November 26, 2013

Legislative action on reducing the State of Illinois’ massive pension obligations could come as soon as next week, but the details of the latest pension reform proposal and its potential impact on the State’s financial condition have not yet been made public.

On November 25, Illinois House Speaker Michael Madigan’s staff reportedly notified House members that they will be back in session on December 3, 2013. The Senate has not yet set a return date. The Illinois General Assembly has been in recess since the fall veto session ended on November 7.

The special session will come a day after the December 2 deadline for candidates to get on the ballot for the primary election in March 2014. The timing could be important, according to observers, because it would remove the threat of a primary challenge for some lawmakers based on their vote on the controversial pension issue.

Legislation incorporating the latest proposal has not been filed. However, a bill that was amended by Speaker Madigan on November 4 and passed by the House Personnel and Pensions Committee two days later could become the vehicle for future pension legislation. The Speaker’s amendment is what is known as a shell bill, which contains no meaningful content but could later be amended to add substantive provisions.

In recent weeks, the legislative leaders—House Speaker Madigan, House Minority Leader Jim Durkin, Senate President John Cullerton and Senate Minority Leader Christine Radogno—have taken control of pension reform efforts, holding private meetings about changes that would affect existing employees and retirees. The leaders moved to the forefront after a conference committee appointed in June 2013 to deal with the pension crisis apparently was unable to agree on a proposal.

Although details of the leaders’ discussions have not been officially disclosed, it has been reported that the plan under consideration would generate more savings for the State than the plan debated by the conference committee. The conference committee plan reportedly would have saved the State $138 billion over 30 years. As discussed here, the proposal featured an annual benefit increase set at one-half of the increase in the rate of inflation, instead of the current automatic 3% compounded increase for retirees and employees hired before January 2011.

The leaders’ proposal would reportedly reduce the State’s pension contributions by an amount closer to $163 million through FY2045—the savings that were estimated to result from a plan previously backed by Speaker Madigan. The Speaker’s proposal was approved by the House but rejected by the Senate during the General Assembly’s regular spring session. As discussed here, the Speaker’s plan featured a reduced automatic annual benefit increase tied to seniority; under the plan, employees with 30 years of years would receive a maximum increase of $900 a year. The leaders’ plan reportedly involves a similar provision, which was initially advanced by Senate Minority Leader Radogno.

The last major changes to State pension benefits were enacted in 2010 and sailed through the General Assembly in one day. Public Act 96-0889 was filed on March 24, 2010 and approved by the House and Senate on the same day. Legislative leaders reportedly rushed the measure through the General Assembly before union officials had time to persuade lawmakers to vote against it.

The 2010 legislation, which was signed by Governor Pat Quinn on April 14, 2010, significantly cut pension benefits for employees hired on or after January 1, 2011. The measure reduced the automatic annual benefit increase, lowered the retirement age and capped the salary on which a pension could be based. The changes did not affect retirees or existing employees.

Union officials have already launched a campaign against the new proposal by legislative leaders, which they have described as an unprecedented threat to the retirement security of public workers. The We Are One Illinois coalition of labor unions declared a series of Pension Emergency Action Days, asking members to flood legislators’ offices with calls on November 25, November 26, December 2 and December 3. The coalition also plans to hold rallies on December 2 at the district offices of key legislators.

As discussed here, the latest draft actuarial valuation reports for the State’s five retirement systems show a total unfunded liability of $97.5 billion as of June 30, 2013 and combined funded ratio of 41.1%, based on the market value of assets. Statutorily required State pension contributions will increase by $103.5 million, or 1.5%, to $6.9 billion in FY2015 from $6.8 billion in FY2014, according to preliminary certifications by the five systems, but the growth will be less than previously projected due mainly to strong investment returns.

State contributions to the retirement systems are based on a 50-year funding plan (Public Act 88-0593) that began in FY1996. After a 15-year phase-in period, the law requires the State to contribute a level percentage of payroll sufficient to bring the retirement systems’ funded ratios to 90% by FY2045.

Despite the favorable investment performance in FY2013, the State’s total unfunded liability rose by $666.2 million, or 0.7%, from $96.8 billion at the end of FY2012, based on the market value of assets. The funding plan and subsequently enacted changes deferred a large portion of the required State contributions to later years. The funding plan does not conform to reporting standards of the Governmental Accounting Standards Board. For most of the funding period, the law has also required State contributions that were insufficient to keep the unfunded liability from growing.

