March 31, 2023

The Civic Federation released its annual Consumer Tax Rates Report in March, which lists and describes selected consumer taxes within the City of Chicago, including the complicated way the hotel operators’ tax is calculated and why. This blog post will explain in detail the hotel operators’ tax history and dissect the tax rate calculation for FY2023.

Hotel Tax Rates and History

The State hotel operators’ tax was enacted in 1961 at a rate of 3% of 97% of gross receipts from transient guests. Since then the rate has increased to 5% of 94% of the gross receipts, plus 1% of 94% of gross rental receipts from such guests, for a combined total rate of 6% of 94%. This structure is intended to prevent the tax from applying to itself. The 1% add-on is earmarked for the Build Illinois program, while the 5% tax is dispersed three different ways:

- 40% is allocated to the Build Illinois Fund, which expands the State’s overall efforts in economic development projects;

- 60% is allocated to the Tourism Promotion Fund; and

- $5 million per fiscal year is transferred to the Illinois Sports Facilities Fund (Subsidy Account).

State statute also permits Chicago to levy a tax of up to 1% of gross rental receipts from hotel operators. The Illinois Sports Facilities Authority imposes a tax of 2% of gross hotel receipts. These taxes are collected by the Illinois Department of Revenue. Other municipalities in the State can impose taxes of up to 5% of gross rental receipts from hotel operators and the funds must be spent to promote tourism.

In contrast, the City of Chicago, Cook County and the Metropolitan Pier and Exposition Authority (MPEA), which is a municipal corporation created by the Illinois General Assembly, apply varying tax rates to the net receipts of hotel operators. Chicago applies a home rule tax rate of 4.5%, MPEA applies a 2.5% tax rate and Cook County applies a 1% tax rate.

Effective Hotel Tax Rate

The hotel tax is expressed as an effective rate because three taxing authorities tax hotel operators’ gross receipts, which include both hotel charges and taxes, and three taxing authorities tax net receipts, which do not include taxes. As noted above, the hotel taxes for the State of Illinois, the City of Chicago through its municipal taxing authority, and the Illinois Sports Facilities Authority (ISFA) are all taxes on the gross hotel bill, which also includes the other two gross taxes. Hotel taxes for Cook County, the Metropolitan Pier and Exposition Authority (MPEA) and the City of Chicago, through its home rule taxing authority, are applied to only net hotel bills paid by guests.

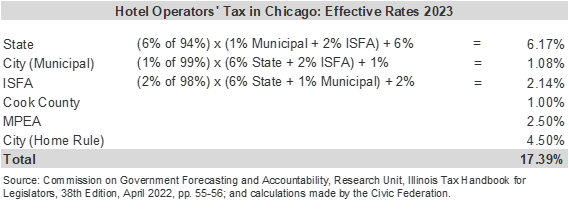

The following table shows how effective hotel tax rates are calculated. In order to compensate for the difference in procedures between taxing authorities, hotel tax rates are expressed as a fraction of gross hotel receipts for the State, City (Municipal) and ISFA. The rates of the Cook County tax, the Metropolitan Pier and Exposition Authority tax and the City of Chicago home rule hotel tax apply only to net hotel charges. The total effective rate, 17.39%, is expressed here as the percentage of the net hotel bill that is paid in taxes, which allows the total sum of all six taxes to be calculated.

Since the revenue collected from the 1% Chicago Municipal and the 2% ISFA taxes is factored into the State tax, the effective tax rate for the State includes an additional 6% of 94% of those taxes, or 5.64%. That is the calculation seen in the first line of the table above. Taking 5.64% of 3% (1% Municipal + 2% IFSA) yields a 0.17% effective rate due to those two taxes. Since the effective rate is the percentage of the net hotel bill paid in taxes, the formula adds the State’s 6% rate for a State effective tax rate of 6.17%.

Similar calculations are made for the Chicago Municipal and ISFA taxes. However, since the Cook County, MPEA and Chicago home rule hotel taxes are on hotel bills net of taxes, their rates are the effective rate as they are only applied to hotel charges.