April 09, 2021

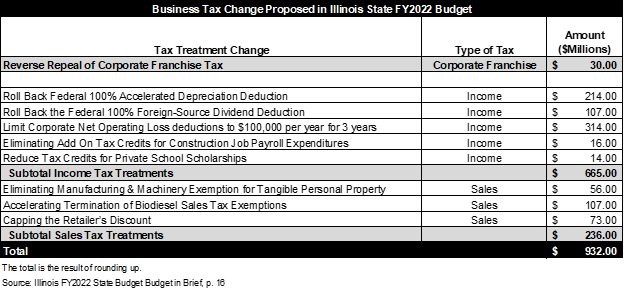

Governor Pritzker’s proposed FY2022 Illinois State Budget includes approximately $932 million in corporate tax changes. These changes increase FY2022 state revenues by reducing or eliminating current exemptions or credits provided to businesses or decoupling state tax treatment eligibility from federal government requirements [1].

The Governor characterized these tax treatments as “corporate and business tax loopholes” that substantially reduce state revenues. In his view it was preferable to reduce or eliminate them rather than imposing additional budget cuts or raising other taxes, as those actions would seriously impact lower or middle income Illinoisans. He noted that several of these changes were the result of actions taken by the federal government, particularly in the 2017 Tax Cuts and Jobs Act [2]. The tax proposals have met with strong opposition from business groups, including the Illinois Retail Merchants Association, Illinois Manufacturers Association and the Illinois Chamber of Commerce. They argue that the Governor is reversing incentives he supported only two years ago and that these proposals reduce the competitive situation for Illinois business at a time they are still recovering from the COVID-19 pandemic [3].

The proposed corporate and business tax changes are a key component in the administration’s plan to close the projected new fiscal year’s budget deficit. Several of these changes, now proposed for elimination, were approved in 2019 in amendments to the State Finance Act in Public Act 101-0009 as part of an agreement to approve the budget that year. The following are now proposed on the grounds that they are not affordable in the current economic climate:

- Eliminating the add-on income tax credits for construction job payroll expenditures;

- Reversing the repeal of the corporate franchise tax; and

- Removing production-related tangible personal property from the Manufacturing Machinery and Equipment Exemption in the sales tax [4].

The tax changes are summarized below.

Proposed Individual and Business Related Income Tax Treatment Changes

Governor Pritzker has proposed to generate an additional $665 million in FY2022 revenues by rolling back individual or corporate tax treatments.

Proposed New Individual Income Tax Change

The income tax credit for individuals or businesses that contribute to private school scholarship funds will be reduced from a 75% to a 40% credit. This is projected to generate $14 million in general fund receipts [5].

Proposed New Corporate Income Tax Changes

The FY2022 budget includes revenues from three proposed corporate income tax changes. These changes are estimated to generate $437 million in additional General Funds revenues for the coming budget year. However, it is important to note that some of the changes do not increase State revenues; they move the revenues forward by pushing out the losses and deductions to future years.

Rolling Back the Federal 100% Foreign-Source Dividend Deduction

The 2017 federal Tax Cuts and Jobs Act created a new 100% dividend deduction for the foreign source portion of foreign dividends as well as a 50% deduction for global intangible low-taxed income (GILTI). This is expected to generate $107 million in the General Funds. The budget emphasized that this change would still allow corporations to take advantage of standard deductions permitted under Internal Revenue Code Section 243 for domestic dividends [6]. The change would also generate an additional $7 million in revenues for local governments [7].

Rolling Back the Federal 100% Accelerated Depreciation Deduction

The administration proposes to amend the Illinois Income Tax Act to reverse a provision of the 2017 federal Tax Cuts and Jobs Act that allows a 100% depreciation deduction in the year of purchase for qualifying capital asset acquisitions such as machinery, computers or equipment. This change could generate $38 million in general fund revenues and a total of $214 million in all funds in FY2022 [8]. This could generate an additional $14 million in local government revenues as well [9].

