May 05, 2022

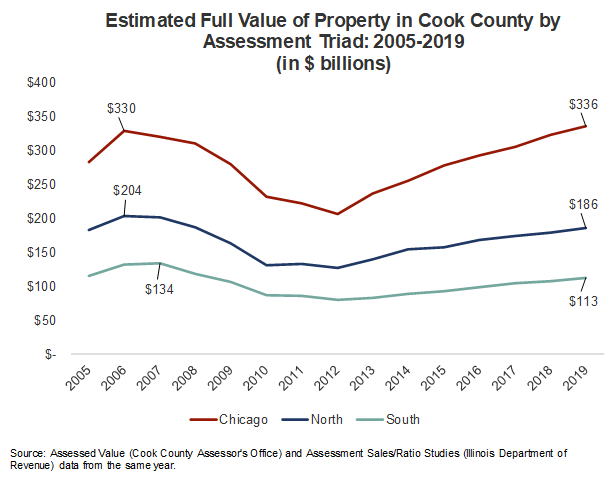

The Civic Federation recently released its annual estimate of the full value of property in Cook County in tax year 2019. While the Federation’s estimate of the full value has grown each year since the trough in 2012, the 2019 total County value of $634.9 billion is still short of the previous peak of $666.2 billion. However, breaking out the values by assessment triad, the City of Chicago’s 2019 estimated full value of $335.9 billion has now surpassed the previous peak of $329.8 billion set in 2006 before the real estate market crash and Great Recession. Both the North and South Triads are still short of their 2006 and 2007 peaks, respectively.

The following chart breaks out the full value by Triad. While the Chicago triad is now 1.8% higher than the 2006 peak, the North Triad is 8.7% short of 2006. For the South Triad, the peak of $134.1 billion was set in 2007. The 2019 estimated South Triad value is still 16.0% short of its 2007 peak. The estimated value of City of Chicago real property has grown 62.3% since its trough in 2012 and property in the North Triad by 46.4% and the South Triad by 40.6%.

This estimate of real estate in Cook County is calculated using two data sources: the total assessed value of property as reported by the Cook County Assessor’s Office and the median level of assessment reported by the Illinois Department of Revenue. The estimate does not include railroad properties or properties that are exempt from real estate taxes.

The Illinois Department of Revenue collects data on property sales and calculates the ratio of assessed values to sales values. That data is used to compute the median assessment-to-sales ratio, or the median level of assessment. The Department of Revenue figures for 2019 were released in the spring of 2021.

The Civic Federation estimates the full value of property by dividing the median level of assessment into the total assessed value of each class of property in Cook County. For those classes for which the Department of Revenue does not calculate a median level of assessment, the level set by County ordinance is used.