratio (the ratio of assets to liabilities) of 100% or more, meaning the fund should have enough in assets to equal or exceed the total liabilities. In 1995, the CTPF was put on a 50-year funding plan that requires employer contributions from CPS when the fund falls below a 90% funded ratio. However, the District skipped payments, taking “pension holidays”, from 1995 to 2006 and again from 2011 to 2013. In 2011, a law was passed delaying the year the pension fund must meet the 90% funding target from 2045 to 2059.

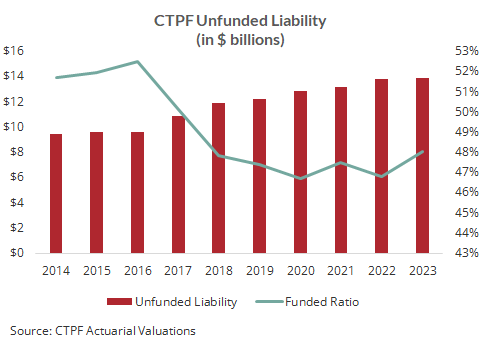

As a result, as of FY2023, the Chicago Teachers’ Pension Fund had a funded ratio of just 48.07%, with assets of $12.9 billion and liabilities of $26.8 billion, leaving a shortfall of $13.9 billion in unfunded liabilities.

Employer Contributions

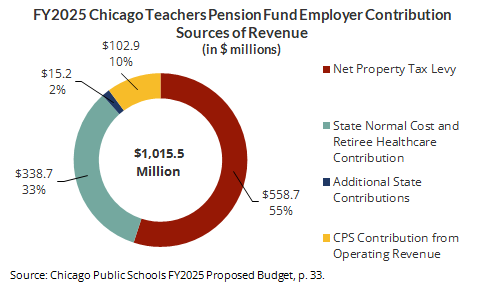

In Fiscal Year 2025 (July 1, 2024 – June 30, 2025), the CTPF requires a statutory minimum employer contribution of $1.02 billion. Of this total, CPS is responsible for $661.6 million, or 65%, while the State of Illinois will cover the remaining 35%. Under state law, the State’s share covers what is known as the “normal cost”, or the estimated value of future pension benefits that current employees will accrue over the course of the fiscal year.

Since the CTPF has substantial unfunded liabilities, covering just the normal cost is not sufficient to fully fund all future pensions. To stay on track with the State’s statutory funding schedule, which aims to get the CTPF to 90% funded by 2059, the District is responsible for covering the remaining costs needed to close the gap. Much of CPS’ pension contributions come from a special property tax specifically designated for funding teachers’ pensions. However, when the pension property tax levy is not enough to cover the rest of CPS’ required contribution, the District must pull from general operating funds. In FY2025, about 15% of the District’s pension payment comes from the District’s general operating budget.

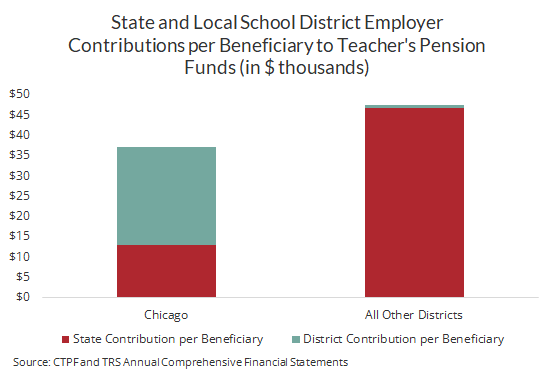

The way the CTPF is funded differs from teachers’ pensions in the rest of Illinois. Teachers outside of Chicago participate in the Teachers’ Retirement System (TRS). TRS’ employer contributions are funded almost entirely by the State, not the individual school districts.

For FY2025, public school districts outside of Chicago were expected to cover approximately $84.4 million in statutory employer contributions, only 1.3% of the total required employer contribution. The State will cover $6.2 billion, or 97.1% of the employer contribution, with the remainder coming from federal funds. This is in sharp contrast to the Chicago Public School District, for which the State covers 35%. While the CTPF has an unfunded liability of $13.9 billion, the TRS is much larger, with an unfunded liability of $83.6 billion.

Remedying the discrepancy between State funding for the CTPF and the TRS is a frequently discussed issue among advocates for the District. The most likely methodology for bringing State funding for Chicago teachers’ pensions to parity is by consolidating the CTPF into the TRS. This would require the State to fund all district pensions at the same level.

Opposition to consolidation comes in two ways. First, the historical discrepancy in funding ratios between the two systems has been larger, and CTPF beneficiaries have opposed joining the TRS because the funded ratio of their fund would drop, potentially diluting future benefits. Today, however, the funded ratios of the two systems at similar levels, making this objection weaker. The TRS currently stands at a funded ratio of 44.8%, only a few percentage points below the CTPF. Second, consolidating the two funds would require the CTPF board to yield some control over the fund’s assets and investment strategies. CPS and teachers union stakeholders have been reluctant to give up their power over the CTPF. With funding discrepancy concerns mitigated, there may be room for a consolidation deal that gives the State control over CTPF by merging it into TRS, but provides CPS with financial relief by increasing state coverage of employer contributions significantly.

