October 31, 2013

Recent trend analysis performed by the Civic Federation shows that the funded status of the Cook County Pension Fund declined again in fiscal year 2012, the most recent year for which data are available. The market value funded ratio for the County pension fund fell to 55.1% in FY2012 from 69.1% in FY2003. The fund was over 90% funded as recently as FY2000.

Funded ratio and unfunded liabilities are two indicators of pension fund fiscal health the Civic Federation uses to evaluate State and local retirement funds.

Funded Ratio

The most basic indicator of pension fund status is its ratio of assets to liabilities, or “funded ratio.” When a pension fund has enough assets to cover all its accrued liabilities, it is considered 100% funded. The optimum situation for any pension fund is to be fully funded, with 100% of accrued liabilities covered by assets. There is no official industry standard or best practice for an acceptable funded ratio other than 100%.

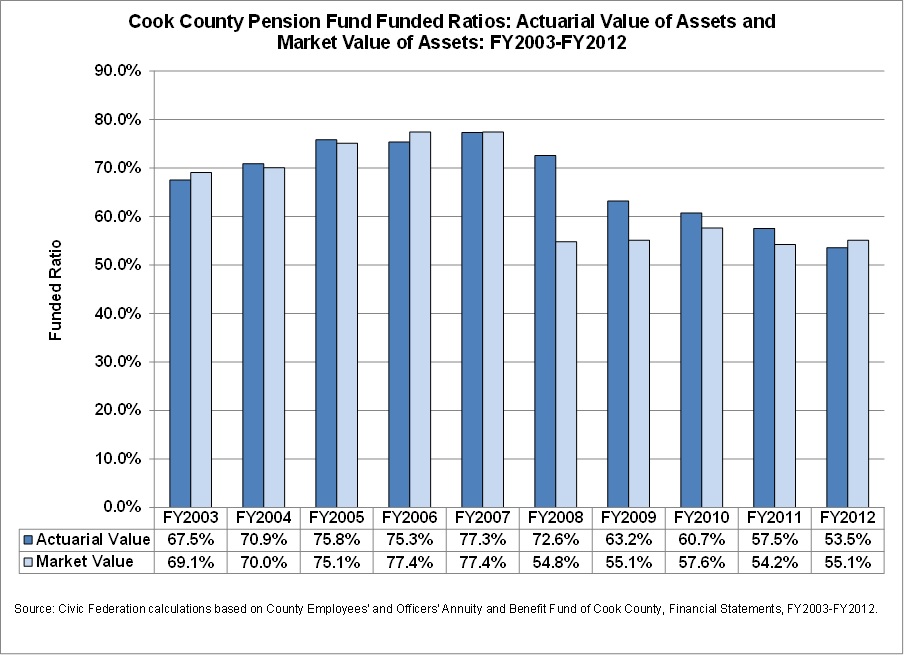

This blog uses two measurements of pension plan funded ratio: the actuarial value of assets measurement and the market value of assets measurement. These ratios show the percentage of pension liabilities covered by assets. The lower the percentage, the more difficulty a government may have in meeting future obligations. The actuarial value of assets measurement presents the ratio of assets to liabilities and accounts for assets by recognizing unexpected gains and losses over a period of three to five years. The market value of assets measurement presents the ratio of assets to liabilities by recognizing investments only at current market value. Market value funded ratios are more volatile than actuarial funded ratios due to the smoothing effect of actuarial value. However, market value funded ratios represent how much money is actually available at the time of measurement to cover actuarial accrued liabilities.

The following exhibit shows the actuarial and market value funded ratios for Cook County’s pension fund over the last ten years. The actuarial value funded ratio was 67.5% in FY2003 and reached a high of 77.3% in FY2007 before falling to 53.5% in FY2012. The market value funded ratio rose from 69.1% in FY2003 to a high of 77.4% in fiscal years 2006 and 2007 before falling to 54.8% in FY2008 and staying fairly flat thereafter, reaching 55.1% in FY2012. The sizeable difference between FY2008 actuarial and market value funded ratios is due to the fact that FY2008 investment returns were much lower than the smoothed returns over five years. The smoothing effect of actuarial valuation of assets is also why the FY2012 actuarial value is lower than the market value. The FY2012 actuarial value is still taking into account some of the loss in value from FY2008 and FY2011 and only reflects some of the growth from high investment returns in FY2012.

Unfunded Actuarial Accrued Liabilities

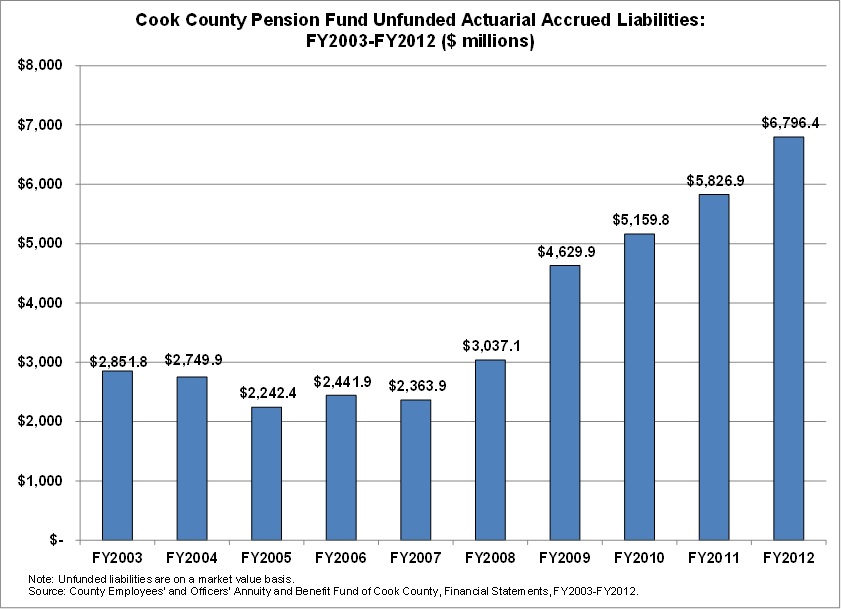

Unfunded actuarial accrued liabilities (UAAL) are those accrued liabilities not covered by actuarial assets. Unfunded liability is calculated by subtracting the actuarial value of assets from the actuarial accrued liability of a fund. The UAAL reflects investment gains and losses smoothed over a five-year period.

One of the functions of this indicator is to measure a fund’s ability to bring assets in line with liabilities. Healthy funds are ones that are able to reduce their unfunded liabilities over time; substantial and sustained increases in unfunded liabilities are cause for concern.

The unfunded actuarial liabilities of the Cook County Pension Fund increased by $3.9 billion between FY2003 and FY2012 to $6.8 billion. In the period between FY2011 and FY2012 the unfunded liability rose by nearly $1.0 billion. This represents a 138.3% increase over the past 10 years and a 16.6% increase between FY2011 and FY2012 alone.

The largest contributor to the $4.0 billion growth in unfunded liabilities between the beginning of FY2005 and the end of FY2012 was investment returns failing to meet the expected rate of return.[1] This added $2.3 billion to the UAAL. The second largest contributor was the shortfall in employer contributions as compared to the annual required contribution (ARC), which added $1.9 billion to the unfunded actuarial accrued liability over eight years.

For more information on the Cook County Pension Fund and the County’s overall financial health, read the Civic Federation’s analysis on the County’s FY2014 Executive Budget Recommendation.

[1] The UAAL reflects investment gains and losses smoothed over a five-year period, so it does not match the annual investment results shown later in this blog. For more information on asset smoothing see Civic Federation, Status of Local Pension Funding Fiscal Year 2011, May 21, 2013.