April 15, 2020

The $2.2 trillion economic relief legislation passed by Congress in late March contains significant new funding for States and large local governments. Exactly how the money will be split appears to have caused considerable confusion in Illinois and elsewhere.

The Coronavirus Aid, Relief and Economic Security (CARES) Act provides a total of $150 billion in federal aid through the Coronavirus Relief Fund. After setting aside $11 billion for tribal governments, U.S. territories and the District of Columbia, the remaining $139 billion is divided among states and local governments based on population. The money can only be used to cover new expenses from March 1 to December 30 of this year to combat COVID-19.

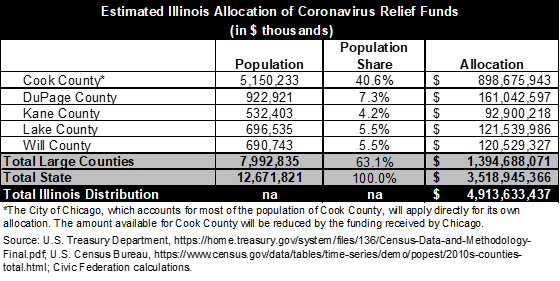

Illinois is expected to receive a total allocation of $4.9 billion. Governor JB Pritzker has said the State itself will keep $2.7 billion, with $2.2 billion going to large local governments, and has called on Congress to provide more aid to address revenue shortfalls. In other communications, the State of Illinois has said at least $2.7 billion will go to the state. Two national fiscal policy research organizations, the Tax Foundation and the Center for Budget and Policy Priorities, arrived at numbers of $3.5 billion for Illinois and $1.4 billion for local governments.

The Civic Federation’s estimate matches those of the two national groups, for reasons explained in this blog post. The Treasury Department’s explanation of the distribution methodology is here, but it does not explain specifically how the $2.2 billion is distributed. It explains how the local governments apply and how to divide funds between overlapping local jurisdictions. The Civic Federation is basing its interpretation on the language within the legislation itself.

Under the CARES Act, each state will receive a total distribution of at least $1.25 billion, with the remainder of the funding allocated based on population. According to the Treasury Department, 21 states will receive total distributions of $1.25 billion. The largest distributions will go to California ($15.3 billion) and Texas ($11.2 billion).

However, these amounts are maximum distributions to each state. The CARES Act specifies that local governments with populations over 500,000 are eligible for a portion of this funding. These large governments may receive at most 45% of the total state distribution. Each local government’s share will depend on its proportion of the total state population. Local governments must apply by April 17 to receive the funds.

Given Illinois’ total distribution of $4.9 billion, a maximum of 45%, or $2.2 billion, may go to local governments. Illinois has five counties with populations of more than 500,000—Cook, DuPage, Kane, Lake and Will. Each county receives an amount equal to the maximum allocation of $2.2 billion multiplied by its proportionate share of the State’s population of 12,671,821. For example, Cook County has an estimated 2019 population of 5,150,233, or 40.6% of the State’s total of 12,671,821. The Cook share is 40.6% of $2.2 billion, or $898.7 million. The total estimated local government share is $1.4 billion, leaving $3.5 billion for the State.

Illinois also has one city, Chicago, with a population of more than 500,000. Cook County’s allocation of $898.7 million is reduced by Chicago’s proportionate share of the State’s estimated population, according to the Treasury guidelines. Chicago has estimated its share at $470 million, with the remainder of about $429 million allocated to the rest of Cook County.

It remains to be seen whether the State and large counties will share any of their funding with smaller local governments. The Illinois Municipal League has asked the Governor to distribute CARES Act funds to smaller local governments.

At his daily press briefing on the virus on April 15, the Governor for the first time announced his administration’s estimate of the crisis-related shortfall in State revenues and noted that CARES Act funding may not be used to fill the gap. For FY2020, which ends on June 30, a shortfall of $2.7 billion is expected, including $1 billion from the three-month delay in income tax payments. For the next fiscal year, the administration predicts a budget gap of $6.2 billion—or $7.4 billion if voters do not approve a proposed constitutional amendment to permit graduated income taxes.

To close the budget gap in FY2020, the Governor said he plans to cut costs, borrow $700 million from accounts outside of the general operating funds and sell $1.2 billion in constitutionally permitted short-term debt. For FY2021, where the budget gap partly reflects repayment of the proposed borrowing, the Governor urged the federal government to provide additional assistance.