May 15, 2014

New actuarial reports released by the Cook County Pension Fund this month show a slight improvement in the Fund’s financial position in 2013 due to better than expected investment returns. Despite the improved performance, however, the Fund is projected to become insolvent by 2038.

The Cook County Pension Fund has experienced a sharp decline in funding over the last decade, from a funded ratio of over 90% as recently as FY2000. While there is no official industry standard or best practice for an acceptable public pension plan funded ratio other than 100%, any funded ratio below 80% generally raises questions about the ability of the government to adequately fund its retirement system over time.

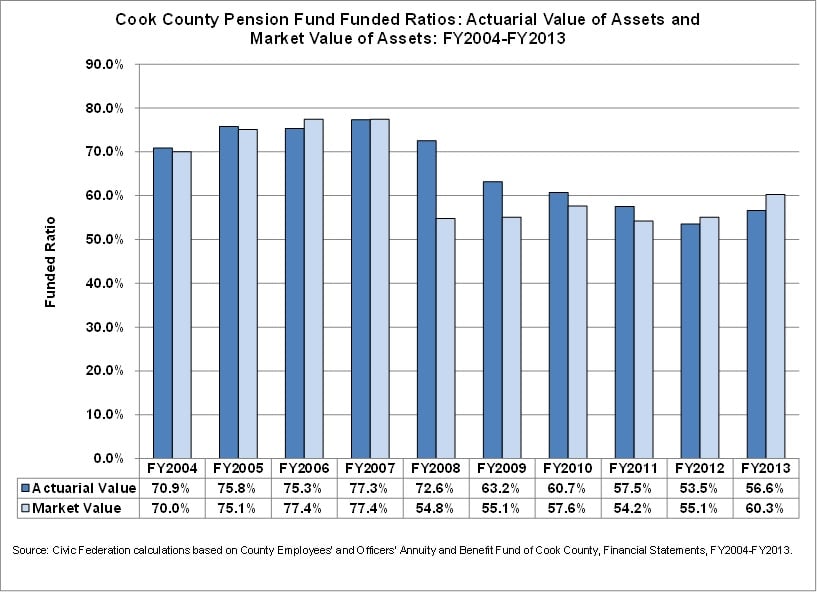

As shown in the chart below, the actuarial value funded ratio for the Cook County Pension Fund increased to 56.6% in FY2013 from 53.5% in FY2012. According to the Fund’s actuaries, the improved performance reflects 2013 investment returns of over 15%.

The chart reflects two methods for reporting the value of pension assets. Market value of assets recognizes unrealized gains and losses immediately in the current year and can produce significant fluctuation year-to-year as can be seen in the large jump in funded ratio for market value between FY2012 and FY2013. The actuarial or smoothed value of assets measurement mitigates the effects of short-term market volatility by recognizing each year’s investment gains or losses over a period of three to five years. The Cook County Pension Fund’s actuarial value of assets reflects gains or losses over a period of five years. This calculation also helps explain the Fund’s improved performance on an actuarial value basis. As of FY2013, the Fund no longer needed to factor in significant market losses of 2008 when calculating actuarial value smoothing over five years.

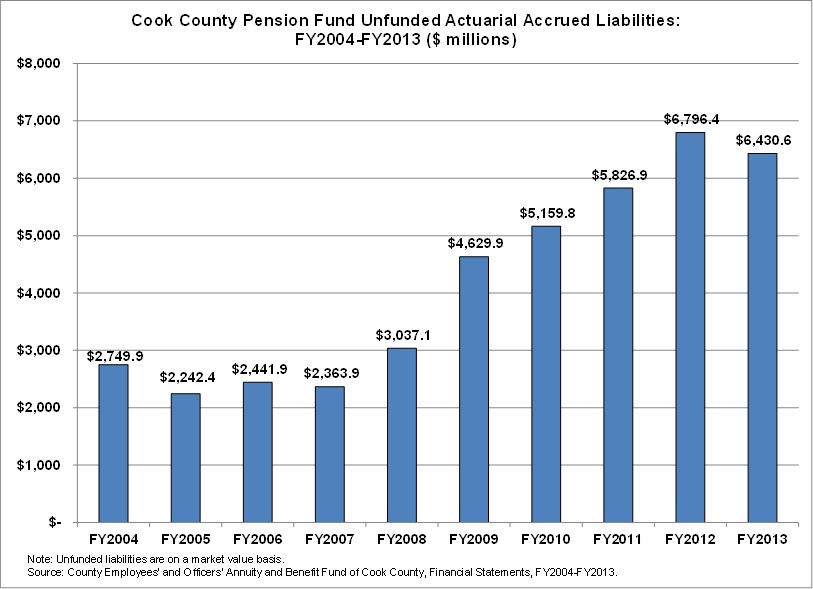

The Cook County Pension Fund’s unfunded liabilities decreased in FY2013 to $6.4 billion from $6.8 billion in FY2012. This number represents promises made to current and future retirees for which the County has no identifiable means to pay. As shown in the chart below, unfunded liabilities increased by $3.7 billion between FY2004 and FY2013. This represents a 133.8% increase over the past 10 years.

As a result of the improved performance in FY2013, actuaries have slightly revised the Cook County Pension Fund’s projected insolvency date to 2038 from a previous estimate of 2034. As outlined in Cook County Commissioner Bridget Gainer’s Truth in Numbers report, the insolvency date means that the Fund will be depleted by 2038 and will not be able to pay pensions or retiree healthcare benefits.

To prevent this painful reality, Cook County officials are reportedly working with the unions that represent County employees on reforms to the Pension Fund’s benefits and funding. Official details of the proposed reforms and their actuarial impact on the Cook County Pension Fund have not yet been released.