December 10, 2021

On November 9, 2021, the Governor’s Office of Management and Budget (GOMB) released the Illinois Economic and Fiscal Policy Report. The report includes a comparison of the FY2022 enacted budget with the current outlook for FY2022 and a five-year budgetary forecast.

The FY2022 Enacted Budget

On June 17, 2021, Governor JB Pritzker signed the State’s fiscal year 2022 budget, contained in P.A. 102-0016 and P.A. 101-0107, into law. The legislative sessions held this past spring were both in-person and remote, but the budget language was not released until the final days of session at the end of May 2021. This rushed process to release the FY2022 budget meant significant drafting errors were discovered within the budget bill, Senate Bill 2800. The errors were corrected through an amendatory veto from Governor Pritzker and then accepted by both houses of the General Assembly. The Governor also signed the budget implementation bill.

The FY2022 budget funds additional investments in education, human services and public safety over the prior year. It also fully funds certified pension contributions and continues progress on paying off short term debt such as the State’s Municipal Liquidity Facility borrowing from the Federal Reserve. The balanced budget will allow the State to maintain progress on reducing its backlog of bills, with vendor payment delays at the lowest levels in years[1].

Illinois was allocated nearly $8.4 billion from the federal government’s American Rescue Plan Act (ARPA) through the Coronavirus State Fiscal Recovery Fund and the Coronavirus Capital Projects Fund. The State plans to use about $5 to $6 billion of ARPA funds in areas such as infrastructure, agency spending, programs and economic recovery and to replace lost revenues.[2] This amount is $2-3 billion higher than the amounts outlined in a GOMB report on ARPA spending from June 2021 and the State’s first report to the federal government on their use of the funds. The difference is due to the creation of a special state fund within the budget that is intended to replace lost revenues due to the pandemic and can be spent on the authority of the Governor. In a Chicago Tribune article about the special fund, the Governor’s office said the difference is due to the amounts to be spent from the special revenue replacement fund being preliminary.[3] According to GOMB’s November 15, 2021 report to the Legislative Budget Oversight Commission, the Governor’s Office has to date transferred $500 million in funds for revenue replacement.[4]

