April 05, 2013

Faced with rising pension costs and modest revenue growth, Governor Pat Quinn has recommended a reduction in State of Illinois funding for local governments and statewide public transportation.

In his FY2014 budget, the Governor proposed capping those distributions at FY2012 levels. Savings to the State are estimated at $143 million, according to State bond documents. The savings estimate is based on the difference between the proposed FY2014 payment and the projected payment under current law. Statutory changes would be required to enact the proposed caps.

State revenue is distributed to local governments and transit districts by transferring money out of general operating funds and into other funds that are specifically designated to receive it. As discussed here, General Funds are diverted to Other State Funds for a wide range of legislatively required purposes, as well as to make debt service payments on bonds.

The Governor’s recommended $35.6 billion FY2014 budget includes total transfers out of $4.9 billion: $2.7 billion of legislatively required transfers and $2.2 billion of debt-related transfers. The FY2014 budget also proposes an annual review of all legislatively required transfers that are not already subject to annual review during the appropriations process.

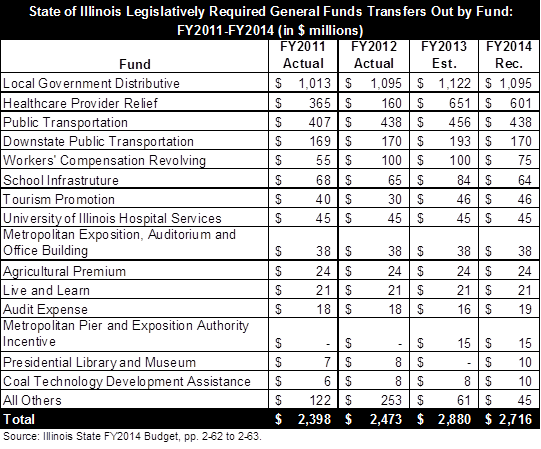

The table below, from the FY2014 budget, shows legislatively required transfers out for FY2011 through FY2013 and the Governor’s proposed transfers out for FY2014. This is the first year that the budget has itemized transfers out, a practice recommended by the Governor’s Budgeting for Results Commission. (Click to enlarge.)

The largest legislatively required transfer out is to the Local Government Distributive Fund, which is estimated to receive 39.0% of all such transfers in FY2013. The Local Government Distributive Fund receives the share of State income tax proceeds that is distributed to local governments. The share had been 10% but was lowered in January 2011 after the State temporarily increased income tax rates so that the State could get the full benefit of the tax increase while preserving local governments’ portion prior to the increase. Local governments currently receive 6% of individual income tax revenues and 6.86% of corporate income tax revenues.

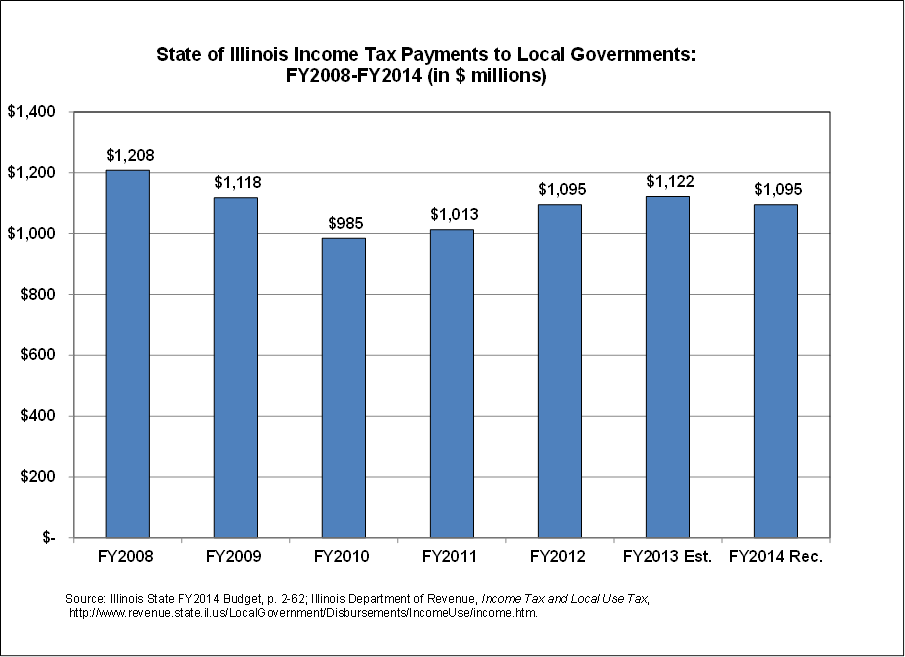

The Governor’s recommended budget for FY2014 caps income tax payments to local governments at the FY2012 level of $1.095 billion. That’s down $27 million from the amount estimated to be paid in FY2013, according to the Governor’s Office, and down $68 million from the projected payment for FY2014, which was based on the statutory percentages now in effect and the expected growth in total income tax revenues.

Local governments have strongly criticized the proposed reduction in revenue. The Illinois Municipal League estimates that the decrease in funding to local governments in FY2014 would be approximately $148 million, rather than $68 million. The League forecasts a larger loss to local governments because it believes that the Governor’s office has underestimated income tax revenues for FY2014.

The chart below shows State income tax payments to local governments from FY2008 to FY2013 and the Governor’s recommended payments for FY2014. The amount of State income taxes shared with local governments remains below its pre-recession level of $1.208 billion in FY2008. (Click to enlarge.)

The Governor has also proposed capping the Public Transportation and Downstate Public Transportation Funds at the FY2012 level. These funds receive money under various state sales tax acts and distribute it to the Regional Transportation Authority (RTA) and to local mass transit districts outside of the boundaries of the RTA.

The Governor’s recommended FY2014 budget transfers $437.8 million to the Public Transportation Fund, down from $456.3 million in FY2013. The Downstate Public Transportation Fund would receive $170.2 million, down from $192.5 million. Transfers to the two funds are based on complex statutory formulas; it is not clear how much might have been paid to the funds in FY2014 before the Governor’s proposed freeze.

Significant transfers are also made to the Healthcare Provider Relief Fund, which supports the State’s Medicaid program. The FY2014 budget proposes a transfer of $601 million to this fund, down from an estimated $651 million in FY2013. In FY2013 transfers of $500 million were authorized to pay down $1 billion of outstanding Medicaid bills through a cycle of State spending and federal reimbursement. It should be noted that $151 million of the FY2013 transfers shown in the budget—to be used to close a projected gap in the Medicaid budget—have not yet been authorized by the General Assembly.