June 23, 2016

In April 2016, the Illinois Department of Revenue announced that it discovered a misallocation totaling an estimated $168 million in extra Personal Property Replacement Taxes (PPRT) distributed to 6,527 local government taxing entities throughout Illinois. This misallocation equals 6% of the total $2.8 billion PPRT payments made to local governments in tax years 2014 and 2015. Each local government that received wrongful PPRT funding will need to refund the State beginning in 2017.

Overview of Personal Property Replacement Tax

The Personal Property Replacement Tax (PPRT) is a state-imposed corporate income tax whose proceeds are distributed to local governments. The PPRT was established by the General Assembly in 1979 to replace a tax on the personal property of businesses which was abolished pursuant to the 1970 Illinois Constitution, Article IX, Section 5. The State levies a 2.5% tax on corporations and a 1.5% tax on partnerships, trusts and S corporations, which is then paid to local governments. Government districts eligible to receive PPRT payments include only those that collected personal property taxes for the 1977 tax year, or 1976 tax year for Cook County. The funds are distributed in two portions – one to Cook County (51.65%) and the other to downstate counties (48.35%) – based on the portion received for the 1977 tax year, or 1976 for Cook County. The Personal Property Tax Replacement Fund statute can be found here.

Personal Property Replacement Tax Misallocations

As noted above, a PPRT misallocation error occurred as a result of the passage of Public Act 098-0478, which discontinued and revised tax forms, leading to calculation errors. Pass-through withholding payments made by S corporations, partnerships and trusts on behalf of shareholders, partners and beneficiaries residing outside of Illinois, were intended to be classified as income tax, but were misclassified as replacement tax and subsequently distributed to local governments.

A factor that contributed to the misclassification is that the Department of Revenue must estimate the type of tax at the time the tax is collected so that it can be distributed into the appropriate fund, such as the PPRT fund. The actual tax type classification is not known until a tax return is submitted, which can sometimes take until October following the tax year due to allowable extensions.

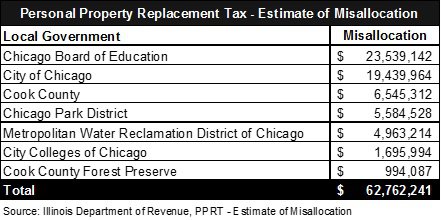

Seven government entities that the Civic Federation monitors are among those that will be required to pay back the taxes to the Illinois Department of Revenue.[1] Their estimated misallocations are listed in the table below. A full list of the estimated misallocations by taxing district can be found here.

Reconciliation Plan

The Illinois Department of Revenue plans to use information from 2014 tax returns to improve the estimation process for tax years 2015 and 2016. Many 2015 tax returns will not be received until October 2016. During this time the Department of Revenue will perform reconciliations in order to calculate the actual amount of the miscalculation for tax year 2015.

According to the Illinois Department of Revenue website, recoupment of the overpayments will occur through reductions in payments to governments beginning in January 2017. A press release from the Illinois Department of Revenue stated that the Department will work with the impacted local governments over an extended period of time. Media reports following the April 2016 announcement reported that some local government entities may be more affected than others, especially school districts.

Local governments will have to absorb the payments into their future year budgets. City Colleges of Chicago is the first of the local governments that the Civic Federation monitors to release a budget after the announcement of the overpayments. City Colleges’ recommended FY2017 budget states that it “is the intention of the state to recoup the overpayments, starting in January 2017, as a reduction in the current payments” over a two year period.

[1] The Chicago Transit Authority (CTA) does not receive PPRT payments.