February 25, 2011

In order to pay income tax refunds owed to taxpayers, the State of Illinois sets aside a percentage of income tax receipts received throughout the year and deposits them into a special fund. Different percentages apply to individuals and businesses, but all refunds are paid from the same fund—the Income Tax Refund Fund.

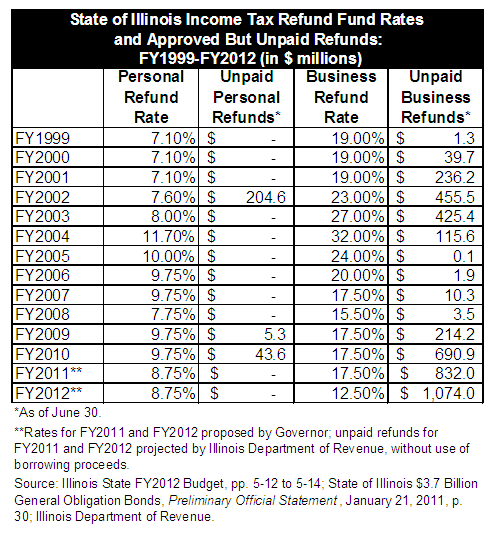

These percentages are known as Refund Fund rates. The higher the Refund Fund rates, the more money deposited into the fund and the less revenue available for the State’s general operations. The rates are set by the Illinois General Assembly.

In the past, the State has typically raised Refund Fund rates when the Fund did not receive enough money to pay all the refunds owed to taxpayers. In his recommended budget for FY2012, Governor Pat Quinn has proposed to use borrowing to eliminate the growing refund backlog rather than raise the Refund Fund rates.

As previously discussed on this blog, the backlog of unpaid business refunds has been growing since FY2009 because Refund Fund rates have been set too low. The Illinois Department of Revenue makes it a priority to pay personal income tax refunds to individuals, so when there is a shortfall in the fund, unpaid business refunds rise.

Less than $1 million in business refunds were paid in FY2010; revenues deposited into the Refund Fund from business taxes were used to help pay personal refunds of $1.3 billion, according to revenue and expenditure data on the website of the Illinois Comptroller’s Office. As shown in the chart below, approved but unpaid business refunds grew to $690.9 million at the end of FY2010 from $214.2 million at the end of FY2009.

Despite the increased refund backlog in FY2010, the personal refund rate was reduced to 8.75% in FY2011 from 9.75% in FY2010. The business refund rate remained unchanged at 17.5%. For FY2012, Governor Quinn recommended in his proposed budget that the business refund rate be reduced from 17.5% to 12.5% and that the personal refund rate be kept unchanged at 8.75%. At those rates, the Department of Revenue projects that the backlog of unpaid business refunds would increase to approximately $832 million by the end of FY2011 and roughly $1.1 billion by the end of FY2012.

However, the Governor proposes to eliminate the refund backlog by the end of FY2012 by using part of the proceeds of a planned sale of $8.75 billion in General Obligation (GO) Restructuring Bonds to pay tax refunds. It is unclear how much of the bond proceeds would be used to pay the refund backlog in FY2011. According to preliminary information provided by the State in connection with a bond sale on February 23, 2011, $460 million of the bond proceeds would be used to pay off the refund backlog in FY2012.

The State previously borrowed to pay income tax refunds in FY2003, according to the Department of Revenue. In May 2003 the Tax Refund Fund received $475 million of bond proceeds to help reduce the refund backlog, which totaled $660.1 million at the end of FY2002. Refund rates were also increased in FY2003 and FY2004.

The backlog of unpaid business refunds had been expected to reach $1.4 billion by the end of FY2011, according to the State’s preliminary information. However, the projection has been reduced to approximately $832 million because businesses are believed to be reducing income tax payments to avoid overpayment and using refunds owed to offset their tax liabilities.

Corporations (other than S corporations) are required to pay their tax bills through quarterly estimated payments in September, December, April and June. State officials saw only modest growth of 3% in December’s estimated payments from the year-earlier quarter, according to the FY2012 budget. The previous three estimated payments—in April, June and September—showed double-digit increases. The slowing growth appears to indicate that firms are reducing their estimated payments to avoid being owed refunds.