November 23, 2010

The operating budget enacted by the State of Illinois for FY2011 is based on General Funds revenues projected to be slightly higher than last year’s, and so far actual monthly revenues appear to be on target to meet or exceed these expectations.

This increase signals the State’s hope that FY2011 will be a transition year for economically sensitive revenues such as income taxes and sales taxes that have plummeted over the last two years. The revenue estimates and early indicators show that overall economic situation for the State may be stabilizing this year but that individual revenue streams will remain weak.

As reported in a review of the FY2011 enacted budget recently published by the Civic Federation’s Institute for Illinois’ Fiscal Sustainability, the estimated General Funds revenue total of $27.7 billion for FY2010 would mark the first year of growth in the State’s General Funds revenue since FY2008. This would be only a moderate increase of 2.1% over year-end estimates for FY2010, which totaled $27.1 billion. The total General Funds revenues for FY2011 would also still be $2.0 billion less than the FY2008 total of $29.7 billion.

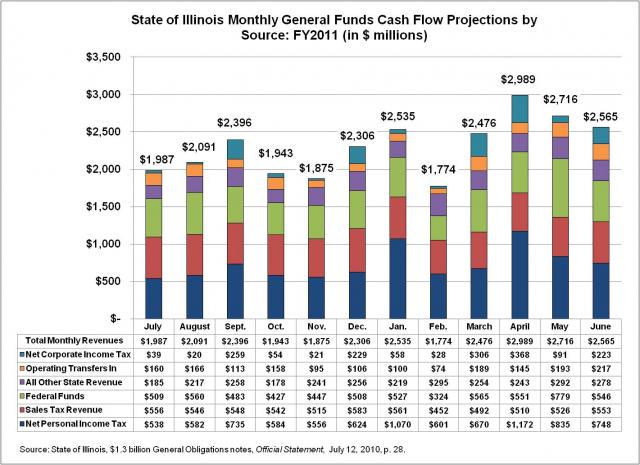

The following chart, which was included in the IIFS enacted budget analysis, shows the projected monthly revenue totals that the enacted budget was based on at the start of the fiscal year on July 1, 2010.

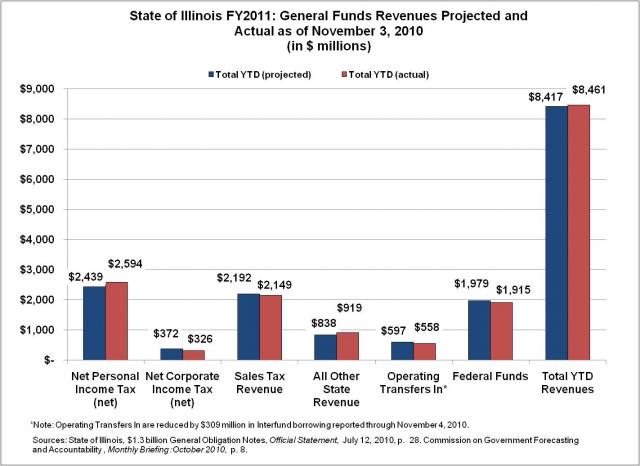

In its monthly briefing published for October 2010, the Commission on Government Forecasting and Accountability (COGFA) provided an overview of actual FY2011 revenue data as reported by the State Comptroller through November 4, 2010. The year-to-date totals were approximately $233 million ahead of revenues for the same period in FY2010. However, the totals included $309 million in interfund borrowing. After deducting to account for the borrowing from the State’s Special Funds, which must be paid back within 18 months, the year-to-year General Funds revenues actually show a decrease of $76 million for the first four months of the fiscal year, for a total of $8.5 billion.

Despite the annual decline, total year-to-date General Funds revenues received by the State are slightly ahead of projections from July 1, 2010 when the State began the current fiscal year. According to financial information provided in the State’s official bond statements, when the budget for FY2011 was enacted, General Funds revenue estimates totaled $8.4 billion for the first four months of the year.

The following chart shows projected FY2011 revenues compared to the actual results for the first four months of the fiscal year by source and total.

The largest increase in actual revenues was in Inheritance Tax receipts, included in Other State Revenues above. The enacted budget included revenues totaling $56 million from this source for all of FY2011, but the State received a total of $107 million for July through the end of October. Estimates of the Inheritance Tax were reduced earlier in the year by $222 million from the Governor’s recommended budget. The drop in inheritance tax was due to a coupling of the Illinois tax base tax with the Federal base that the proposed budget assumed would end in FY2011 but did not. It is unclear why the inheritance tax is so high for the first four months of FY2011 but COGFA notes that the revenue from this source is expected to decline dramatically as the year progresses.

Actual personal income tax receipts to the State also increased by 6.4%, or $155 million more than FY2011 projections for the first four months of the year. However part of this increase is due to a statutory change made to the amount of funds the State sets aside to pay for anticipated refunds. The General Assembly included a provision in the Emergency Budget Act for FY2011 that reduces the rate from 9.75% to 8.75%, which accounts for $28 million of the net increase. The change was made despite the fact that the State estimates that it will be $1.4 billion short in funding to pay for refunds at the end of FY2011.

These slight revenue gains are mostly offset by losses elsewhere for a total increase of 0.5%, or $44 million in total General Funds revenues through the end of October 2010. Even though this marginal rise is a positive result, it pales in comparison to the State’s combined $12.3 billion deficit for FY2011. As previously discussed on this blog, total $27.7 billion in revenues for FY2011 is not sufficient to support total General Funds expenditures of $33.5 billion. The imbalance creates an operating shortfall of $5.8 billion, which the State will reduce in FY2011 only through one-time authorization to borrow $2.2 billion. If no other actions are taken before the end of the year to deal with the shortfall, the remaining amount will increase the total backlog of unpaid bills. Currently the State’s unpaid bills are expected to total at least $6.4 billion without any additional operating shortfall by the end of the year.