January 22, 2021

The Chicago Transit Authority (CTA) released a $3.4 billion, five year FY2021-FY2025 capital plan in October 2020. The CTA prepares a multi-year, comprehensive capital improvement plan (CIP) at the same time as its annual operating budget. It is included in the operating budget book. The first year of the CIP is the capital budget for that fiscal year.

The CTA capital budget for FY2021 is projected to be $995.4 million. This a 34.4%, or $522.9 million, decrease from the original FY2020 capital budget of $1.5 billion.[1]

The current COVID-19 pandemic has injected a great deal of uncertainty into the CTA’s fiscal future. Ridership on trains and buses dropped 80% in 2020 and revenue is anticipated to fall by $554 million.[2] Federal funding has permitted the CTA to avoid large scale service disruptions through early 2021. The recently approved $900 billion federal stimulus legislation will provide $14 billion in funding for all U.S. transit agencies. This falls short of the $32 billion the American Public Transit Association believes is needed to bring transit agencies back to pre-pandemic funding levels. The Chicago area transit agencies will receive approximately $450 million of that funding.[3] The capital plan may need to be amended to reflect funding changes in the coming year.[4]

The CTA notes that revenue shortfalls in the next year may negatively impact its primary funding sources, sales taxes and real estate transfer taxes. There is a great degree of uncertainty regarding the trajectory of the pandemic and the ability of governments to respond to the economic crisis it has generated.

CTA Capital Plan FY2021-FY2023

The CTA has identified a total of $29.0 billion in long-term capital project needs. A breakdown of those needs includes:

- $13.1 billion to maintain infrastructure and facilities in a state of good repair;

- $10.4 billion for modernization projects; and

- $5.5 billion for expansion projects.[5]

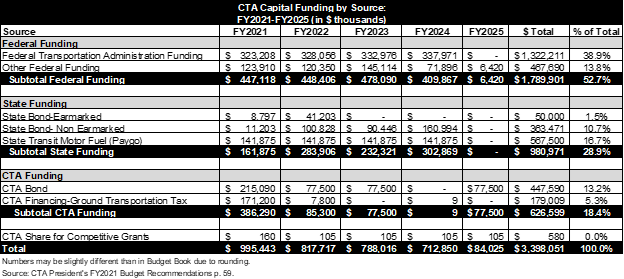

The five-year capital plan for FY2021-FY2025 proposes a total of nearly $3.4 billion in funding to address the CTA’s capital needs. Of that amount:

- Federal funds will account for 52.7% of all funding, or $1.8 billion;

- Funding from the State of Illinois will provide $980.9 million, including $413.5 million in state bond funding and $567.5 million in motor fuel tax pay-as-you-go funding. These State funds come from the Rebuild Illinois Capital Plan approved by the General Assembly in 2019;[6]

- CTA bond funds and ground transportation tax receipts will fund approximately $625.6 million in projects; and

- A small amount, roughly $580.0 million, will be derived from competitive grant funds.

The CTA notes that severe revenue shortfalls in 2020 due to the COVID-19 pandemic likely will affect capital funding for many years to come. This may require revisiting and amending the plan in the future.[7]

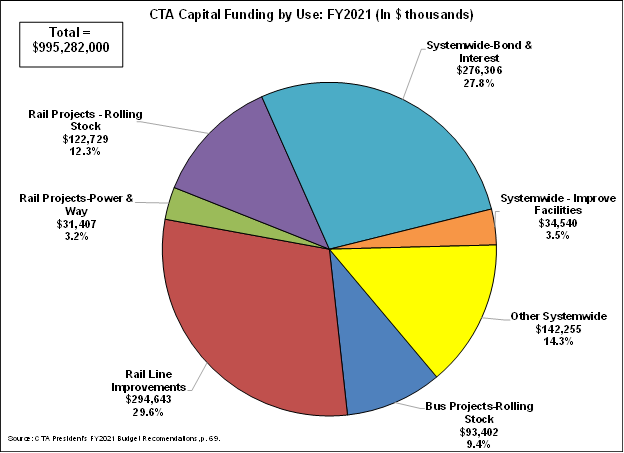

CTA capital funding by use in FY2021 is projected to total $995.3 million. In that year:

- Rail line improvements will use $294.6 million, or 29.6%, of all spending;

- Bond financing costs will total $276.3 million, or 27.8%, of total spending;

- Rail rolling stock projects will spend $122.7 million, or 12.3%, of FY2021 funding;

- Bus rolling stock projects will use $93.4 million, or 9.4%;

- Systemwide expense to improve facilities will use $34.5 million;

- Approximately $31.4 million, or 3.2% of all spending, will be used for rail power and way projects; and

- Other funding uses include $142.3 million. This category includes information technology projects, equipment replacement, security projects, bus slow-zone elimination projects, rehabilitating rail stations, CIP management and planning studies.