GOMB’s November Estimate

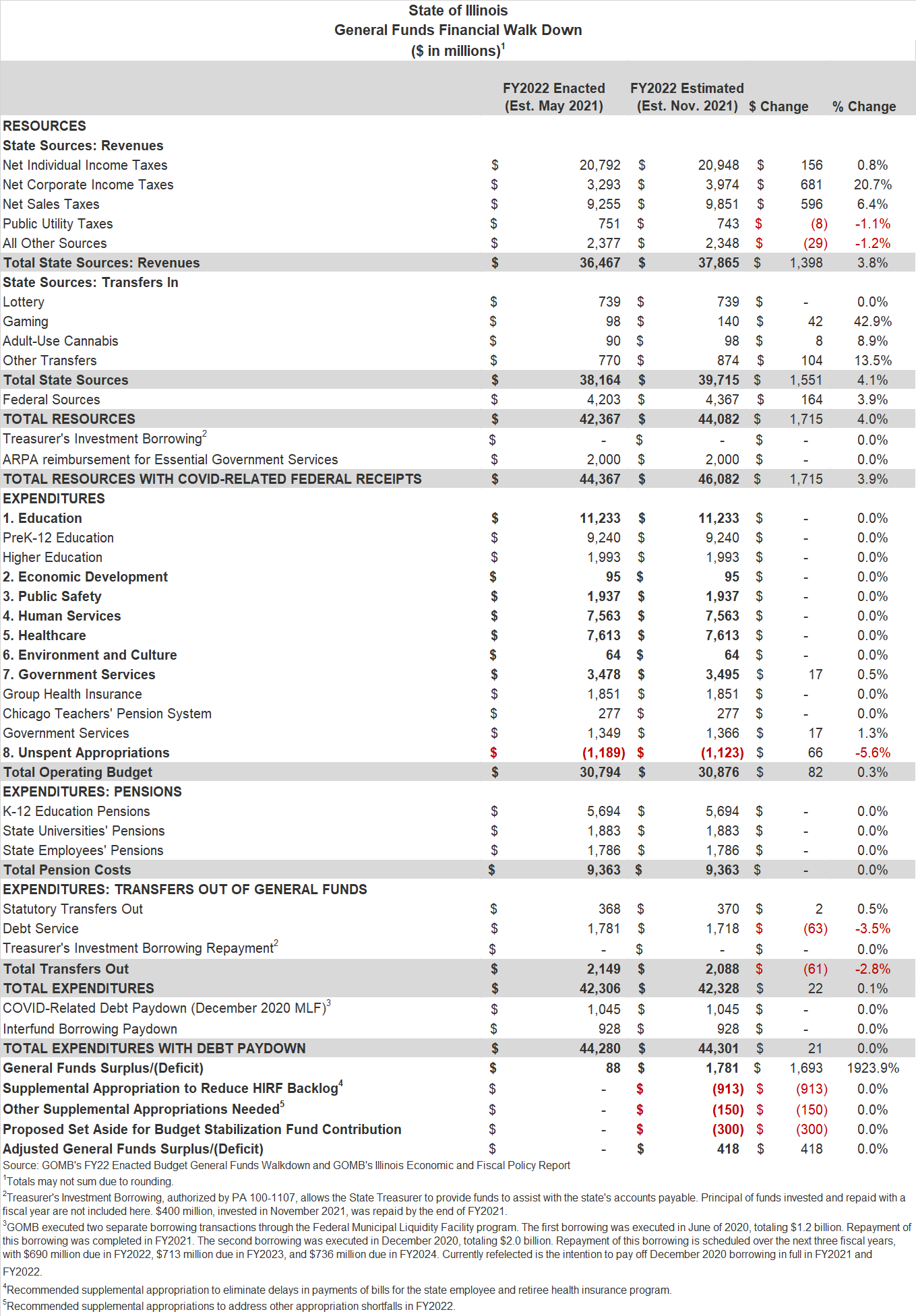

The Illinois Economic and Fiscal Policy Report includes significant upward revisions to operating revenues and additional expenditures. The most significant revisions are to all three major state revenues for an increase of nearly $1.4 billion over the enacted budget. The increase to the projection is due to income and sales tax collections in the first quarter of FY2022 that “exceeded budget forecasts by significant margins.”[5] The proposed supplemental expenditures of $1.1 billion are mainly for unpaid state employee and retiree health insurance bills. The Governor additionally proposes a $300 million rainy day fund contribution. When additional revenue increases of approximately $300 million from transfers in and federal sources are factored in, the result is a projected increase of $330 million in the General Funds budget surplus. When the FY2022 budget was enacted, it projected an $88 million General Funds budget surplus. The following table compares the FY2022 enacted budget and the November estimate.

Operating Revenues

The November estimate projects $44.1 billion in General Funds resources, plus $2.0 billion in ARPA revenue replacement funds, for a total of $46.1 billion. The General Funds support the regular operating and administrative expenses of most State agencies and are the funds over which the State has the most control. The operating budget also includes Other State funds, which accounts for activities funded by revenue sources that may only be used for specific purposes and the Federal Funds, which support a variety of State programs with federal revenues. The remaining revenues that are not included in the General Funds are restricted for specific purposes, shared through revolving funds between government agencies, held in trust or generally not available for discretionary spending by the General Assembly.

The table above shows the change in General Funds revenues between FY2022 enacted budget and the FY2022 November projection. Overall, total revenues including ARRA revenue replacement are projected to increase by $1.7 billion or 4.0%. The increase is mainly due to income and sales taxes exceeding the budget forecasts by significant margins. Corporate Income taxes are projected to be $681 million or 20.7% higher than in the FY2022 enacted budget. Updated sales tax receipts are $596 million or 6.4% higher than the enacted budget and individual income taxes are projected at $156 million or 0.8% higher. State Sources such as gaming, adult-use cannabis and other transfers increased by $154 million in the estimated budget compared to FY2022 enacted budget. Lastly, federal sources increased by $164 million in the estimated budget from the enacted budget.

Operating Expenditures

The FY2022 November estimate projects a total of $44.3 billion in General Funds expenditures, a $21 million increase from $44.2 billion in the FY2022 enacted budget. The increase is due to a slight rise in the Government Service area of agency spending and a decrease in the amount of unspent appropriations, offset by lower projected debt service costs, which are attributed to the timing of debt issuances in FY2022.

