July 19, 2012

Total revenues collected by the State of Illinois in FY2012 beat expectations by $576 million, according to an update from the General Assembly’s financial oversight commission. However, the same report suggested that stalled economic growth may prevent continued gains in the current fiscal year.

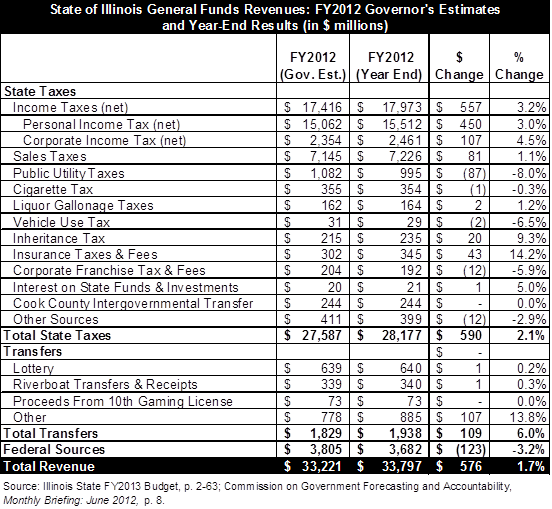

In its monthly briefing for June 2012, the last month of FY2012, the Commission on Government Forecasting and Accountability (COGFA) reported that General Funds revenue totaled $33.8 billion, which is a 1.7% increase from the estimate of $33.2 billion included in the Governor’s FY2013 recommended budget published in February 2012.

The majority of the increase in FY2012 operating revenues is attributable to gains in income taxes, which totaled $18.0 billion, or $557 million more than previously projected. Personal income taxes totaled $15.5 billion net of refunds, or $450 million more than the Governor’s estimate. Net corporate income tax collected by the State totaled $2.5 billion, exceeding expectations of $2.4 billion by $107 million. Sales taxes were also up by $81 million totaling $7.2 billion.

The revenue gains were slightly offset by a shortfall in federal revenues of $123 million and public utility taxes of $87 million.

The following chart compares the year-end results for FY2012 General Funds revenues to the Governor’s estimates included in the FY2013 budget.

The results for FY2012 are also $624 million more than the revenue estimate that the General Assembly used for its FY2012 spending cap. As discussed here, the legislature based its FY2012 General Funds budget on an estimate included in a resolution passed by the Illinois House of Representatives.

The General Assembly undertook a similar budget process this year, with both chambers enacting a joint resolution on the amount of revenue that would be available to fund General Funds operations for FY2013 before passing appropriations bills. The year-end results for FY2012 also slightly exceed this projection for FY2013, which totaled $33.7 billion.

COGFA did not include an update to the FY2013 projections based on this new data but did warn that some economic indicators are showing signs of weakness that could slow or halt additional revenue growth in the coming year. Specifically, it is noted that the Federal Open Markets Committee (FOMC) lowered its economic growth estimates for the last half of the 2012 calendar year from 2.4% to 1.9% and expects the unemployment rate to remain at current levels, only improving slightly over the next two years. The Illinois Department of Employment Security (IDES) reported that in June 2012 Illinois had an unemployment rate of 8.7%, which is higher than the national unemployment rate of 8.2% but much lower than the same month in 2011 when the rates were 9.9% and 9.1%, respectively.

Despite the less optimistic economic outlook, the revenue estimates enacted by the General Assembly were considered conservative compared to the projections provided by COGFA and the Governor’s office last spring. The total revenues that the General Assembly based its FY2012 budget on were more than $200 million less than the other estimates. The total growth in General Funds revenues in the projections approved by the legislature totaled only $455 million, or 1.5% more than the estimates of the FY2012 revenues. General Fund revenues available in FY2013 would increase by $750 million from the total projections enacted by the General Assembly if the same year-to-year growth rates were applied to the new year-end results for state-source revenues in FY2012.

It remains to be seen how this new revenue data will affect the FY2013 budget. However, as discussed here, the budget enacted by the General Assembly and signed by the Governor already has a shortfall of more than $550 million due to appropriating only 6 months of funding for State group health insurance costs.