March 02, 2021

In January 2021, Cook County issued $499.8 million in general obligation and revenue bonds.

A total of $330.5 million was issued by the County in Series 2021A general obligation refunding bonds. These bonds will be used to refund the County’s outstanding Series 2010A and 2010G bonds [1]. The bonds being retired had an average interest rate of 5.2%, while the refunding bonds will carry a blended interest cost of 1.32%. The transaction will save Cook County approximately $104.1 million in interest costs on a net present value basis. The maturity date for this issue will remain at 2033. The County plans to use the savings from this transaction to provide future fiscal capacity for the capital budget and to help meet its goal of ensuring that debt service costs over time do not rise more than 2.0%, with a maximum target of $400 million per year.

An additional $169.3 million was issued in Series 2021A sales tax revenue bonds. The bonds mature in 2041 and have an interest cost of 2.41%. This issue was sold at a premium of $41.9 million above the par amount, for a total amount of $211.0 million [2]. The primary purpose of this issue is to refund all or a portion of outstanding Series 2014D and Series 2018 bonds to be used to refinance capital projects that were originally funded with those debt issuances [3]. The prior bonds were issued and privately placed with PNC Bank in connection with a tax-exempt revolving line of credit [4]. Cook County will use $175.0 million of the bond proceeds to repay the line of credit and $35.0 million to fund capital purchases that occurred between October 18 and November 30, 2020.

Recent Rating Agency Actions

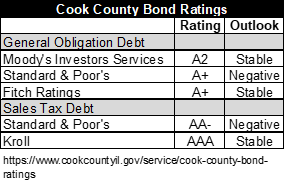

Kroll Bond Rating Agency assigned a AAA rating with a stable outlook to the Series 2021A sales tax revenue bonds on December 18, 2020. At the same time, Kroll affirmed its AAA rating with a stable outlook to the County’s Series 2018 sales tax revenue bonds because the County’s pledged sales tax revenue stream guarantees strong debt service coverage, the issue includes robust bondholder protections and County has a strong and diverse economic base [5].

Fitch provided Cook County’s 2021A refunding bond issue with an A+ rating with a stable outlook on December 18, 2020. The rating agency based its rating on several factors:

- The County has strong reserves, giving it the ability to deal with the fiscal pressures brought about by the COVID-19 pandemic and cyclical economic downturns;

- The long-term liability burden is moderate relative to the County’s tax base;

- The County government has demonstrated its ability to control costs and raise taxes when necessary; and

- The County has addressed its unfunded pension liabilities in part by increasing funding [6].

In January 2020 Standard and Poor’s reduced the credit rating for Cook County general obligation bonds to A+ with a negative outlook from the previous rating of AA- with a negative outlook. It also lowered the rating for the County’s sales tax revenue debt from AA to AA- with a stable outlook. The reason for the downgrade was that although the County had made strides in meeting its employee pension obligations, its ability to fund ongoing obligations remains very challenging [7]. Several months later, in May 2020, Standard & Poor’s lowered the outlook for both general obligation and sales tax revenue bonds to negative. The revised outlook was due to concerns over the financial pressures caused by the coronavirus pandemic [8].

Cook County Credit Ratings

Current Cook County bond ratings as of February 2021 are shown in the table below.

Cook County Approved FY2021 Capital Budget and Plan

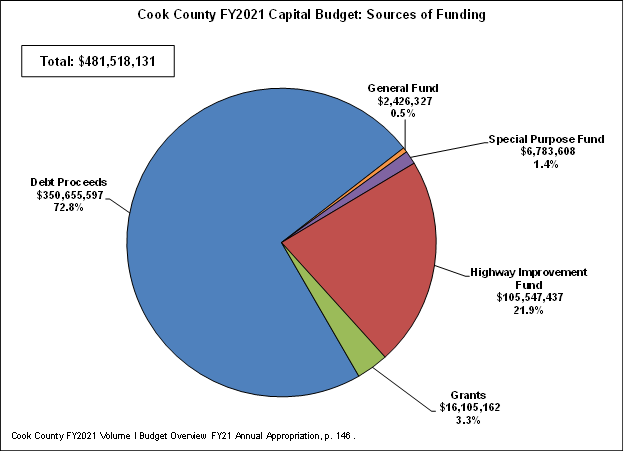

The Cook County Board of Commissioners approved a FY2021 total capital budget of approximately $481.5 million in FY2021. The approved budget was $35.6 million, or 6.9%, less than President Preckwinkle’s originally proposed capital budget of $517.1 million [9].

The graph below shows the sources of funding for the capital budget. Approximately 72.8% of all capital funds, or $350.7 million, will be derived from general obligation debt fund proceeds. Approximately 21.9%, or $105.5 million, of capital funding will come from highway improvement funds. Smaller amounts will be funded by grants, the General Fund and the Special Purpose Funds.