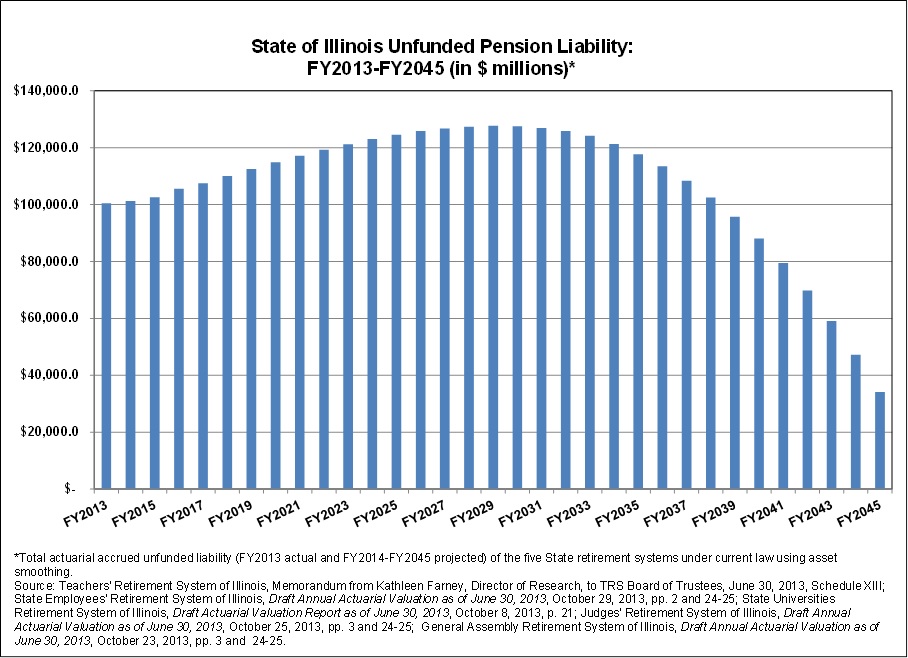

According to the latest actuarial valuations, the total unfunded liability is expected to continue to climb through FY2029, when it is projected to reach $127.6 billion. By FY2045, when the combined funded ratio is required to be 90%, the total unfunded liability is projected to be $34.2 billion. These figures are based on asset smoothing, the valuation approach that has been required by State law since FY2009. Under asset smoothing, unexpected gains or losses in asset values in any fiscal year are recognized over five fiscal years. Market value valuations are more volatile than smoothed valuations but provide a more realistic view of the systems’ actual financial position at the time of measurement.

The following chart shows the trend in total unfunded liability for the State’s five retirement systems from FY2013 to FY2045, based on the most recent actuarial valuations using asset smoothing.

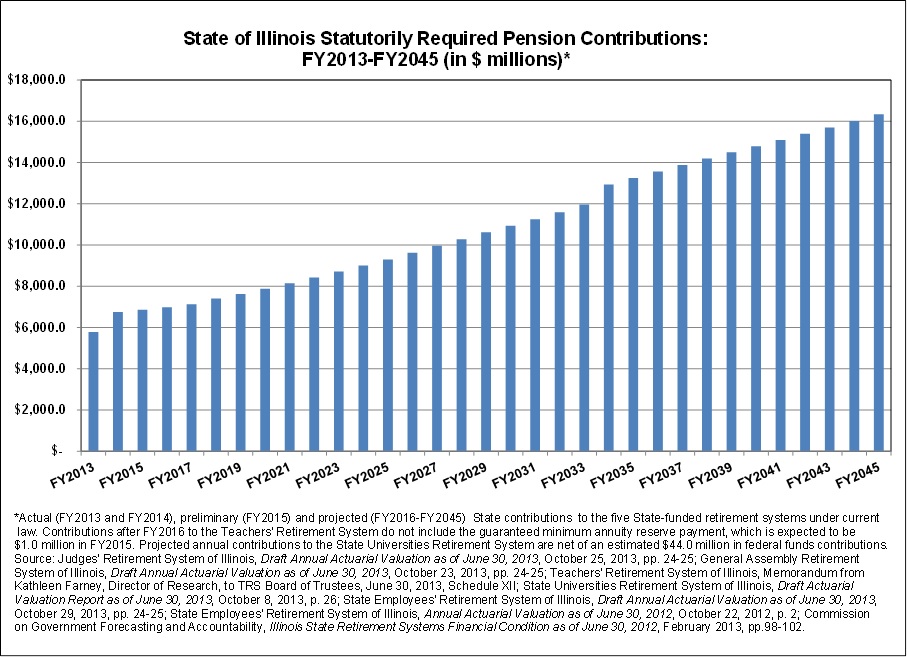

Under the current funding plan, total annual State contributions are projected to climb to $16.3 billion by FY2045. Roughly 89% of the State’s total pension contributions come from General Funds. The remaining contributions are made from other funds that support State agency payrolls and from the State Pensions Fund, which receives proceeds from the sale of unclaimed property.

In FY2014 General Funds pension contributions of $6.0 billion are expected to consume 19.0% of State-source General Funds revenues of $31.6 billion. Required State debt-service payments of $1.7 billion on previously issued pension bonds bring total General Funds pension costs to $7.6 billion, or 24.2% of State-source General Funds revenues.

The next chart shows actual total State pension contributions in FY2013 and FY2014, proposed contributions in FY2015 and projected contributions thereafter.

It should be noted that the latest draft actuarial valuations were required to be submitted by November 1 to the State Actuary. The Illinois Auditor General must file a report with the Governor and General Assembly by January 1 including any changes to the actuarial valuations recommended by the State Actuary. Final certified contribution amounts for FY2015 are due from the systems by January 15 so they can be included in the Governor’s recommended budget for the next fiscal year.