September 13, 2019

In the State of Illinois, non-home rule units of government located in counties subject to the Property Tax Extension Limitation Law (PTELL) are limited in the size of their annual property tax extension to 5% or the increase in the Consumer Price Index (CPI), whichever is less. However, the limitation is subject to some exceptions and can be increased by referendum. The Forest Preserve District of Cook County is reportedly considering asking taxpayers for a larger levy to pay for pensions and a large backlog of land restoration and maintenance needs.

PTELL referenda are fairly common in Cook County and the Collar Counties, especially for school districts. However, none of the non-home rule governments in Chicago has ever tried to raise property taxes via PTELL referendum, so a possible countywide referendum for the Forest Preserve District would be a first for City voters.

What is PTELL?

The Property Tax Extension Limitation Law (PTELL) was passed in reaction to rapid growth in the collar counties and was applied to those counties beginning with tax year 1991. When PTELL is applied to a county, all non-home rule taxing districts in that county are subject to it. Cook County was made subject to PTELL beginning in tax year 1994.

PTELL is intended to limit the growth of an overall taxing district levy to 5.0% or the rate of inflation, whichever is less. The rate of inflation used to calculate the PTELL limit is the national CPI for all urban consumers for the year preceding the tax year published by the United States Bureau of Labor Statistics in January of each year. For example, the tax year 2018 (payable in 2019) CPI was 2.1% and the tax year 2019 (payable in 2020) CPI is 1.9%. This limit can be raised by voters through a local referendum, which is what the Forest Preserve District may propose to do.

The intention of tax caps is to limit the increase in the dollar amount of property tax revenue that a taxing district may receive. However, the dollar limit must be converted into a tax rate in order to be billed to taxpayers. The PTELL tax rate for a district is called the “limiting rate.” Additionally, it is important to note that the term “tax cap” can be misleading because the PTELL limiting rate does not “cap” taxable value of property or property tax bills and there are some exceptions to the limit, such as levies for some types of bonds.

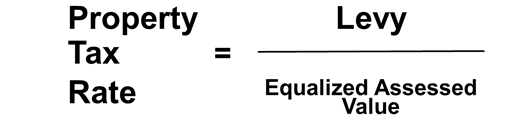

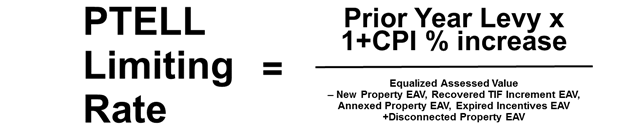

The limiting rate is the highest aggregate rate at which the county clerk can extend taxes for governmental funds subject to PTELL. It is similar to a tax rate, which is calculated by dividing a government’s levy by the equalized assessed value of property in the district.

A limiting rate has a numerator that is the prior year’s levies for tax capped funds increased by the lesser of 5% or the change in CPI divided by EAV in the district minus new property and expired TIF increment and other property value that is “outside the cap.”

This limiting rate is then the highest tax rate at which the government can extend property taxes for its capped funds. That is, the limiting rate prevents the government from increasing its levy by more than 5% or the rate of increase in CPI.

There is much more to PTELL than can be summarized here. To learn more, see the Civic Federation’s primer on property tax extension and publications by the Illinois Department of Revenue and Taxpayers’ Federation of Illinois.

What is a PTELL Referendum and How Does it Work?

If a government decides it needs more property tax revenue than it can raise under PTELL, it has a few different options for referenda to ask voters’ permission for a larger increase. One is to ask for an inflationary increase that is greater than allowed by PTELL for one or more years, known as an extension limitation referendum. Another is to ask for an increase to the limiting rate for up to four years. A third is to ask voters to approve a new tax rate for a specific governmental fund.[1] Any referenda authorized by PTELL are exempt from the limit of three public policy questions for a taxing district at an election.

A PTELL referendum of any kind must be submitted by the governing body of the district via ordinance or resolution and conducted at a regularly scheduled election. It must follow the election code and use ballot language specified in statute. Extension limitation and limiting rate referenda also require supplemental ballot information on the additional tax the owner of a $100,000 home would have to pay if the voters approve the increase. A majority of ballots cast on the proposition is required to approve the referendum.