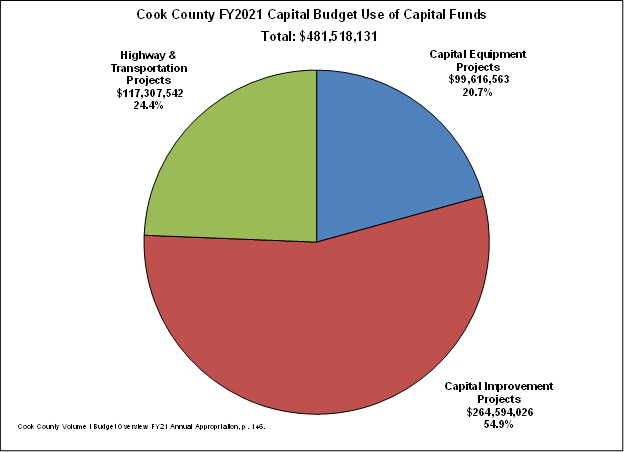

Cook County will use 54.9%, or $264.6 million, of its FY2021 capital budget for capital improvement projects. Highway and transportation projects are expected to total 24.4% of the capital budget, or $117.3 million. Capital equipment investments will account for 20.7%, or $99.6 million, of the total capital budget.

The FY2021-FY2030 Capital Improvement Plan

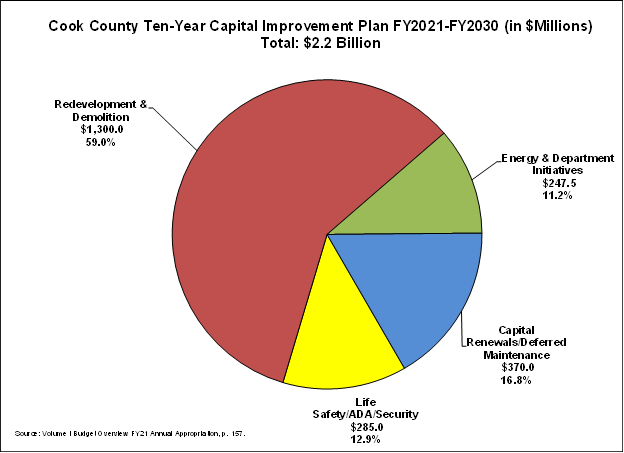

Cook County’s approved 10-year capital improvement plan (CIP) for FY2021 to FY2030 includes approximately $2.2 billion of infrastructure investment. These projects are ranked using a facilities condition assessment [10]. The CIP includes an overview of the proposed infrastructure investment by category of need and area of expense as well as some narrative description of the projects to be undertaken. The document also includes a list of all of the projects included in the CIP and the annual amounts needed for each to complete the plan.

The graph below shows that 59.0%, or $1.3 billion, of the capital expenditures between FY2021 and FY2030 will be earmarked for redevelopment and demolition projects. Approximately 16.8% or $370.0 million, will be used for capital project renewals and to address deferred maintenance. Smaller amounts are earmarked for energy and departmental initiatives and life safety projects, compliance with the American with Disabilities Act (ADA) and security improvements.

[1] Cook County, Official Statement: $330,495,000 General Obligation Refunding Bonds, Series 2021A, January 13, 2021, p. i.

[2] Cook County, Official Statement: $169,280,000 Sales Tax Revenue Bonds, Series 2021, January 14, 2021, p. 19.

[3] Cook County, Official Statement: $169,280,000 Sales Tax Revenue Bonds, Series 2021, January 14, 2021, p. 1.

[4] Cook County, Official Statement: $169,280,000 Sales Tax Revenue Bonds, Series 2021A, p. 1, January 13, 2021. January 29, 2021.

[5] Kroll Bond Rating Agency, KBRA Assigns AAA Rating with Stable Outlook to Cook County, Illinois Sales Tax Revenue Bonds, Series 2021A, December 18, 2020.

[6] Fitch Ratings, Fitch Rates Cook County, (IL)’s 2021A ULTGO Refunding Bonds ‘A+’; Outlook Stable. December 18, 2020 at https://www.fitchratings.com/research/us-public-finance/fitch-rates-cook-county-il-2021a-ultgo-refunding-bonds-a-outlook-stable-18-12-2020.

[7] Rachel Hinton, “Cook County bond rating slips a notch,” Chicago Sun Times, January 10, 2020 at https://chicago.suntimes.com/politics/2020/1/10/21060747/cook-county-bond-rating-s-p-downgrade-notch.

[8] Rachel Hinton, “Cook County bond rating slips a notch,” Chicago Sun Times, May, 1, 2020 at https://chicago.suntimes.com/politics/2020/5/1/21244265/cook-county-bond-rating-outlook-downgraded-negative.

[9] Cook County FY2021 Executive Budget Recommendation, Volume I, p. 144.

[10] Cook County FY2021 Executive Budget Recommendation, Volume I, pp. 154-155.