May 18, 2012

With two weeks left to go before the Illinois General Assembly is scheduled to adjourn, two budget plans for FY2013 are on the table: Governor Pat Quinn’s recommended budget and an alternative budget framework approved by the Illinois House.

The General Assembly is scheduled to adjourn on May 31, 2012. Bills voted on after that date require three-fifths majority to pass, rather than a simple majority.

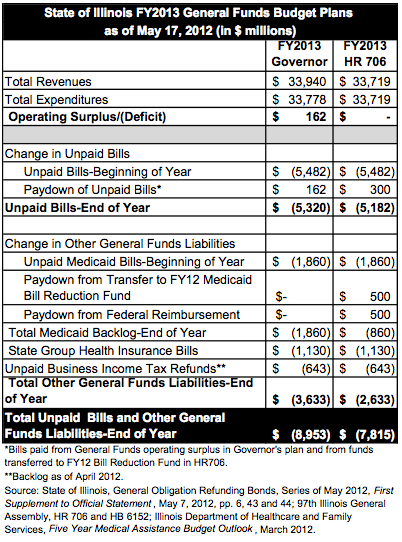

As discussed here, the Governor presented his FY2013 budget on February 22, 2012. The $33.78 billion general operating budget is based on projected revenues of $33.94 billion and results in an operating surplus of $162 million that would be used to reduce the State’s backlog of unpaid General Funds bills. The Governor’s budget does not address the accumulated backlog of unpaid Medicaid bills, which will total an estimated $1.86 billion at the end of FY2012.

House Resolution 706, approved on March 29, 2012, includes General Funds spending of $33.72 billion and is based on projected revenues of $33.72 billion. As discussed here, the House plan sets aside $300 million to reduce unpaid General Funds bills and $500 million to reduce the backlog of Medicaid bills.

The Senate agreed to the House’s revenue estimate on March 7, 2012 but has not yet approved a spending plan. House Joint Resolution 69, which contains the same spending plan as HR706, was introduced in the Senate but has been held in the Senate Executive Committee.

Both Governor Quinn’s budget proposal and HR706 underfund projected Medicaid costs by $2.7 billion and assume that steps will be taken to close the gap and prevent unpaid bills from growing. The Governor on April 19, 2012 announced a plan to eliminate the shortfall by making program changes, reducing reimbursement rates paid to healthcare providers and increasing the State’s cigarette tax. Legislation expected to incorporate the Governor’s Medicaid proposal may be considered by the General Assembly next week.

The following table summarizes the two FY2013 budget plans.

Under the House plan, the $300 million allocated to reduce the backlog of unpaid General Funds bills would be transferred out of General Funds to a new fund called the FY12 Bill Reduction Fund. The $500 million allocated to reduce the accumulated backlog of Medicaid bills would be transferred to a newly created FY12 Medicaid Bill Reduction Fund. Through a cycle of State expenditures and federal reimbursements, the $500 million would be used to pay down a total of $1 billion in Medicaid bills. This process, known in Illinois as churning, is explained here.

For both budget plans, projections of the accumulated backlog of unpaid General Funds bills have been updated to reflect new information included in documents filed on May 7, 2012 in connection with the State’s planned sale of General Obligation refunding bonds.

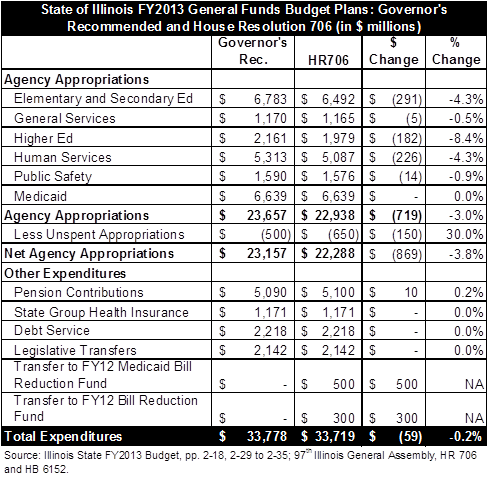

The next table compares the House spending plan for FY2013 with the Governor’s proposed General Funds expenditures. As shown in the table, agency appropriations are $719 million lower under HR706, with the largest percentage decline, at 8.4%, in the area of higher education.

Net agency appropriations of $22.29 billion in the House plan are $869 million, or 3.8%, below net agency appropriations of $23.16 billion in the Governor’s plan. Net appropriations subtract out appropriations that remain unspent because expenses do not reach budgeted levels or because they are held back at the Governor’s direction.