The ballot question for the extension limitation referendum asks,

“Shall the extension limitation under the Property Tax Extension Limitation Law for [name of government], Illinois, be increased from the lesser of 5% or the percentage increase in the Consumer Price Index over the prior levy year to [ ]% per year for [levy year(s)]?”

The ballot question for the limiting rate increase asks,

“Shall the limiting rate under the Property Tax Extension Limitation Law for [name of government], Illinois, be increased by an additional amount equal to [ ]% above the limiting rate for the purpose of [ ] for levy year [ ] and be equal to [ ]% of the equalized assessed value of the taxable property therein for levy year(s) [list the levy years]?”

The ballot question for the new tax rate asks,

“Shall [name of government], Illinois, be authorized to levy a new tax for [ ] purposes and have an additional tax of [ ]% of the equalized assessed value of the taxable property therein extended for such purposes?”

An actual example of an extension limitation ballot question used recently by a township in McHenry County was:

Shall the extension limitation under the Property Tax Extension Limitation Law for Hebron Township, McHenry County, Illinois, be increased from the lesser of 5% or the percentage increase in the Consumer Price Index over the prior levy year to 7.31% per year for 2018? ___ Yes ___ No

The additional required information provided on the ballot for the Hebron Township referendum was the following:

(1) For the 2018 levy year the approximate amount of the additional tax extendable against property containing a single family residence and having a fair market value at the time of the referendum of $100,000 is estimated to be $4.15.

(2) Based upon an average annual percentage increase in the market value of such property of 4.7%, the approximate amount of the additional tax extendable against such property for the 2019 levy year is estimated to be $4.35 and for the 2020 levy year is estimated to be $4.55.

The limiting rate question looks a little different. The following is an example of a school district’s limiting rate referendum question:

Shall the limiting rate under the Property Tax Extension Limitation Law for Mokena School District Number 159, Will County, Illinois, be increased by an additional amount equal to .30% above the limiting rate for school purposes for levy year 2017 and be equal to the 2.7967% of the equalized assessed value of the taxable property therein for levy year 2019? ___ Yes ___ No

The additional required information provided on the ballot for the school district referendum was the following:

(1) The approximate amount of taxes extendable at the most recently extended limiting rate is $14,355,842 and the approximate amount of taxes extendable if the proposition is approved is $16,080,820.

(2) For the 2019 levy year the approximate amount of the additional tax extendable against property containing a single-family residence and having a fair market value at the time of the referendum of $100,000 is estimated to be $100.

(3) If the proposition is approved, the aggregate extension for 2019 will be determined by the limiting rate set forth in the proposition, rather than the otherwise applicable limiting rate calculated under the provisions of the Property Tax Extension Limitation Law (commonly known as the Property Tax Cap Law).

An example of a new rate referendum question submitted by the Village of Greenwood in McHenry County in 2018 was the following. There is no requirement for supplementary information for a new tax rate question.

Shall the Village of Greenwood, McHenry County, Illinois be authorized to levy a new tax for roadway maintenance purposes and to have an additional tax of .25% of the equalized assessed value of the taxable property therein extended for such purposes? ___ Yes ___ No

The township and village referenda failed and the school district referendum was approved. The Illinois Association of School Administrators (IASA) releases summaries of all kinds of school referenda results around the state by election. IASA also annually compiles the percentage of successful and not successful referenda by election going back to 1988 and shows that the percentage of successful referenda changes significantly from year to year. It is important to note that there are included in both summaries non-PTELL referenda for decisions such as issuing bonds for school construction projects or district reorganization. However, looking just at the school PTELL referenda compiled by the IASA over the last five years, 53% were approved and 47% failed.

Local governments seeking voter approval for PTELL referenda typically engage in public information campaigns to inform voters about the need for and proposed use of the funds. If the Forest Preserve District decides to move forward with a referendum, it will additionally need to educate Chicago and suburban residents who may never have voted on a tax cap referendum.

[1] There is a fourth possible referendum, to increase a district’s debt service extension base.