Limit Corporate Net Operating Loss Deductions to $100,000 per year for three years

Under current state law, corporations can carry forward losses that occur when tax deductions are greater than taxable income in a given year. These losses can be used to count toward profits accruing in future years. The proposal would cap the amount of net operating losses that a corporation could claim in in one year to $100,000 for the next three years. This tax change is projected to generate $314 million in general funds revenues in FY2022 [10]. It could generate an additional $21 million in local government revenues as well [11].

Eliminating Add-On Tax Credits for Construction Job Payroll Expenditures

Eliminating the add-on tax credits for construction job payroll expenditures is estimated to yield an additional $16 million in general funds revenue in FY2022 [12].

Proposed Corporate Sales Tax Treatment Changes

The FY2022 budget includes revenues from three proposed corporate sales tax changes. These changes are estimated to generate a total of $236 million in additional revenues.

Capping the Retailer’s Discount

The Governor proposes once again, as in FY2020, capping the retailer’s discount. Illinois retailers currently retain 1.75% of the sales tax due to the State to help defray the cost of collection. The Governor proposes to cap the discount for each retailers at $1,000 per month. The proposal would provide the State an estimated $73 million in additional revenue as well as $55 million for local governments. The State contends that this change would only impact large retailers, representing about 1% of all retailers.

Eliminating the Manufacturing & Machinery Exemption for Tangible Personal Property

This change proposes eliminating production related tangible personal property from the corporate manufacturing machinery and equipment exemption, which had been added as part of the FY2020 budget. It is projected to yield approximately $56 million in FY2022 for the state general funds. It is also expected to yield an additional $44 million for local governments [13].

Accelerating Termination of Biodiesel Sales Tax Exemptions

Finally, the termination of remaining state sales tax exemptions on biodiesel purchases would be accelerated to July 1, 2021 rather than in future years. This action could generate $107 million for the State of Illinois and $85 million for local governments [14].

Rversing Franchise Tax Appeal

Public Act 101-0009 began the phase out of the Corporate Franchise Tax in calendar year 2020. This process was intended to conclude on January 1, 2024. The budget, however, includes a proposal to reverse the repeal of this tax, returning it to its structure prior to the passage of Public Act 101-0009 at a rate of 0.15% of paid-in capital when beginning business in the state, an additional 0.15 percent of any increase in paid-in capital during the year and an annual tax of 0.10 percent of paid- in capital [15]. According to the Governor's Office of Management and Budget, reversing the repeal of the corporate franchise tax would generate $30 million in revenues in FY2022 [16].

[1] Illinois State FY2022 Budget, pp. 48-49.

[2] Illinois State FY2022 Budget, pp. 48-49.

[3] Greg Hinz, “Biz leaders rip guv's spending plan,” Crain’s Chicago Business, February 17, 2021 at https://www.chicagobusiness.com/greg-hinz-politics/biz-leaders-rip-guvs-spending-plan.

[4] Illinois State FY2022 Budget, p. 50.

[5] Illinois State FY2022 Budget, p. 148.

[6] Illinois State FY2022 Budget, p. 150.

[7] Governor’s Office of Management and Budget. FY2022 Proposed Tax Changes Budget One Pager.

[8] Illinois State FY2022 Budget, pp. 148-149.

[9] Governor’s Office of Management and Budget. FY2022 Proposed Tax Changes Budget One Pager.

[10] Illinois State FY2022 Budget, p. 150.

[11]Governor’s Office of Management and Budget FY2022 Proposed Tax Changes Budget One Pager.

[12] Illinois State FY2022 Budget, p. 150.

[13] State of Illinois FY2022 Budget, p. 152 and Governor’s Office of Management and Budget. FY2022 Proposed Tax Changes Budget One Pager.

[14] Governor’s Office of Management and Budget. FY2022 Proposed Tax Changes Budget One Pager.

[15] State of Illinois FY2022 Budget, p. 156.

[16] State of Illinois FY2022 State Budget in Brief, p. 16.