Employee Contributions

Under current law, members of CTPF are required to contribute 9% of their salary to the Fund. In FY2025, employee contributions are projected to total $268.9 million. However, CPS pays a significant amount of the employee contribution on behalf of teachers hired before 2017. In 1981, to avoid a strike during collective bargaining negotiations, CPS agreed to cover 77.8% of the employee contribution (or 7% out of the 9% of any individual’s salary). So, although employees nominally contributed 9% of their paycheck to the CTPF, in reality, they only contributed 2%. This was known as the “pension pick-up.” The Civic Federation opposed this move at the time and repeatedly testified against it to the Board of Education. The employee contribution “pick-up” continued until 2017, when new collective bargaining deals eliminated it for new hires. However, the District still covers the 7% for employees hired before January 1, 2017. In 2025, the cost of this pick-up is projected to be $135.0 million, or about 50.2% of total employee contributions. The “pick-up” cost is factored in on top of the employer contribution that CPS makes annually to the CTPF.

Other CPS Employees

CPS has many non-teacher employees, such as teaching assistants, school counselors, and central office administrators. All CPS employees who are not members of the CTPF are instead eligible to receive pensions through Chicago’s Municipal Employees’ Annuity and Benefit Fund (MEABF). The 1921 state law creating the Fund defined employees to include municipal workers employed by the City of Chicago and several of its sister agencies, including CPS, the Chicago Housing Authority, and the Chicago Public Building Commission. The MEABF is a component of the City of Chicago and is governed by a five-member board of trustees composed of the City Treasurer, the City Comptroller, and three officials elected by the members of the Fund.

As of FY2023, the MEABF had a total of 36,968 active members currently contributing to the Fund. Of these, 23,166, or 62.7%, were employed by CPS. The Fund had a total of 26,028 retirees and beneficiaries receiving benefit payments.

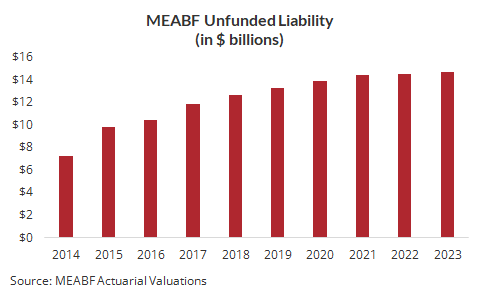

As with the CTPF, the MEABF is on a statutory funding plan that aims to reach a 90% funded ratio by 2059. However, the Fund remains severely underfunded: as of FY2023, it had a funded ratio of just 24.25%, with assets of $4.7 billion and liabilities of $19.4 billion. This means the fund has a total of $14.7 billion in unfunded liabilities. In FY2023, the total employer contribution to the MEABF was $976 million.

CPS Reimbursement

Although the MEABF covers retirement benefits for workers from several local units of municipal government, including, predominantly, the City of Chicago, the City is statutorily responsible for paying all employer contributions to the pension plan, regardless of which unit of government employs a covered member. CPS is not legally obligated to pay any employer contribution for its MEABF-covered employees.

Historically, the City has covered these payments. However, in 2020, Mayor Lori Lightfoot negotiated an intergovernmental agreement between the City and CPS to secure reimbursements from CPS. Under this agreement, CPS made annual payments to the City to reimburse it for a portion of the CPS share of MEABF employer contributions in FY2021, 2022, and 2023. The most recent reimbursement in FY2023 was approximately $175 million.

In 2022, the City hired the consulting firm Segal to better understand CPS’ share of the pension fund. Segal determined that approximately 45% of the MEABF’s “normal costs”, or the cost of benefits earned in a given year, are attributable to CPS. If CPS employees covered by the MEABF were under a separate pension plan, the statutory contribution requirement would have been $259.4 million in FY2022, significantly more than the $175 million the City received as a reimbursement.

Facing the financial strain of the end of federal Covid relief funding and the looming onset of increased costs of a new collective bargaining agreement with the Chicago Teachers Union, CPS did not make the MEABF reimbursement payment of $175 million as requested (and budgeted) by the City in FY2024. Despite this, the City factored a MEABF reimbursement from CPS as revenue in FY2025 and is continuing to pursue the reimbursement payment for FY2024.

The future of these reimbursements remains an unresolved issue between CPS and the City of Chicago.

This report is part of a three-part educational series on what's at stake for CPS in FY2026 and beyond. Click here to view the one-page summary of these reports.

This research was supported in part by the Joyce Foundation. The Civic Federation is a nonpartisan, independent research organization, and the views expressed in this report do not necessarily reflect those of the Joyce Foundation.