August 16, 2013

Moody’s Investors Service downgraded the bond ratings for seven of the nine public universities in Illinois on August 9, 2013. The ratings include a negative outlook for all of the institutions.

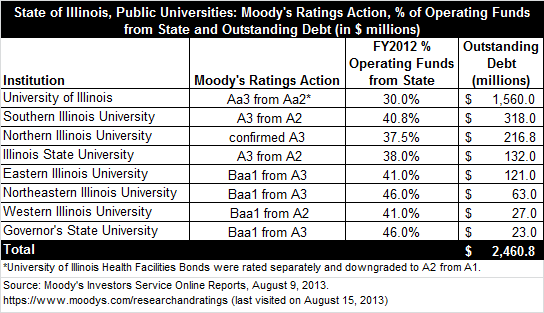

The action from Moody’s comes after a review of the finances of the State’s university system which began on June 10, 2013, less than a week after the agency downgraded the State’s General Obligation Bond (GO Bond) rating to A3 from A2. Nearly all of the debt issued by the institutions is now rated the same or lower than the State. Only the University of Illinois remains higher. Moody’s downgraded its revenue bonds and certificates of participation to Aa3 from Aa2 and Health System Facilities Bonds were reduced to A2 from A1.

No action was taken on Chicago State University, which is currently rated Baa1, and Northern Illinois University was confirmed at A3. Both have negative outlooks.

As previously discussed here, when Moody’s downgraded the State of Illinois’ rating in June, the criticism of the State’s financial condition focused on the General Assembly’s lack of action on pension reform. The latest downgrades of the State’s universities mention the pension crisis but only in the context of how it may affect funding received by the schools from the State. Instead the concern surrounding the finances of the higher education institutions centered on their reliance on the State for their annual operating expenses.

The analyses that accompanied Moody’s ratings actions for each of the universities were very similar and mentioned the actual percentage of their operating budgets provided by the State in fiscal year 2012. The reports showed that universities depend on State funding for between 30% and nearly 46% of their annual operating resources. Moody’s decision to cut most of the universities to the same level or below the State’s rating was based on the combined threat of future State payment delays and potential appropriations cuts due to State financial issues.

All of the seven institutions that were downgraded reported positive annual operating cash flow for FY2010 through FY2012 and many have shown increases in fund balance, which helped mitigate payment delays from the State.

Nonetheless, Moody’s points out the State is in a precarious financial condition and pension reform if enacted is likely to include a shift of some or all of the future cost of funding pensions to the universities. Both scenarios have negative budgetary consequences for the universities and complicate their future financial outlook. Currently the State is responsible for funding the employer costs of the State Universities Retirement System (SURS).

The ratings agency included the following statement describing the budgetary Catch 22 that the universities face in its analysis of the University of Illinois.

“The university is vulnerable to the impact of pension reform at the state level. If pension reform is passed, UI may need to fund a portion of its pension expense, possibly as early as FY 2015. If pension reform fails to be enacted, we expect continued pressure on state operating appropriations.”

The same statement is repeated in Moody’s report on each of the university downgrades.

The following table shows the ratings action by Moody’s for each of the eight universities reviewed, the percentage of its budget funded by the State in FY2012 and total debt outstanding.

The only university not affect by the action on August 9 was Chicago State University. Moody’s upgraded Chicago State’s rating as of May 21, 2013 to Baa1 from Baa2 and its rating has been at that level or lower since November of 2008.

The full report on each of the downgrades is available at the following links.