March 10, 2016

Ed. note: Updated information on this topic can be found here.

-----

Three years ago, this blog examined the impact of the housing market collapse on a specific property tax exemption, the Senior Citizens Freeze Homestead Exemption, or “Senior Freeze.” We found that in Cook County the value of the Senior Freeze exemption fell sharply between tax years 2009 and 2011 as home values fell. Since then, the trend has continued, with the amount of taxable property value exempted by the Senior Freeze continuing to fall in tax years 2012, 2013 and 2014, the most recent years for which data are available. Since 2009, the amount of property tax value exempted from taxation by the Senior Freeze in Cook County has fallen by 71.7%.

The following chart shows the amount of taxable property value in Cook County that has been exempted under two homestead exemptions available to certain homeowners 65 years of age and older between 2000 and 2014. This blog will discuss how the two senior homestead exemptions work and why the value of the two exemptions has fared so differently.

Background

Homestead property tax exemptions are intended to reduce the taxable value of a homeowner’s property in order to provide property tax relief, since the property tax is not based on a taxpayer’s ability to pay. Homestead exemptions are only allowed for a primary residence that is inhabited by the owner, that is, not a second home. There are many different homestead exemptions that have been granted by the Illinois General Assembly, including a general exemption for all homeowners, as well as special exemptions targeted at seniors, veterans and people with disabilities.

Two homestead exemptions exist for some homeowners at least 65 years of age, the abovementioned Senior Freeze and the Senior Citizens Homestead Exemption. Both exempt equalized assessed value (EAV). The EAV of a homestead property is the final taxable value unless exemptions are applied.[1] However, the two exemptions work in different ways, which is why the taxable value of property in Cook County exempted by the Senior Freeze has fallen so significantly, while the value of the Senior Citizens Homestead Exemption has not.

Senior Citizens Homestead Exemption

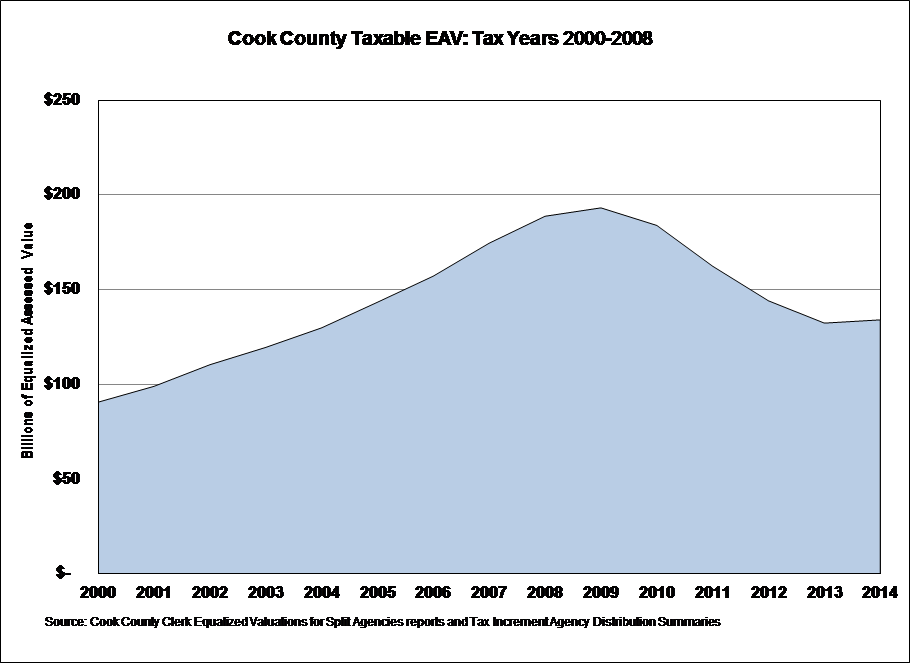

The Senior Citizens Homestead Exemption has removed a flat $5,000 of EAV from taxation in Cook County since tax year 2012, when the Illinois General Assembly increased the exemption.[2] As can be seen in the chart above, the amount of EAV exempted under the Senior Citizens Homestead Exemption has generally increased in years when the value of the exemption is increased. However, in tax years 2010 and 2011, the value of the exemption decreased as the taxable value of all property in Cook County declined significantly. The value of the exemption increased in 2012 despite a fall in total Cook County EAV because the exemption was increased to $5,000. The trend in the taxable value of property in Cook County between tax years 2000 and 2014 is shown in the following chart.

Senior Citizens Assessment Freeze Homestead Exemption

In contrast to the flat exemption provided by the Senior Citizens Homestead Exemption, the Senior Freeze “freezes” an eligible homeowner’s EAV at the level of the year prior to a homeowner’s first application. In other words, it exempts all increases to taxable value over the base amount. The household income eligibility limit was increased to $55,000 in tax year 2008, where it has remained since.

It is important to note that the Senior Freeze does not freeze tax bills or tax rates. It freezes the taxable value of a qualifying homeowner’s property. There is no exemption maximum or property value maximum, so the Senior Freeze can be a very valuable exemption for qualifying homeowners, particularly during times of increasing home values.

The Senior Freeze logically becomes less valuable during times of falling home values because there is less EAV above a homeowner’s base value to exempt. Again, as shown in the chart above, the total taxable value of property in Cook County declined significantly between tax years 2009 and 2013, before increasing slightly in 2014. Similarly, the value of the Senior Freeze exemption fell sharply between tax years 2009 and 2013 before leveling off in tax year 2014.

Additionally, there is a failsafe in the authorizing legislation (35 ILCS 200/15-172) that prevents the freeze from artificially increasing taxable value. If the taxable value of a qualifying homeowner’s property ever falls below its original “frozen” base value, the lower value becomes the new base amount. If the property’s taxable value subsequently grows above this lower base amount, the growth in EAV will again be exempted.

Helpful Links

- Applications for both senior exemptions must be made annually to the Cook County Assessor.

- Information about how much property value is annually exempted from taxation by various homeowner exemptions can be found on the Cook County Clerk’s website.

- Civic Federation Property Tax Primers

[1] Read the Civic Federation’s primer on the Cook County property tax assessment process to learn more about how the taxable value of a property is calculated.

[2] A homeowner who qualifies for the Senior Citizens Homestead Exemption automatically also qualifies for the General Homestead Exemption, which has exempted a maximum of $7,000 of EAV since tax year 2012.