December 16, 2011

On December 16, 2011, the Governor signed half of a tax incentive package that was sent to him earlier in the week by the legislature.

The package of tax incentives had failed to advance earlier in the veto session. After splitting a bill that passed the Senate but failed in the House into two separate measures, the House approved both sets of incentives on December 12, 2011. The Senate followed suit the next day and the bills were sent to Governor Pat Quinn on Thursday, December 15, 2011.

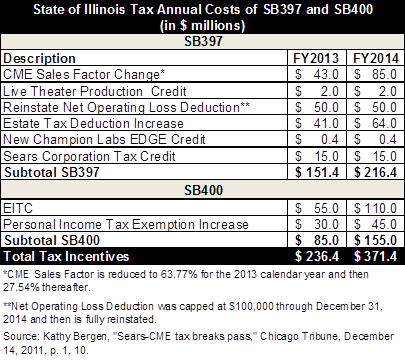

The first of the tax cuts bills, Senate Bill 397 (SB397), signed by the Governor includes all of the business tax credits, a change in the estate tax and specific incentives for CME Group and Sears Corporation. Senate Bill 400 (SB400) includes an increase in the Earned Income Tax Credit (EITC) and an increase in Illinois’ personal income tax exemption. It is estimated that all of the credits and exemptions in both bills, also known as tax expenditures, will cost the State $236.4 million in FY2013 and $371.4 million in FY2014.

The following table shows the estimated cost of each specific tax benefit in the package, published in the Chicago Tribune and reportedly provided by the Commission on Government Forecasting and Accountability.

The largest business tax break included in the package was a reduction in corporate income tax liabilities for the CME Group. The bill reduces the sales factors for the exchanges to 63.77% in FY2013 and then drops again to 27.4% in FY2014. Currently the sales factors for the exchanges are calculated at 100%, so the all of the trades made at the exchanges are considered Illinois sales and taxed at the full corporate tax rate of 7.0% by the State. By reducing the sales factor percentage, the State reduces the corporate income tax liability for CME. The incentives are expected to cost the State $43 million in FY2013 and $85 million in FY2014.

State tax credits worth $15 million annually are included for Sears in SB397 for the next 10 years. The bill additionally renews a special taxing district for Sears. The Economic Development Area (EDA) is estimated to reduce the corporation’s property taxes over the next 15 years by $217 million according to the local school district. The original property tax incentive deal for Sears was enacted 20 years ago and reduced its property tax liabilities by an estimated total of $250 million.

Also included in SB397 is an increase in the minimum amount eligible for the State’s estate tax exemption. Previously inheritances of up to $2.0 million were exempt from Illinois income taxes. The bill increases the ceiling to $3.5 million beginning on January 1, 2012 and to $4.0 million in FY2013. The estimated cost to the State for the estate tax change in FY2013 totals $41 million and $64 million in FY2014.

As part of the income tax increase legislation passed in January 2011, the State suspended the net operating loss deduction for businesses, other than Subchapter S corporations, through December 31, 2014 in order to maximize the receipts from the corporate income tax. The net operating loss deduction allows businesses reporting a loss in total annual income to reduce future tax liabilities by their losses and spread the amounts out for up to 12 years. It was estimated that suspending the deduction would increase annual State revenues by $250 million. Under SB397 the net operating loss deduction is reinstated but capped at $100,000 per year. It is estimated this will cost the State $50 million a year. The reinstatement of the rule does not take place until December 31, 2012, so it is not expected to affect State revenues in FY2012.

The Earned Income Tax Credit (EITC) is a federal program that allows low and moderate income workers to reduce their tax burden and receive refunds. Since January 1, 2000, Illinois has allowed individuals who qualify for the program to also claim 5% of the federal credit toward their State income tax returns. SB400 increases the credit in Illinois to 7.5% in FY2012 and 10% in FY2013, which will cost the State an estimated $55 million and $110 million, respectively. The EITC cost the State a total of $105 million in FY2010 at the 5% level according to the Comptroller.

The standard individual income tax deduction in Illinois was set at $2,000 on December 31, 2000. SB400 increases that amount to $2,050 in FY2013 and increases the exemption each year thereafter by the change in the Consumer Price Index for All Urban Areas to account for inflation. This tax break is expected to cost the State an additional $30 million in FY2013 and $45 million in FY2014.

The total cost of the tax changes from SB397 in the table above excludes the cost of other tax credits renewed in the legislation. SB397 provides for automatic renewal and a five year extension of all business tax credits set to expire in 2011, 2012 and 2013. The Illinois Income Tax Act was amended in 1994 to include an automatic sunset provision. The law requires that all tax credits have a “reasonable and appropriate sunset date” and if one is not directly enacted all credits sunset five years after they are enacted by the legislature. It is unclear how many credits to which the general extension in SB397 will apply.

The sales tax credits on the sale of ethanol, gasohol and biodiesel set to expire in 2013 are extended to 2018 by SB397. The Comptroller’s expenditure report shows the gasohol credit cost the State $102 million in FY2010 and the biodiesel credit cost $83 million. The specific cost of the ethanol discount was not included in the report.

The Research and Development Credit, which predates the automatic sunset provisions, allows companies to reduce their taxable income by 6.5% of any qualifying expenditures that increase research activity in the state. The credit was first enacted on July 1, 1990 and ran through December 31, 2003. The General Assembly then extended the credit through December 31, 2011. Although the credit was allowed to expire halfway through FY2011, SB397 reinstates the credit and extends it through January 16, 2016. Due to the amended expiration date, businesses that made qualifying expenditures over the past year may chose to claim those credits after the bill is signed into law. An earlier version of the bill included a fiscal analysis provided by the Illinois Department of Revenue that estimated the renewal would cost the State $40 million in FY2012 and each year after.