August 01, 2012

This week the City of Chicago released its Annual Financial Analysis for 2012. According to an executive order issued by Mayor Emanuel on May 20, 2011, the Office of Budget and Management is mandated to produce a financial analysis of the City budget by July 31st of each year. The analysis includes:

• A financial condition analysis that covers the previous ten years including a discussion of key factors impacting the performance of the City’s revenue streams;

• A three-year baseline forecast that describes key assumptions as well as alternative forecasts to show positive and negative variances;

• A reserve analysis that includes the corporate fund reserve and asset lease reserves;

• An analysis of the City’s capital improvement program; and

• An analysis of general debt obligations and long-term liabilities, including pensions.

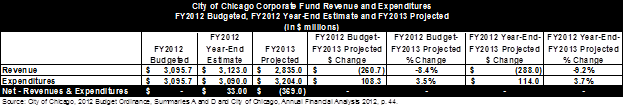

The analysis includes year-end estimates for FY2012. The City’s fiscal year runs from January 1 to December 31, therefore, year-end estimates are based upon the first six months of the fiscal year.

The Annual Financial Analysis for 2012 reports that Corporate Fund revenues for FY2013 are projected to be approximately $2.84 billion. This is approximately $288 million, or 9.2%, less than FY2012 year-end estimates and approximately $261 million, or 8.4% less, than FY2012 budgeted amounts. Expenditures for FY2013 are projected to be approximately $3.20 billion, which is $108 million, or 3.5%, higher than 2012 budgeted expenditures. The Corporate Fund is expected to finish the 2012 fiscal year with a $33 million surplus. However, this surplus is not factored into the gap projection for FY2013, which is projected to be $369.0 million.

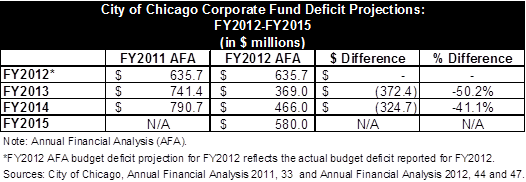

The Corporate Fund budget gap for FY2013 is projected to be $369.0 million. This is a decrease of $372.4 million, 50.2%, from the City’s 2011 Annual Financial Analysis projections when the FY2013 budget deficit was projected to be $741.4 million. Similarly, the projections for the Corporate Fund budget gap for FY2014 has also declined from last year’s estimates, from $790.7 million to $466.0 million, according to the 2012 analysis. The projected budget gap for FY2015 is $580.0 million.

While the budget deficit projections for FY2013 through FY2015 have shrunk substantially from last year’s estimates, the Corporate Fund gap for FY2013 still remains very large - equivalent to 11.5% of total Corporate Fund expenditures.

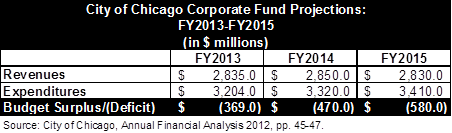

The following chart displays the projected Corporate Fund revenues and expenditures for the next three fiscal years. As shown below, the budget deficits are expected to grow by approximately $100 million each year between FY2013 and FY2015.

Click here to read the second part of this blog post which addresses the City’s future budget stressors included in the 2012 Annual Financial Analysis, such as pension liabilities and long-term debt.