April 24, 2020

The coronavirus pandemic has dealt a severe blow to Chicago’s hospitality industry. Conventions have been cancelled, dine-in restaurants have closed, airport traffic has plunged and sporting events have been cancelled. As of early April, the City had experienced the loss of over 20 conventions and 250,000 hotel bookings related to those events.[1] The coronavirus closures have had an abrupt and serious impact on the hospitality tax revenues used to pay for bonds issued by the Metropolitan Pier and Exposition Authority (MPEA) and the Illinois Sports Facilities Authority in Chicago (ISFA).

Bonds issued by these entities are backed up by pledges from the State of Illinois and the City of Chicago if the primary revenue sources are inadequate. Unfortunately, the negative financial situation across the United States comes at a time when the City of Chicago expects serious revenue shortfalls and the State of Illinois projects a General Funds FY2020 revenue shortfall of $2.7 billion and a FY2021 shortfall of up to $7.4 billion.[2]

In response to the worsening financial situation, Moody’s Investor Services revised their outlook on the State of Illinois’ debt and therefore MPEA bonds from stable to negative, Fitch has downgraded MPEA and ISFA bonds and Standard and Poor’s has revised the outlook on ISFA from stable to negative.[3]

This blog post presents information about the finances of the Metropolitan Pier and Exposition Authority (MPEA) and the Illinois Sports Facilities Authority in Chicago (ISFA).

Metropolitan Pier and Exposition Authority (MPEA)

The MPEA is a municipal corporation located in the City of Chicago. It owns and operates the McCormick Place Convention Center, the largest convention center in North America, as well as Hyatt Regency McCormick Place, the Marriott Marquis Chicago and the 10,000-seat Wintrust Arena. The Authority is governed by a 9-member Board of Directors. Four of the directors are appointed by the Governor of Illinois, four by the Mayor of Chicago and the ninth member is the Chairman, who is chosen by the other Board members.

The economic impact of McCormick Place is substantial. A 2017 study by the University of Illinois at Chicago concluded that activities related to the convention center deliver an estimated regional economic impact of nearly $1.73 billion annually and support 15,000 Illinois jobs.[4]

MPEA Finances

The MPEA FY2020 operating budget was $315.4 million.[5] In F2019, the last year for which audited data are available, the Authority had over $4.1 billion in convention center expansion and revenue bonds outstanding.[6]

The MPEA’s operations and capital program are financed with the following tourism-related taxes:

- A 1% restaurant tax in downtown Chicago;

- A 2.5% hotel operators’ tax on hotel rooms in Chicago;

- A 6% automobile rental tax; and

- An airport departure tax at O’Hare and Midway Airports that ranges between $2.00 and $54.00.

MPEA bonds are special limited obligations. The debt service on these bonds is paid for with proceeds of the four taxes listed above.[7] If those revenues are insufficient to fund debt service, an allocated portion of State of Illinois sales tax is available to service the debt. This draw on the use of State sales tax revenues occurs automatically, whether or not appropriating legislation has been passed.[8] Between 2008 and 2010, when its debt was restructured, Authority revenues were not sufficient to service its debt, thus requiring draws on Illinois sales tax revenues.[9] In 2017 legislation was approved that allowed MPEA to use surplus tax amounts to repay prior year sales tax draws.[10] By 2019 MPEA had repaid those funds.[11]

Whether payments for bonds are made from pledged tourism taxes or State sales tax receipts, the legislature must annually appropriate funds for debt service payments.

The closure of Chicago’s hospitality industry will likely at some point trigger the requirement to use State sales tax resources to fund the Authority’s debt service at the same time it is projected that State’s sales tax revenues will drop dramatically, by a projected $1.5 billion from prior forecasts in FY2021.

Rating Agency Changes

In response to the worsening financial situation nationally, Standard and Poor’s revised their outlook on MPEA bonds from stable to negative on April 3, 2020. The credit rating of BBB was affirmed for outstanding McCormick Place expansion bonds. The outlook change reflected the State of Illinois’s worsening fiscal situation due to the COVID-19 pandemic. Concern was also expressed about lack of budgetary flexibility and constitutional limits the State faces in dealing with its mounting pension obligations.[12]

Moody’s Investor Services also revised their outlook on MPEA bonds from stable to negative on April 9, 2020. The bond rating was affirmed at Ba1. MPEA bonds were rated below the State of Illinois general obligation sales tax revenue bond rating of Baa3 because sales tax pledges for State debt, including a backup pledge for MPEA bonds, require annual legislative approval.[13]

