December 09, 2011

This week marks the end of the Civic Federation's fiscal year 2012 local government budget analysis season. The nine local governments monitored by the Civic Federation include: City Colleges of Chicago, Chicago Public Schools, DuPage County, City of Chicago, Cook County, Chicago Transit Authority, Forest Preserve District of Cook County, Metropolitan Water Reclamation District of Greater Chicago and Chicago Park District.

The most notable finding of the budget season was that six of the eight governments that levy property taxes held their levies flat or nearly flat for the FY2012 budget year. The two exceptions are the Chicago Public Schools and Metropolitan Water Reclamation District, which raised their property tax levies to the maximum allowed under state law. (The Chicago Transit Authority does not levy a property tax).

Other major findings include:

- Property tax levy:

- Six of eight governments held their property tax levies flat.

- Two of eight governments increased their levies to the maximum amount allowable.

- General Fund budget appropriations:

- Five of the nine governments increased their operating budget appropriations.

- Four of the nine governments decreased their operating budget appropriations.

- Personnel – FTE (full-time equivalent) positions:

- All but two of the eight governments (City Colleges of Chicago and the Forest Preserve District of Cook County) reduced their FTE count.[1]

- Personnel Expenses:

- Four of eight governments increased their appropriations for personnel expenses.

- Four of eight governments reduced their appropriations for personnel expenses.[2]

- Fund Balance:

- Four of nine governments met the Government Finance Officers Association’s recommendation for maintaining a General Fund fund balance of at least 17% of operating expenditures.

- Pension Fund:

- Funded ratios for government employee pension funds declined for the seven governments with their own pension funds.[3]

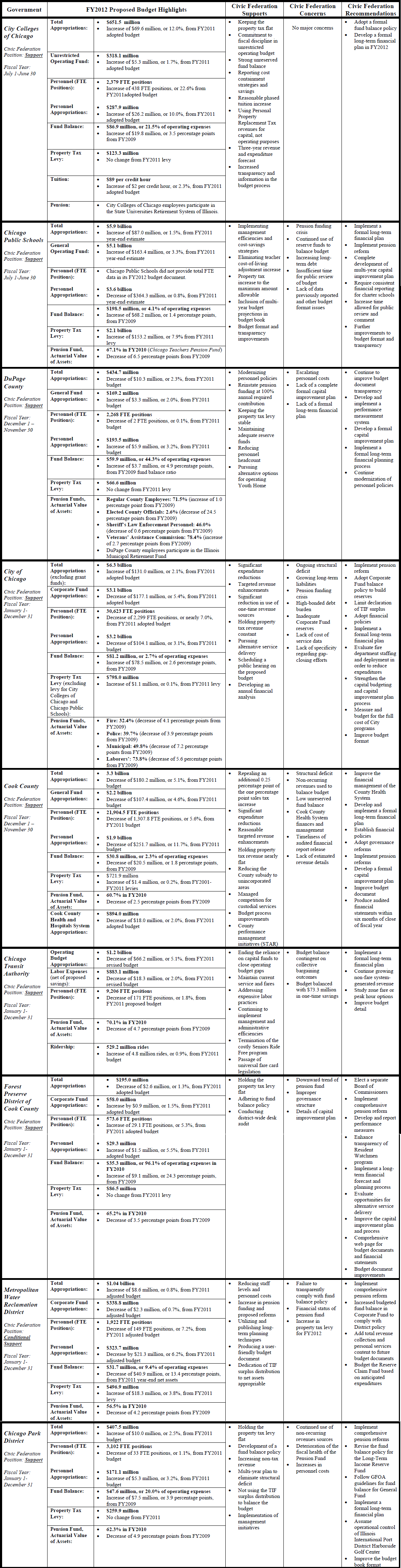

The exhibit below provides a summary of the budget analysis reports published by the Civic Federation following the release of each local government’s FY2012 proposed budget. The summary chart provides:

- Appropriation and financial data highlights;

- Changes from the previous year’s actual expenditures, year-end estimates or adjusted/adopted budgets;

- The Civic Federation’s positions; and

- The Civic Federation’s statements of support, concern and recommendation.

It should be noted that the figures below represent the data available at the time the Civic Federation’s analysis of each budget was published; appropriations and other financial data may have changed since the release of each report. Also, the Civic Federation’s individual analyses for some aspects of a government’s budget may not be comparable to the analyses of other governments, and therefore may not be included in the summary exhibit. Full analysis reports can be accessed here.

Click here to download a pdf copy of this chart.

[1] Chicago Public Schools did not provide total FTE data in its FY2012 budget document.

[2] Chicago Transit Authority did not provide personnel appropriation data.

[3] City Colleges of Chicago employees participate in the State Universities Retirement System of Illinois and DuPage County Employees participate in the Illinois Municipal Retirement Fund.