February 25, 2016

Consumers of electronic cigarettes in the City of Chicago and Cook County as a whole will pay new taxes in 2016. As part of their FY2016 budget processes the City of Chicago and Cook County both expanded their taxes on tobacco products to include liquid nicotine products, also known as e-cigarettes.

New Tobacco Related Taxes

The City of Chicago’s FY2016 budget originally included a tax on liquid nicotine products at the rate of $1.25 per product unit, plus an additional $0.25 per fluid milliliter of liquid nicotine product. However, an ordinance was introduced following approval of the budget amending the tax to reduce the per product unit rate from $1.25 to $0.80 and increasing the per fluid milliliter rate from $0.25 to $0.55. The tax on liquid nicotine products went into effect January 1, 2016 and is projected to generate $1.0 million in additional revenue this fiscal year, which is the same amount as the original ordinance that passed as part of the budget process. The City of Chicago is the first major U.S. city to tax electronic cigarettes.[1]

Similarly, as part of Cook County’s FY2016 budget process, the Board of Commissioners passed an ordinance amending the County’s tobacco tax ordinance to include a tax on liquid nicotine at the rate of $0.20 per fluid milliliter. The tax on liquid nicotine products is scheduled to go into effect May 1, 2016 and generate $1.5 million this fiscal year.[2]

Composite Cigarette and Other Tobacco Product Taxes

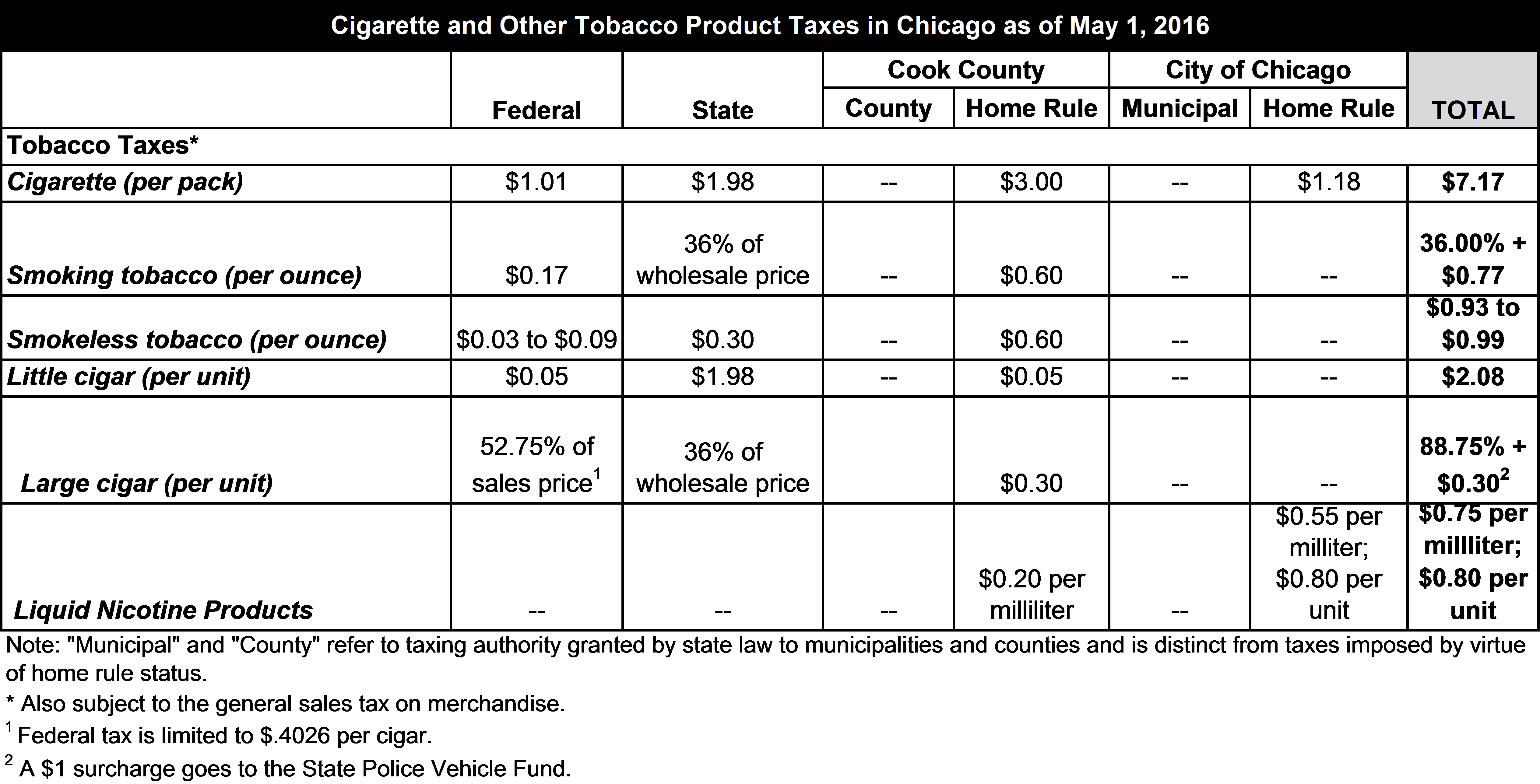

A consumer of cigarettes and other tobacco products in the City of Chicago is subject to tax rates imposed by the federal government, State of Illinois, County of Cook and City of Chicago. Below is a chart that compiles the composite tax rate for cigarettes and other tobacco products. State and local laws specify tax per cigarette, but per pack (20 cigarettes) is used here for simplicity.