Fitch downgraded MPEA bonds to BB+ from BBB- with a negative outlook on April 16, 2020. The rating change was based on concerns about the State’s declining financial situation caused by the coronavirus pandemic’s impact on tax collections, Illinois’ lack of meaningful reserves and its limited ability to utilize other financial management tools to mitigate the serious fiscal situation. The Fitch analysis also noted that sales tax pledges require annual legislative approval.[14]

Illinois Sports Facilities Authority (ISFA)

The Illinois Sports Facilities Authority (ISFA) is a municipal corporation created in 1987 to build, renovate and maintain sports stadiums for professional teams in Illinois. ISFA owns and operates Guaranteed Rate Field, home of the Chicago White Sox baseball team. In 2001 its authority was expanded to include bonding authority to fund the renovation of Soldier Field, home to the Chicago Bears football team, as well as parkland adjacent to the stadium.[15]

ISFA is governed by a 7-member Board of Directors. Three members are appointed by the Governor of Illinois, three are appointed by the Mayor of Chicago and the Board Chair is appointed by the Governor with the Mayor’s approval.

ISFA Finances

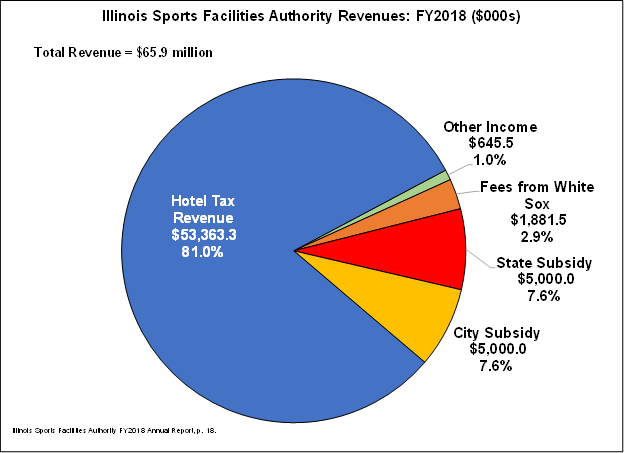

In FY2018, the most recent year for which ISFA provides public budget data, the Authority collected $65.9 million in taxes, fees and other resources.

The Authority is financed by a complex mix of taxes and fee revenues, discussed below.

Hotel Taxes: The primary revenue source is a 2.14% hotel tax. In FY2018, this constituted 81.0% of all ISFA revenues, or $53.4 million.

The State of Illinois advances to ISFA every month for the first 8 months of each fiscal year a sum equal to the difference between the annual amounts appropriated to the Authority from the Illinois Sports Facilities Fund less the subsidy portion of the appropriation. The amount advanced is drawn from State hotel tax revenues and is repaid with proceeds of the ISFA hotel tax. It is set at an annual increase of 5.615% from the base year amount of $22.2 million in FY2002 through the year FY2032. The annual State advances to the Authority are subject to legislative appropriation.[16]

If ISFA hotel taxes are not adequate to repay the State advance in a given year, the City of Chicago must repay the shortfall from its share of State income taxes from the State’s Local Government Distributive Fund.[17]

Intergovernmental Subsidies: ISFA receives $10 million each fiscal year in intergovernmental subsidies through FY2032. Of that amount:

- $5 million is from a portion of the proceeds of the State Hotel Operator’s tax; and

- $5 million is from State Local Government Distributive Funds allocated to the City of Chicago.

These funds are subject to subject to annual appropriation by the legislature.

Fees from the Chicago White Sox: ISFA receives annual fees from the White Sox baseball team. In FY2018, they amounted to nearly $1.9 million. These fees are provided primarily through three mechanisms:

- Ticket revenues: Article III of the Management Agreement between the Authority and the Chicago White Sox outlines how much revenue ISFA will receive each year from ticket fees. These fees are paid based on a computation made at the beginning of the season. They are equal to the amount of the gross revenue collected if all tickets were sold for full price for a single game divided by the number of seats (excluding suite seats) in the Stadium. If paid attendance in a season is below a break-even point of 1.5 million, no fees are owed.[18] Tickets sold are subject to Chicago’s amusement tax. Under the terms of the Management Agreement, ISFA must reimburse the White Sox for a certain percentage of Chicago amusement taxes on the sale of tickets.

