November 06, 2015

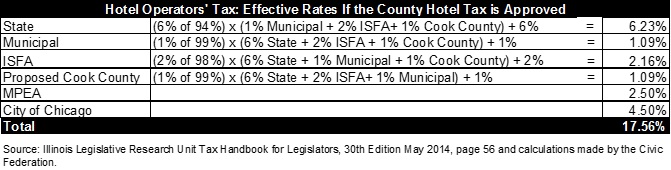

UPDATE: On Monday, November 9, 2015, Cook County Board President Preckwinkle called a special meeting of the Board of Commissioners to address the Hotel Accommodations Tax. On Friday November 6, 2015, the Civic Federation discussed a Hotel Tax based on net receipts; however, the ordinance introduced to the Board indicates that the 1.0% tax will be on gross receipts which will change the effective tax rates discussed previously and are shown in the table below. Because four levels of government would tax gross hotel operator receipts and two levels would tax net receipts, the effective County Hotel Tax rate would be 1.09% and the total Hotel Tax rate would be 17.56%.

On Friday, November 6, 2015, the Office of Cook County Board President Toni Preckwinkle announced that she will propose a new 1.0% tax on hotels in order to close the County’s budget shortfall and fund public safety in FY2016. In her original FY2016 Executive Budget Recommendation, Board President Preckwinkle proposed to eliminate exemptions in the Amusement Tax that were estimated to generate an additional $20.3 million to close the budget gap. However, at a public hearing on the budget, the Cook County Board of Commissioners Finance Committee Chairman John Daley said that there were not enough votes from the full Board of Commissioners to pass an amended Amusement Tax ordinance, which is discussed in more detail below. The County estimates that the 1.0% Hotel Tax will bring in $15.4 million in additional revenue. To help close the budget gap, the County will also seek a total of $750,000 in taxes on ticket resellers (which was originally proposed in the Amusement Tax amendment) and cut expenditures by an additional $4.1 million. The Hotel Tax will put the tax burden on visitors to the City and County. Board President Preckwinkle has not yet presented the Hotel Tax to the Board of Commissioners, so details are not yet known. However, in this blog we discuss the existing Hotel Tax in Chicago which is followed by a discussion of the previously proposed Amusement Tax amendment.

Hotel Operators' Tax

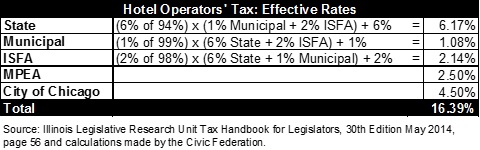

Cook County does not currently impose a Hotel Tax, but is not prevented from doing so under State law as a home-rule unit of government under 55ILCS 5/5-1009. The following section discusses the current Hotel Tax in place in the City of Chicago. The following table exhibits the Hotel Operators’ Tax effective rates. This rate is expressed as an effective rate because three levels of government tax gross hotel operator receipts while two levels tax net receipts. The State, Municipal and Illinois Sports Facilities Authority hotel taxes are all taxes on gross receipts including tax receipts. In order to compensate for this structure and not double-tax, the rates are expressed as a fraction of total receipts, excluding the receipts from collecting the Metropolitan Pier and Exposition Authority tax and the City of Chicago home rule hotel tax. The latter two taxes are applied to net receipts or base charges paid by guests.

The Hotel Operators’ Tax is the only tax available to the Illinois Sports Facilities Authority. The City of Chicago tax also applies to online sales. The Chicago City Council amended the law to clarify that the law applies to online sales on November 13, 2007 with the approval of the FY2008 City Budget. Permanent residents of a lodging place are exempt from the tax.

The most recent increase to the Chicago Hotel Tax was raised on November 2, 2011, when the Chicago City Council approved an ordinance increasing the Hotel Operators’ Tax from 3.50% to 4.50% effective January 1, 2012. If Cook County passes a 1.0% Hotel Tax on net receipts, it would bring the total Hotel Tax in the City of Chicago to nearly 17.4%.

Understanding the Proposed Elimination of Exemptions in the Cook County Amusement Tax

On November 3, 2015, the Cook County Board of Commissioners convened for the second of four public hearings regarding Board President Preckwinkle’s FY2016 Executive Budget Recommendation. Among other objections to tax and fee increases in the proposed budget, the suggestion by the Board President to eliminate many of the exemptions in the Amusement Tax garnered a great deal of attention from members of the public who testified at the hearing. Current Cook County Amusement Tax exemptions include cable television and recreational activities, such as bowling or golf, and the exemption was projected to generate an additional $20.3 million in FY2016. It should be noted that prior to FY2014 the City of Chicago exempted cable television from a portion of the Amusement Tax, meaning it imposed a 4.0% rate instead of the 9.0% tax applied to other amusements; however, the City decreased the Amusement Tax exemption on cable television which increased the rate paid 6.0% on January 1, 2014 and again to 9.0% on January 1, 2015. While Board President Preckwinkle, as noted above, has set aside the Amusement Tax proposal for now, the following discussion provides context for the new proposal above.

What is the Amusement Tax?

The current amusement tax is imposed on admission fees of other charges for live performances, with some exceptions. For example, in Cook County an Amusement Tax of 1% of admission fees or other charges is applied for performances with capacity of 750-5,000 persons; a 1.5% tax is applied to all such performances with capacity over 5,000 persons; and the tax does not apply to such performances with capacity under 750. A tax of 3% applies to other exhibitions, performances, presentations and shows such as movies and sports. There are currently 407 taxable amusement operators registered with the Cook County Department of Revenue.

The Ordinance also defines what the County does not consider “amusement” for tax purposes, or the current exemptions, and states that amusement “shall not mean any recreational activity offered for public participation or on a membership or other basis…” which includes bowling, golf, health club memberships and tennis clubs. Further, the Amusement Tax does not impose a tax on fees or other charges for amusement provided “solely within the confines” of a patron’s home, which includes cable television, or on admission fees for live theatrical or musical performances in venues with a maximum capacity of fewer than 750 people. The FY2016 Cook County Executive Budget Recommendation estimates that the County would generate an additional $20.3 million by expanding the Amusement Tax to include the previously mentioned exemptions. It should be noted that the Board President’s Executive Budget Recommendation did not specify all of the exemptions that would be eliminated, it only provided a few examples, but the entire list of exemptions can be found in the Amusement Tax ordinance.