April 16, 2015

Rhode Island recently reached a potential settlement agreement with most employee and retiree groups involved in litigation against its 2011 landmark pension reforms. The details of the agreement became available on April 13, 2015 through a court filing that was one of several steps necessary for the settlement to be finalized. The settlement averts a trial that had been scheduled to start later this month.

The proposed agreement comes nearly a year after a previous settlement was rejected even though most employee and retiree groups overwhelmingly backed it. This time, the approval of all nine plaintiff groups was not required for the settlement to go forward. The three groups that rejected the new settlement—municipal police officers enrolled in the state-run pension system and the police and fire unions in Cranston, RI—will proceed separately in court.

Rhode Island Governor Gina Raimondo, who developed and promoted the 2011 reforms as state Treasurer, said the new settlement would preserve about 92% of the savings of the 2014 settlement, which in turn had preserved approximately 95% of the savings from the original law. All of the provisions of the 2014 Proposed Settlement are maintained in the new settlement, along with some additional elements. See this blog post for details of how the 2014 Proposed Settlement would have impacted the funded status of the affected Rhode Island pension funds.

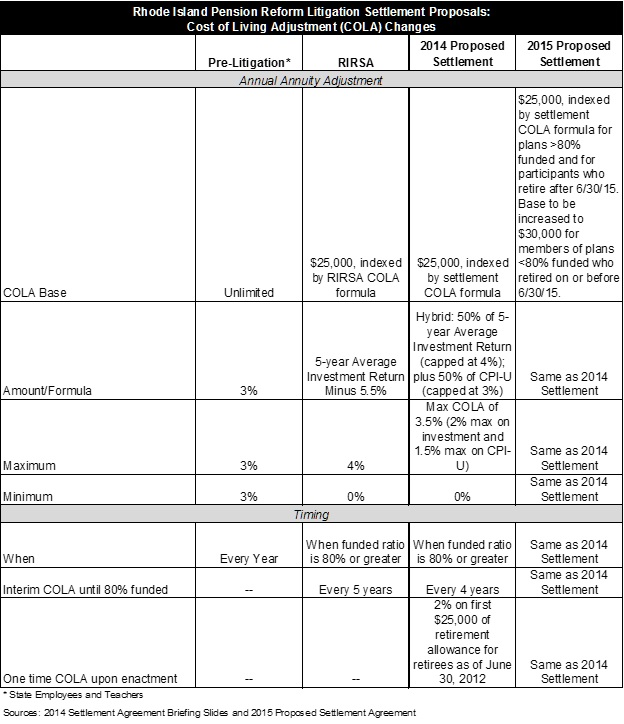

The main change to the Rhode Island Retirement Security Act of 2011 (RIRSA) reforms that affects all participants, like in the 2014 proposed settlement, is to the cost of living increase. There are additional major changes to benefit accrual for employees with 20 or more years of service and a new retirement age provision that would apply to all current and future employees that is a new part of the 2015 Settlement.

The following table summarizes the pre-RIRSA annual automatic annuity increase, changes made to annual adjustments under RIRSA and the changes proposed under the 2014 and 2015 proposed settlements. The COLA changes apply to all plans covered by the RIRSA reforms.

Changes to benefit accruals for workers with 20 or more years of service from the 2014 settlement are maintained in the 2015 proposed settlement. These changes were described in a previous IIFS blog post. The accrual changes impact one of the innovative aspects of the 2011 Rhode Island pension reform package: the fact that it moved current employees from a defined benefit (DB) plan to a hybrid plan with a slower-accruing defined benefit plan and a supplemental defined contribution (DC) plan. Previously earned benefits for vested employees were frozen and future benefits were to be accrued at a lower rate. Proponents of the reform asserted that the hybrid structure would provide a similar level of benefits to workers as a DB plan, but with shared risk between the employee and taxpayer.

Under the 2015 settlement agreement, teachers and state employees with 20 or more years of service as of June 30, 2012 remain under RIRSA until June 30, 2015 and thereafter will no longer participate in the defined contribution plan. Instead, they will keep the DC assets they accrued in the two years they participated but only participate in a DB plan going forward. The accrual rate for the DB plan will be 2% of final average salary per year. The accrual rate for the DB portion of the hybrid plan under RIRSA was 1% and before RIRSA ranged from 2% to 3%, depending on years of service and when the employee became a member of the fund. To somewhat offset the cost of this change, employees will be required to contribute a higher percentage of their salary. Prior to RIRSA, teachers contributed 9.25% of salary and state employees contributed 8.75%. Under the settlement agreement, members of both groups with 20+ years of service will be required to contribute 11% of salary.

Under the 2015 settlement (same as the 2014 settlement), the hybrid DB/DC plan will remain in place for teachers and state employees who had fewer than 20 years of service as of June 30, 2012, and the DB portion will continue to accrue at 1% of final average salary per year. However, the employer contribution to the employee’s individual account under the DC portion of the benefit will increase for those employees with 10-20 years of service from 1% of salary to either 1.25% or 1.5%. Employee contribution rates do not change for employees with fewer than 20 years of service.

New Provisions of the 2015 Settlement[1]

A completely new initiative in the 2015 settlement is the inclusion of two one-time “stipends” of $500 to be paid in 2015 and 2016 to each participant who retired on or before July 1, 2015.

While the 2014 Settlement did include some changes to retirement age for employees in service as of June 30, 2012, as noted above, the 2015 settlement will impact possible retirement date for all current and future employees, allowing earlier retirement for employees with 30 years of service and over. The original RIRSA law increased retirement age to match Social Security eligibility, which is currently 67 years of age. Under the 2015 Settlement, state employees and teachers will be able to retire as early as 62 with at least 33 years of service.

Employer Cost of the 2015 Settlement

According to a letter from actuaries included in the court filings for the 2015 Settlement, annual employer contributions in FY2017 will increase by $31.6 million due to the changes in the agreement. This represents 7.9% of the savings generated from all of the changes included in the original 2011 law, and is two percentage points more than the 2014 Settlement Agreement.

Next Steps

The settlement must be approved by Judge Sarah Taft-Carter and the Rhode Island legislature before it can go into effect. If the Judge approves the settlement process, she will hold fairness hearings in May 2015 and make a decision as to whether or not to certify the agreement as a class action. The draft legislation that needs to be passed by the Rhode Island General Assembly is included in the court filings for the settlement. Legislative leaders expressed support for the deal, but noted that they need time to review it and it is not certain when a bill would be considered.

[1] There are additional new provisions for firefighters in the state plan not discussed here.