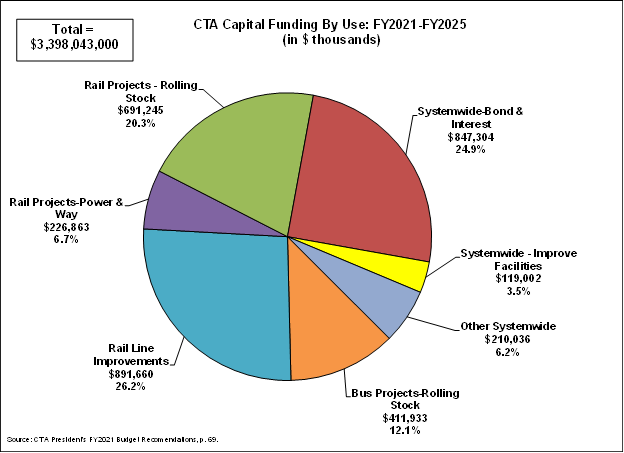

A five-year breakdown of CTA capital funding is shown next. Rail line improvements will be the biggest use of funds, at $891.7 million, or 26.2%, of the total. This will be followed by systemwide bond financing costs at $847.3 million or 24.9% of the total. Rolling stock for rail projects will use $691.2 million, while bus rolling stock projects will use $411.9 million.

CTA Debt Service Trends

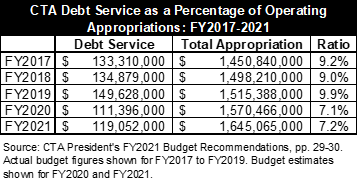

The CTA pays for debt service associated with pension obligation bonds as well as capital debt secured by federal Transportation Infrastructure Finance and Innovation (TIFIA) loans and Chicago ground transportation tax proceeds from its operating budget.[8] Other debt issues are paid for through the capital budget. Between FY2017 and FY2021, pension obligation bond debt service as a percentage of operating appropriations is expected to average 8.5%, which is below the range of 15% to 20% considered high by the rating agencies.[9]

CTA Long-Term Obligations

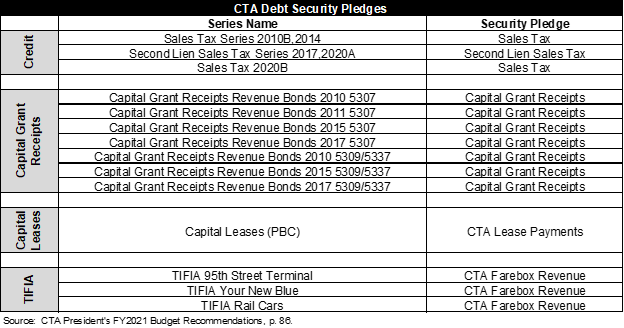

CTA’s total long-term debt obligations as of December 31, 2020 include sales and transfer tax receipts revenue bonds, sales tax receipts revenue bonds, capital grant receipts revenue

bonds,[10] capital lease obligations, building revenue bonds, and federal Transportation Infrastructure Finance and Innovation (TIFIA) loans. The security pledges for the outstanding debt issues are shown below.

CTA 2020 Bond Issues

In 2020, the CTA issued a total of $901.9 million in revenue bonds. Of that amount:

- $367.9 million was issued in second lien sales tax receipts revenue bonds (Series 2020A). These funds are primarily to be used to be used to finance capital projects and refund a portion of the second lien sales tax receipts capital improvement notes;[11] and

- $534.0 million was issued in taxable sales tax receipt revenue refunding bonds (Series 2020B). These funds will primarily be used to refund outstanding sales tax bonds.[12]

