October 11, 2019

In her “State of the City” address in August, Chicago Mayor Lori Lightfoot stated her administration will pursue a graduated real estate transfer tax as part of her strategy to address an $838 million deficit in next year’s budget. This blog post explains the City’s current real estate transfer tax and provides context regarding a graduated rate. The Civic Federation has not taken a position on the proposal and this post is for informational purposes only.

Real Estate Transfer Tax

A real estate transfer tax (RETT) is imposed upon the privilege of transferring title to, or beneficial interest in, real property. Cities, counties and states across the U.S. impose some version of ad valorem taxation on the transfer of real property. There are several forms of this tax category, such as a property transfer tax, a deed transfer tax or a mortgage recording tax. However, structures are not identical across these taxes. For instance, a RETT is a tax on the property’s value while a mortgage recording tax is one on the long-term debt attached to the property.[1]

State and local governments in 38 states including the District of Columbia impose a property transfer tax.[2] In six states and the District of Columbia, tax rates vary depending on the value of the property, geographic location or they levy a surcharge on the highest value homes. For instance, Hawaii has a seven-bracket transfer tax structure depending on the value of the property and Vermont’s applies a higher rate to the portion of the property value above $100,000.[3] A few major cities in the U.S. impose a graduated RETT, notably San Francisco, Oakland and New York City. The City of Evanston, which is discussed later, also adopted a graduated RETT last year.

Real Estate Transfer Tax in Chicago

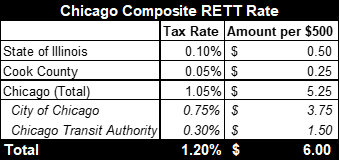

The current composite rate for a real estate transfer in Chicago is 1.2%, or $6 per every $500 of the property value. Chicago imposes two separate taxes of 0.75%, or $3.75, and 0.3%, or $1.50. This first tax contributes to the City’s Corporate Fund; the latter contributes to the Chicago Transit Authority’s Real Estate Transfer Tax Fund. According to the FY2019 Proposed Budget for Chicago, the Corporate Fund was projected to receive $160.0 million that year from the City RETT, while the CTA transfer fund was projected to generate $64.0 million. The total $5.25 per $500 is split between the buyer, who pays $3.75, and the seller, who pays $1.50. The composite rate also includes taxes charged by the State of Illinois and Cook County, which together equal 0.15% or $0.75 for every $500. The seller pays for both taxes. The State’s revenue from this tax is deposited into the Illinois Affordable Housing Trust Fund, the Open Space Lands Acquisition and Development Fund and the Natural Area Acquisition Fund. Cook County tax revenue is deposited into the County’s General Fund.

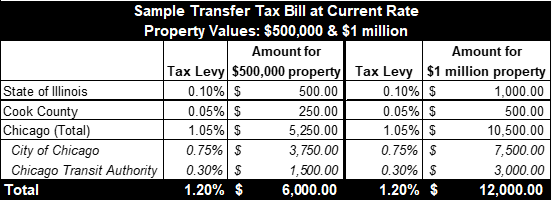

As examples, transferring a property valued at $500,000 would incur $6,000 in total taxes. Of this amount, $3,750 would go to the City’s Corporate Fund and $1,500 to CTA’s own fund. Transferring a property worth $1 million would incur $12,000, with $7,500 for the Corporate Fund and $3,000 for the CTA fund.

There are various exemptions to the real estate transfer tax. For example, the City of Chicago exempts sales under $500, bankruptcies and Enterprise Zone sales from the tax.

Proposals for a Graduated Real Estate Tax

Over the past several years, there have been proposals that call for changing the City’s flat rate to a graduated one. These proposals by Chicago Coalition for the Homeless and the Metropolitan Planning Council included several uses for additional revenue, such as funding affordable housing, the removal of lead pipes in homes or to pay for police and fire pensions. Chicago could implement a graduated structure via voter referendum, as the City of Evanston recently did, or via a change to state law.

In November 2018, voters in Evanston approved a referendum to institute a graduated rate. Evanston’s transfer tax is now $2.50 per $500 in value for homes below $1.5 million; $3.50 per $500 in value for homes valued between $1.5 million and $5.0 million; and $4.50 per $500 value for sales over $5.0 million. The new rates went into effect January 1, 2019. Tax revenue will be put toward the City’s General Fund.

Potential Effects of a Graduated Real Estate Transfer Tax

Instituting a graduated RETT has faced opposition and support in Chicago and other communities.

Points made by opponents:

- A graduated rate could hurt the real estate market by reducing transactions, increasing closing costs and making housing unaffordable;

- Buyers could circumvent higher tax rates by making purchases on lower valued properties, which could contribute to urban sprawl;

- Sellers could circumvent higher tax rates by lowering the price of their own homes; and

- Such a revenue source may prove unreliable in an economic downturn.

Points made by supporters:

- A graduated rate would ease the tax burden on the majority of homebuyers while relying more on wealthier homebuyers;

- Additional revenue could fund government services; and

- A graduated rate would take advantage of growing property values in wealthier areas.

[1] Patricia Atkins et al., Tax Notes, “State Tax Notes,” “Real Estate Transfer Taxes: Widely Used, Little Conformity,” 2015.

[2] Terri A. Sexton, Lincoln Institute of Land Policy, “Challenging the Conventional Wisdom on the Property Tax,” “Taxing Property Transactions Versus Taxing Property Ownership,” 2010.

[3] Michael Leachman and Samantha Waxman, Center on Budget and Policy Priorities, “State ‘Mansion Taxes’ on Very Expensive Homes,” 2019.