- A guaranteed base fee: The Authority is entitled to a guaranteed base fee each year. This fee is an amount equal to a CPI escalator from a base amount of $1.5 million set in 2012. In FY2018 this sum was approximately $1.6 million.[19]

- An escalating fee for use of the Conference Center: The Authority gets a rental payment for use of the Conference Center at the ballpark. This fee is an amount equal to a CPI escalator from a base amount of $100,000 established in 2001. This was $129,301 in FY2018.[20]

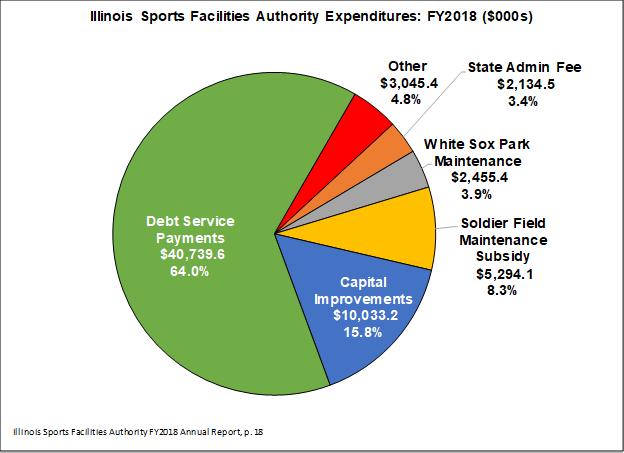

In FY2018, the last year for which ISFA published budget data, Authority expenditures were overwhelmingly used for capital purposes: 64%, or $40.7 million, were earmarked for principal and interest payments on outstanding debt while 15.8% of spending, or $10.0 million, was used for capital improvements. The next largest amount, $5.3 million, was used for maintenance of Soldier Field in a subsidy to the Chicago Park District.

ISFA provides subsidies to the Chicago Park District related to the issuance of nearly $399.0 million in series 2001 bonds for the renovation of Soldier Field and surrounding parkland.[21] These subsidies will continue until the bonds are defeased in 2032. Under terms of an Operation Assistance Agreement between ISFA and the Chicago Park District, the Authority provides the Park District with the following amounts:

- An annual subsidy for Soldier Field maintenance equal to 103% of the amount paid in the prior year. In 2018, this was nearly $5.3 million.[22]

- Deposits into the Soldier Field Capital Improvement Fund to subsidize capital repairs and enhancements. These deposits are set at amount that is 103% of the amount paid in the prior year.[23] This amount was $3.1 million in 2018.[24]

Rating Agency Change

Standard and Poor’s revised the outlook from stable to negative on ISFA bonds on April 3, 2020 but affirmed the Authority bonds’ BBB rating. The negative outlook was based on the rating agency’s revised outlook on the State of Illinois, which now carries a BBB- rating with a negative outlook. The outlook reflects concerns about the fiscal impact of the COVID-19 pandemic on State finances as well as Illinois’ limited budget flexibility.[25]

Fitch also downgraded ISFA bonds to BB+ from BBB- with a negative outlook on April 16, 2020. The Fitch analysis also noted that the State tax advances to the ISFA for its bonds are subject to legislative approval.[26]

[1] Commission on Governmental Forecasting and Accountability, Fiscal Year 2021 Capital Plan Analysis, p. 53 at http://cgfa.ilga.gov/Upload/FY2021CapitalPlanAnalysis.pdf.

[2] Governor’s Office of Management and Budget, April 2020 Revenue Forecast Revision, April 15, 2020, p. 2 at https://www2.illinois.gov/sites/budget/Documents/April-2020-GOMB-Revenue-Forecast-Revision.pdf.

[3] Moody’s Investors Services, “Moody’s Revises Outlook on Illinois to negative from stable; GO rating affirmed at Baa3,” April 9, 2020 at https://www.moodys.com/research/Moodys-revises-outlook-on-Illinois-to-negative-from-stable-GO--PR_906390372, and Fitch Ratings, “Fitch Downgrades Illinois’ IDR to ‘BBB-’ from ‘BBB:’ Outlook Revised to Negative,” April 16, 2020, and Standard and Poor’s Global, “Illinois Sports Facility Authority Debt Outlook Revised to Negative From Stable on Revenue Uncertainty,” April 3, 2020.

[4] MPEA Financial Plan FY2020-2022, p. 4 and at http://www.mpea.com/wp-content/uploads/2017/01/EIS-Executive-Summary.pdf.

[5] MPEA Financial Plan FY2020-2022, p. 6.

[6] MPEA FY2019 Audited Financial Statements at https://www.mpea.com/wp-content/uploads/2020/01/FY19-MPEA-Audited-Financial-Statements.pdf, p. 35.

