October 24, 2019

The Civic Federation recently released its annual Effective Property Tax Rates report, which examines two- and ten-year trends in estimated effective tax rates for residential, commercial and industrial property in selected northeastern Illinois communities. The report highlights that in the ten-year period between tax years 2008 and 2017, the effective tax rates increased in all of the selected communities in Cook County and the collar counties (Lake, McHenry, Kane, DuPage and Will), except industrial properties in the City of Chicago, since there were not enough sales of industrial property in tax year 2017 to calculate an effective tax rate. This blog will specifically look at the ten-year trend for all property types in the collar counties bordering Cook County.

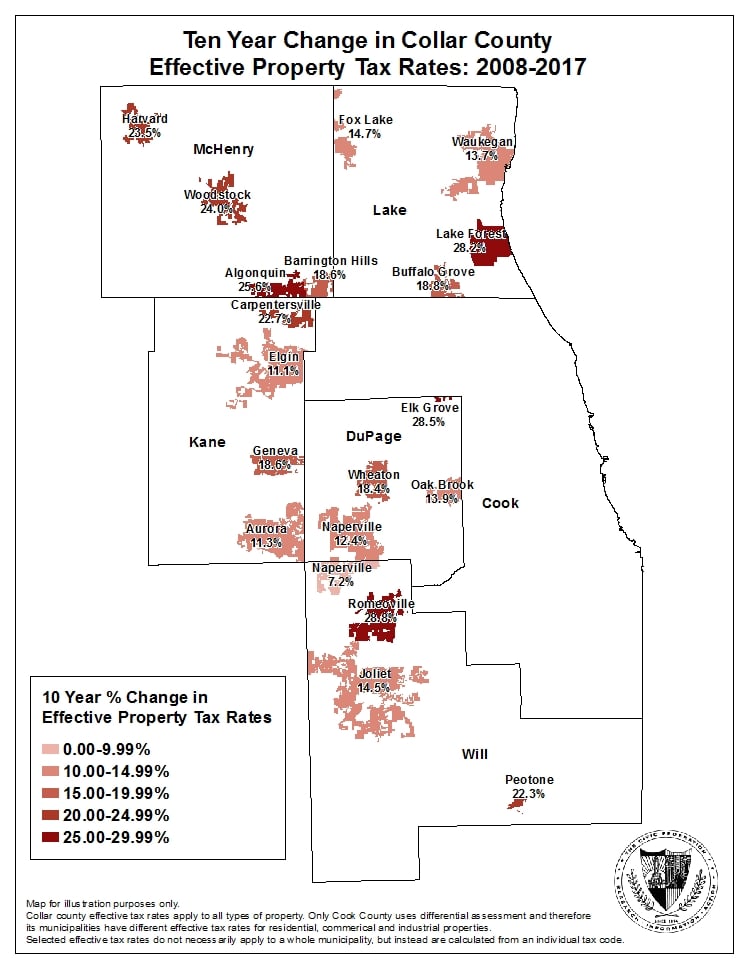

It is important to note that collar county effective tax rates apply to all types of property. Only Cook County uses differential assessment and therefore its municipalities have different effective tax rates for residential, commercial and industrial properties.

An effective property tax rate is an estimate of the percentage of a property’s full market value owed in property taxes during a given tax year. It offers a method of comparing property tax burdens across municipalities and counties. For example, the report shows that in 2017 the estimated effective property tax rate for property owners in a selected tax code in Naperville in DuPage County was 2.07%. More simply stated, in 2017 a residential property owner in that particular tax code in Naperville with property worth $200,000 would have an estimated property tax bill of $4,140 in property taxes without any exemptions.[1]

The table and map below show the percent change in effective property tax rates for residential, commercial and industrial property in the ten-year period between tax years 2008 and 2017 for selected communities in the collar counties (DuPage, Kane, Lake, Will and McHenry). Over this time period, every selected community experienced an increase in effective property tax rate, with increases ranging from 7.2% in Naperville in Will County to 28.8% in Romeoville.

While estimated effective property tax rates cannot be used to accurately determine the precise tax burden on specific properties, they are useful for providing an apples-to-apples comparison of average property tax burdens in different areas over time. To take the most extreme example from the table above, a residential property owner with a home worth $200,000 in a selected tax code in Romeoville with a 2.34% effective property tax rate would have paid an estimated $4,680 in property taxes in tax year 2008 without exemptions. In tax year 2017, the same homeowner in Romeoville — if the home was still worth $200,000 — would have owed an estimated $6,020 in property taxes if they were not eligible for exemptions. In the ten-year period from tax year 2008 to tax year 2017, the effective property tax rate in Romeoville increased from 2.34% to 3.01%, which is a 28.8% increase.

Change in effective tax rates over time is due to changing actual composite tax rates, changing median levels of assessment, or both. In the case of Romeoville, both factors contributed. The actual composite property tax rate in Romeoville increased from 6.6174% in 2007 to 9.9581% in 2017. Over the same time period, the median level of assessment as calculated by the Illinois Department of Revenue decreased from 35.29% to 30.20%.[2] The increasing trend in property tax rates is by no means standard. Between tax years 1999 and 2006 the majority of the collar county communities experienced a decrease in their respective effective property tax rates, with reductions ranging from -29.1% in Oak Brook to -2.1% in Barrington Hills. There were only three municipalities that experienced increases during that same time period: Elk Grove Village in DuPage County (1.0%), Naperville in Will County (3.2%) and Waukegan (6.3%).

Related Links:

Estimated Effective Property Tax Rates 2008-2017: Selected Municipalities in Northeastern Illinois

Calculate Your Community’s Effective Property Tax Rate

School Districts and Property Taxes in Illinois

The Final 2018 Cook County Equalization Factor is 2.9109

Estimated Full Value of Real Property in Cook County: 2008-2017

[1] Property tax exemptions available to eligible homeowners reduce the taxable value of their property.