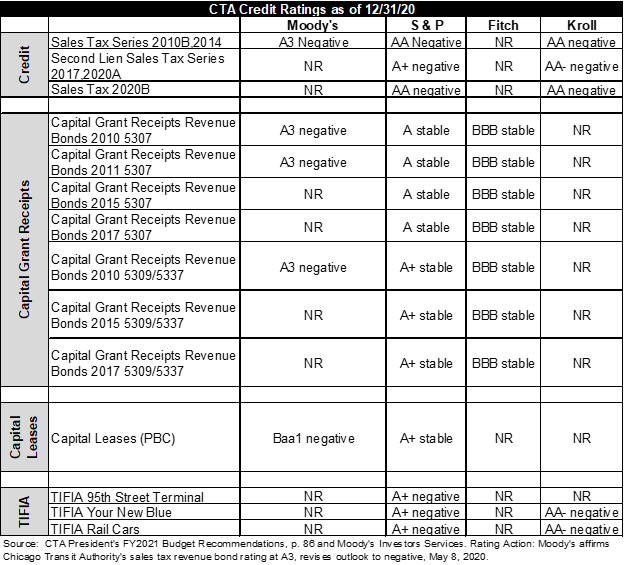

CTA Credit Ratings

The CTA’s outstanding debt was assigned the following ratings as of December 31, 2020.

Rating Agency Actions in 2020

In late March 2020 Standard and Poor’s Global Ratings revised its credit outlook for many U.S. transit agencies including the CTA to negative from stable due to the negative economic and revenue impact of the coronavirus pandemic. This impacted the CTA’s sales tax and senior lien sales tax bond issues.[13]

Standard and Poor’s Global Ratings affirmed its A+ rating on TIFIA loans, the A+ rating on Public Building Commission of Chicago bonds backed by CTA capital lease payments on April 30, 2020. The CTA’s stand-alone credit profile remained A+ with a negative outlook. The ratings reflected S&P’s view that the CTA would be able to implement measures to maintain the current credit rating such as expense reductions and the deferral of capital spending.[14]

In May 2020, Moody’s Investors Services affirmed its A3 credit rating on the CTA’s sales tax bonds while changing the outlook to negative from stable. At the same time Moody’s also affirmed the A3 rating on the CTA’s grant receipts bonds and the Baa1 rating on Public Building Commission of Chicago bonds backed by CTA capital lease payments, but changed the outlook for both issues to negative from stable. The reason for the change in outlook was the serious reduction in economic activity and transit ridership brought about by the COVID-19 pandemic that has negatively impacted revenues.[15]

Fitch affirmed its BBB credit rating for the CTA’s grant receipts bonds on May 28, 2020. The revenues for these bond anticipation notes are provided by the federal surface transportation funding program which has traditionally been a stable funding source.[16]

CTA Capital Improvement Plan

According to best practices for capital budgeting, a complete capital improvement plan (CIP) includes the following elements:[17]

- A comprehensive inventory of all government-owned assets, with description of useful life and current condition;

- A narrative description of the CIP process including how criteria for projects were determined and whether materials and meetings were made available to the public;

- A five-year summary list of all projects and expenditures by project that includes funding sources for each project;

- Criteria for projects to earn funding in the capital budget including a description of an objective and needs-based prioritization process;

- Publicly available list of project rankings based on the criteria and prioritization process;

- Information about the impact of capital spending on the annual operating budget for each project;

- Annual updates on actual costs and changes in scope as projects progress;

- Brief narrative descriptions of individual projects, including the purpose, need, history and current status of each project; and

- An expected timeframe for completing each project and a plan for fulfilling overall capital priorities.