As noted above, the Governor’s Office made recommendations for supplemental spending in a few areas, to be funded by the higher revenue projection. Total proposed supplemental expenditures are $1.1 billion. This includes $913 million to fully address unpaid state employee and retiree health insurance bills and $150 million in what are described as “other pressures.” The proposed increase to health insurance spending comes after Central Management Services (CMS) indicated that absent supplemental appropriations, it expects to have approximately $1.0 billion in bills held at its office by the end of FY2022.[6] In the most recent Debt Transparency Report, the Office of the Illinois Comptroller also noted the CMS reporting and explained that since CMS has reported that it may not have sufficient appropriated General Funds deposits to cover all of the health insurance bills, the office believes it is appropriate to include the liability as an appropriation shortfall.[7] GOMB indicates that if the supplemental appropriation to health insurance is approved, it would eliminate payment delays for the employee and retiree insurance program and reduce total unpaid bills and transfers to under $2.8 billion.[8]

The Governor also proposes making a $300 million contribution to the Budget Stabilization Fund. The Budget Stabilization Fund is the State’s rainy-day fund, which was never sufficiently funded. The small balance in the fund was drained in FY2017 when the $275 million balance was used to pay bills related to the budget impasse.[9] According to the report, the $300 million contribution is intended to start the process of preparing for the next economic downturn, since Illinois with no rainy day fund was forced to borrow for cash flow purposes during the pandemic. The Civic Federation has long recommended that the State of Illinois, once it pays down its backlog of bills, should build a rainy day fund equal to 10% of General Funds revenues over time. The recommendation is in keeping with the conclusions of a COGFA analysis of the State’s revenue volatility.

Five-Year Fiscal Forecast

The FY2022 budget is balanced and represents an improvement in the State’s financial trajectory, particularly in comparison to the outlook in the prior fiscal year. However, it is still important to remember that the State has an underlying structural deficit. Projected deficits in the General Funds budget are based partly on revenue projections provided by Illinois Department of Revenue economists and IHS Markit, a national economic forecasting firm. They are also on based on growth rates in certain categories of state spending, increases in funding to the Evidence Based Funding Model for primary and secondary education of $350 million per year and projected increases to statutory pension contributions. Deficits are projected for the entire five-year projection from FY2023 through FY2027.

The Governor’s Office of Management and Budget in the report outlines the steps it has taken that helped to close the FY2022 budget deficit, including paying off its short term pandemic borrowings early, reducing unpaid bills and its contribution to the rainy day fund. GOMB concludes that those actions, together with investment in economic development and management of spending levels, will improve the budget outlook.

Reducing the State’s deficit and creating sustainable balanced budgets will be a difficult task, particularly given the uncertainties of the ongoing pandemic. It is important that the State avoid facing a revenue cliff from use of ARPA funds as it makes its plans to spend the rest of its $8.4 billion allocation. The Federation looks forward to learning more about those plans in coming months.

[1] Illinois State Comptroller, Illinois State Comptroller’s Quarterly Report, October 2021, https://illinoiscomptroller.gov/office/ComptrollersQuarterly/Comptroller_Report.cfm

[2] Governor’s Office of Management and Budget, Illinois Economic and Fiscal Policy Report, November 2021, p. 10-11, https://www2.illinois.gov/sites/budget/Documents/Economic%20and%20Fiscal%20Policy%20Reports/FY2022/Economic%20and%20Fiscal%20Policy%20Report%20FY22%20FINAL.pdf

[3] Dan Petrella, “Illinois budget allows Gov. J.B. Pritzker to spend billions in federal COVID-19 aid without legislative input,” Chicago Tribune, November 24, 2021. https://www.chicagotribune.com/politics/ct-pritzker-federal-covid-relief-aid-spending-20211124-skoooyboujhi7az6bpamfdcnym-story.html

[4] Governor’s Office of Management and Budget, “October 2021 Report to the Legislative Budget Oversight Commission,” November 15, 2021, p. 11. https://www2.illinois.gov/sites/budget/Documents/LBOC/LBOC-Report-October-2021-FINAL-11.15.21.pdf

[5] Governor’s Office of Management and Budget, Illinois Economic and Fiscal Policy Report, November 2021, p. 11. https://www2.illinois.gov/sites/budget/Documents/Economic%20and%20Fiscal%20Policy%20Reports/FY2022/Economic%20and%20Fiscal%20Policy%20Report%20FY22%20FINAL.pdf

[6] Commission on Government Forecasting and Accountability, “State of Illinois Budget Summary Fiscal Year 2022,” July 20, 2021, p. 90. https://cgfa.ilga.gov/Upload/FY2022BudgetSummary.pdf

[7] Office of the Illinois Comptroller, “Debt Transparency Report Summary, Vol. 4, No. 11, Period Ending October 31, 2021,” p. 3. https://illinoiscomptroller.gov/comptroller/assets/file/DTA/current/DTAReport.pdf

[8] Governor’s Office of Management and Budget, Illinois Economic and Fiscal Policy Report, November 2021, p. 15, https://www2.illinois.gov/sites/budget/Documents/Economic%20and%20Fiscal%20Policy%20Reports/FY2022/Economic%20and%20Fiscal%20Policy%20Report%20FY22%20FINAL.pdf