Historical Changes to Cigarette and Other Tobacco Product Taxes

Cigarettes (Per Pack)

On April 1, 2009, the federal tax on cigarettes increased by $0.62 to $1.0066 per pack. Effective June 24, 2012, the State of Illinois increased its cigarette tax by $1.00 from $0.98 per pack of cigarettes to $1.98. Effective July 1, 2012, the State also expanded its definition of cigarettes to include little cigars. With the approval of the FY2013 budget, Cook County increased its tax on cigarettes from $2.00 per pack to $3.00 per pack, effective March 1, 2013. With the approval of the FY2014 budget, the City of Chicago increased its tax on cigarettes from $0.68 per pack to $1.18 per pack, effective January 10, 2014. The total tax per pack in the City of Chicago is now $7.17. The cigarette tax is also subject to the sales tax on general merchandise.

(26 USC Sec. 5701)

(35 ILCS 130/1ff and 35 ILCS 135/1ff)

(Code of Ordinances of Cook County, Illinois, Chapter 74, Article XI)

(City of Chicago Municipal Code, Chapter 3-42)

Other Tobacco Products

Federal, state and local governments also tax other tobacco products as described below. Cook County began taxing these products effective March 1, 2012. As of January 1, 2013, County taxes on tobacco include $0.60 per ounce of smoking tobacco and smokeless tobacco, $0.05 per little cigar and $0.30 per large cigar.

The City of Chicago does not currently tax other tobacco products, such as those currently taxed by Cook County. However, Ordinance 2016-105 was introduced to the Chicago City Council on January 13, 2016 which would begin taxing other tobacco products and also includes additional regulations. On February 8, 2016 the Finance Committee debated the ordinance with some alderman raising concerns about the proposed ordinance. The Finance Committee went into recess and reconvened on February 10, 2016 with a substitute ordinance, which was ultimately recommended for passage. On the same day, a procedural move was made to defer and publish the ordinance, delaying action until the March Council meeting.

The State of Illinois imposes a tax on the wholesale price for non-cigarette tobacco products. Effective July 1, 2012, the State tax on the wholesale price for non-cigarette tobacco products increased from 18.0% to 36.0%. Effective August 1, 2012, roll-your-own cigarette machine operators are required to pay an annual license fee of $250. While this fee is not a consumer tax, the additional cost may be passed onto consumers. Cigarettes sold by roll-your-own establishments are also subject to the State’s regular cigarette tax of $1.98 per pack. As of January 1, 2013, moist snuff tobacco products are taxed at $0.30 per ounce. Previously, moist snuff was taxed at its wholesale price and categorized under smokeless tobacco.

Federal government taxes on tobacco products range from $0.03 per ounce for smokeless tobacco to $0.18 per ounce for smoking tobacco. Large cigars are taxed by the federal government at 52.75% of the sale price, up to approximately $0.40 per cigar.

The sale of other tobacco products is also subject to the sales tax on general merchandise.

(26 USC 5701)

(35 ILCS 143/10-1ff)

(Code of Ordinances of Cook County, Illinois, Chapter 74, Article XI, (Ordinance No. 15-6025))

(City of Chicago Municipal Code 3-47 and Ordinance 2015-7826)

Pending Local Legislation

As noted above, the City of Chicago is considering imposing a new tax on other tobacco products, as well as additional regulations.

In summary, the proposed substitute ordinance would:

- Increase the legal age to purchase tobacco products from 18 to 21 years of age;

- Set minimum prices for certain tobacco products;

- Establish minimum package sizes for tobacco products;

- Prohibit the use of coupons and other discounts on tobacco products;

- Impose a tax on other tobacco products, such as roll-your-own tobacco, smokeless tobacco and little and large cigars; and

- Increase penalties for selling cigarettes illegally.

The proposed ordinance is projected to generate approximately six million dollars in new revenue, which would be earmarked for Chicago Public Schools high school orientation program.

The Federation will continue to monitor the proposed ordinance and provide additional information as it becomes available.

To read more on many of the other consumer taxes imposed on Chicago residents and visitors, you can access the Civic Federation’s 2016 Selected Consumer Taxes in the City of Chicago report here.