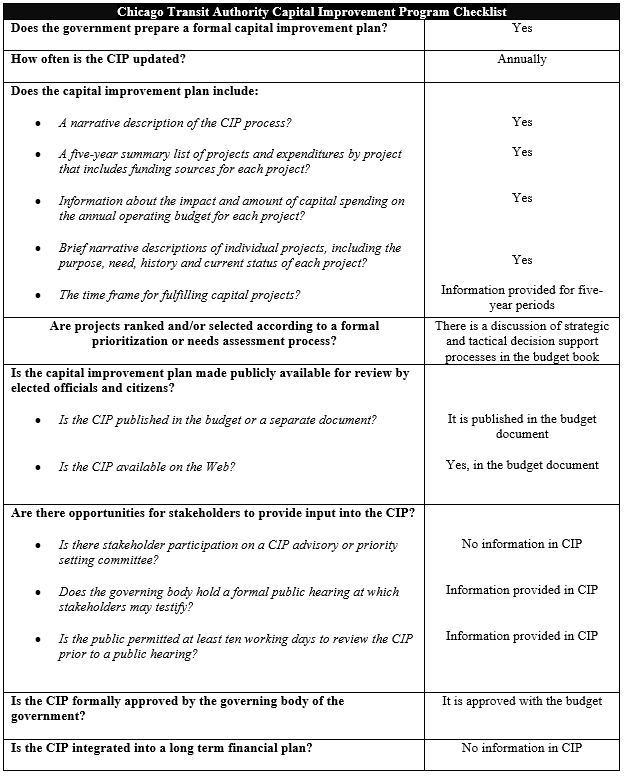

Once the CIP process is completed, the plan should be formally adopted by the governing body and integrated into its long-term financial plan. There should be opportunities for public input into the process. A well-organized and annually updated CIP helps ensure efficient and predictable execution of capital projects and helps efficiently allocate scarce resources. It is important that a capital budget prioritize and fund the most critical infrastructure needs before funding new facilities or initiatives.

The checklist that follows assesses how well the CTA’s CIP conforms to best practice guidelines. It is important to note that the CTA develops its CIP in accordance with guidelines established by the Regional Transportation Authority (RTA). The annual RTA budget includes five-year capital program information for CTA, Metra and Pace, the three service boards it oversees. The information RTA provides includes:

- Five-year summaries of capital program expense by category for the CTA, Metra and Pace;

- A discussion of capital impact on operations;

- A discussion of the amount of capital funds available for the RTA’s ten-year plan; and

- A discussion of capital impact on maintenance operations.

The CTA CIP, as published in its annual budget, conforms to most best-practice guidelines.

The five-year capital plan in the 2021 budget book now provides a detailed description of the CIP process, a marked improvement from prior years. This includes a CIP development timeline and a discussion of strategic and tactical decision support processes in the budget book.[18]

[1] CTA President’s FY2020 Budget Recommendations p. 65.

[2] CTA President’s FY2020 Budget Recommendations p. 8.

[3] John Greenfield, StreetsBlogChicago “What will the new COVID stimulus bill mean for Chicagoland transit?,” December 21, 2020 at https://chi.streetsblog.org/2020/12/21/what-will-the-new-covid-stimulus-bill-mean-for-chicago-transit/

[4] CTA President’s FY2020 Budget Recommendations p. 59.

[5] CTA President’s FY2020 Budget Recommendations p. 70 and CTA President’s FY2021 Budget Recommendations p. 59.

[6] CTA President’s FY2021 Budget Recommendations p. 61.

[7] CTA President’s FY2021 Budget Recommendations p. 59.

[8] CTA President’s FY2021 Budget Recommendations. 43.

[9] Standard & Poor’s, Public Finance Criteria 2007, p. 64. See also Moody’s Investors Services, General Obligation Bonds Issued by U.S. Local Governments, October 2009, p. 18.

[10] These are Grant Anticipation Revenue Vehicles, known as GARVEE Bonds, that are issued in anticipation of receiving federal funds at a later date. See California Transportation Commission, “Grant Anticipation Revenue Vehicles Bond Financing (GARVEE) Bond Financing” at https://catc.ca.gov/programs/grant-anticipation-revenue-vehicles-bond-financing.

[11] Chicago Transit Authority, Official Statement: $367,895,000 Second Lien Sales Tax Receipts Revenue Bonds Series 2020A, August 27, 2020, p. 1.

[12] Chicago Transit Authority, Official Statement: $534,005,000 Sales Tax Receipts Revenue Refunding Bonds Series 2020B (Taxable), August 27, 2020, p. 1.

[13] S&P Global Ratings, Mass Transit Agencies’ Priority Lien Revenue Bond Outlooks Revised to Negative on Anticipated COVID-19 Pressures, March 27, 2020.

[14] S&P Global Ratings, Chicago Transit Authority Debt Rating and ICR Affirmed at A+ on Efforts to Maintain Financial Metrics, April 30, 2020

[15] Moody’s Investors Services, Rating Action: Moody’s affirms Chicago Transit Authority’s sales tax revenue bond rating at A3, revises outlook to negative, May 8, 2020.

[16] Fitch Ratings, Rating Action Commentary: Fitch Affirms US Municipal Standalone GARVEE Ratings. May 28, 2020.

[17] National Advisory Council on State and Local Budgeting Recommended Practice 9.10: Develop a Capital Improvement Plan, p. 34; Government Finance Officers Association, Best Practices, Development of Capital Planning Policies, October 2011.

[18] CTA President’s FY2021 Budget Recommendations, pp. 63-64.