[7] A portion of the debt service is also paid for with annual energy savings from projects financed with 2019A project revenue bonds. MPEA FY2019 Audited Financial Statements at https://www.mpea.com/wp-content/uploads/2020/01/FY19-MPEA-Audited-Financial-Statements.pdf, p. 37.

[8] Moody’s Investors Services, “Moody’s Revises Outlook on Illinois to negative from stable; GO rating affirmed at Baa3,” April 9, 2020 at https://www.moodys.com/research/Moodys-revises-outlook-on-Illinois-to-negative-from-stable-GO--PR_906390372.

[9] MPEA FY2019 Audited Financial Statements at https://www.mpea.com/wp-content/uploads/2020/01/FY19-MPEA-Audited-Financial-Statements.pdf, p. 37.

[10] MPEA Financial Plan FY2020-2022, p. 38.

[11] MPEA FY2019 Audited Financial Statements at https://www.mpea.com/wp-content/uploads/2020/01/FY19-MPEA-Audited-Financial-Statements.pdf, p. 37.

[12] Standard and Poor’s Global Ratings, “Metropolitan Pier and Exposition Authority, IL Outlook Revised to Negative from Stable on Revenue Uncertainty,” April 3, 2020.

[13] Moody’s Investors Services, “Moody’s Revises Outlook on Illinois to negative from stable; GO rating affirmed at Baa3,” April 9, 2020 at https://www.moodys.com/research/Moodys-revises-outlook-on-Illinois-to-negative-from-stable-GO--PR_906390372.

[14] Fitch Ratings, “Fitch Downgrades Illinois’ IDR to ‘BBB-’ from ‘BBB:’ Outlook Revised to Negative,” April 16, 2020.

[15] Illinois Sports Facilities Authority FY2018 Annual Report, p. 1 at https://236c3m49r38mg7ixa39zqru1-wpengine.netdna-ssl.com/wp-content/uploads/2019/05/2018_AR_Guaranteed-Rate-Field_Single-Pages_FINAL.pdf.

[16] Illinois Sports Facilities Authority, Combined Bond Indenture Basis, Financial Statements as of and for the Year Ended June 30, 2018, Additional Information for the Year Ended June 30, 2018 With Independent Auditor’s Report, pp. 22-23.

[17] Illinois Sports Facilities Authority, Combined Bond Indenture Basis, Financial Statements as of and for the Year Ended June 30, 2018, Additional Information for the Year Ended June 30, 2018 With Independent Auditor’s Report, p. 23.

[18] There are also media fees on broadcast income. Article III (sections 3.01 and 3.02) of the Management Agreement between the Illinois Sports Facilities Authority and the Chicago White Sox Ltd., June 29, 1988.

[19] Illinois Sports Facilities Authority FY2018 Annual Report, p. 23 at https://236c3m49r38mg7ixa39zqru1-wpengine.netdna-ssl.com/wp-content/uploads/2019/05/2018_AR_Guaranteed-Rate-Field_Single-Pages_FINAL.pdf.

[20] Illinois Sports Facilities Authority FY2018 Annual Report, p. 23 at https://236c3m49r38mg7ixa39zqru1-wpengine.netdna-ssl.com/wp-content/uploads/2019/05/2018_AR_Guaranteed-Rate-Field_Single-Pages_FINAL.pdf.

[21] Official Statement Illinois Sports Facilities Authority Bonds (State Tax Supported) Series 2001, October 4, 2001, p. 1.

[22] Official Statement Illinois Sports Facilities Authority Bonds (State Tax Supported) Series 2001, October 4, 2001, p. 39.

[23] Operation Assistance Agreement between Illinois Sports Facilities Authority and the Chicago Park District, August 1, 2001, pp. 7-8 at https://236c3m49r38mg7ixa39zqru1-wpengine.netdna-ssl.com/assets/operation-assistance-agreement-_-1st--amendment2.pdf.

[24] Illinois Sports Facilities Authority FY2018 Annual Report, p. 19 at https://236c3m49r38mg7ixa39zqru1-wpengine.netdna-ssl.com/wp-content/uploads/2019/05/2018_AR_Guaranteed-Rate-Field_Single-Pages_FINAL.pdf.

[25] Standard and Poor’s Global, “Illinois Sports Facility Authority Debt Outlook Revised to Negative From Stable on Revenue Uncertainty,” April 3, 2020.

[26] Fitch Ratings, “Fitch Downgrades Illinois’ IDR to ‘BBB-’ from ‘BBB:’ Outlook Revised to Negative,” April 16, 2020.