February 20, 2014

As noted in many media reports and in the Civic Federation’s analysis of the City of Chicago’s FY2014 budget, the City balanced its budget in part with a number of targeted revenue enhancements. One of these revenue enhancements was a reduction in the cap on the partial exemption of the amusement tax that is issued to cable television providers. The amusement tax rate is 9% and cable providers were exempted up to 5%. As of January 1, 2014, the exemption was reduced to 3%, leaving cable providers with an effective amusement tax rate of 6%.

The following blog provides a brief summary of the amusement taxes imposed by Cook County and the City of Chicago. For more information about selected consumer taxes in Chicago, including the composite tax rates of overlapping governments, see the Civic Federation’s recently released report here. This blog also provides a look at the City’s revenue projections as a result of its recent change to the amusement tax rate.

Amusement Tax

In Cook County an Amusement Tax of 1% of admission fees or other charges is applied for live theatrical, musical or other cultural performances with capacity of 750-5,000 persons. A 1.5% tax is applied to all such performances with capacity over 5,000 persons. The tax does not apply to such performances with capacity under 750. A tax of 3% applies to other exhibitions, performances, presentations and shows such as movies and sports. The tax may apply to amateur productions, benefits for non-profit organizations, non-profit professional orchestras and operas or participatory activities (e.g., amusement parks, sports games) pursuant to an amendment to the ordinance passed February 1, 2012. Under the amended ordinance, if the Cook County Department of Revenue determines that granting an exemption would result in a potential loss of tax revenue greater than $150,000, the Board of Commissioners would need to provide final approval of the exemption. Prior to February 2012, the tax was not imposed on these organizations if they applied for a waiver from the Department of Revenue.

In Chicago an Amusement Tax of 5% of admission fees and other charges is applied for live theatrical, musical or other cultural performances with capacity over 750 persons. A 9% tax applies to all other performances and participatory events including movies, sports, amusement parks, circuses, pleasure boat rides, dancing, bowling, tennis, weightlifting, etc. Activities that are primarily educational rather than recreational are excluded. Initiation fees and memberships to health clubs are not taxed, but per-event or per-admission fees are taxed at 9%. The current amusement tax rate reflects the City Council’s 1% increase for both live performances and other events as part of the FY2009 City Budget that took effect on January 1, 2009.

Cable television is also taxed at 9% of charges, though the City issues a partial exemption of the tax to cable television providers. With the approval of the FY2014 City Budget, the cap on the partial exemption of the amusement tax issued to cable television providers was reduced from 5% to 3% effective January 1, 2014.[1] As a result, as noted above the net amusement tax rate that cable companies are required to collect will increase from 4% to 6%. This increase may be passed on to consumers in part or in whole.

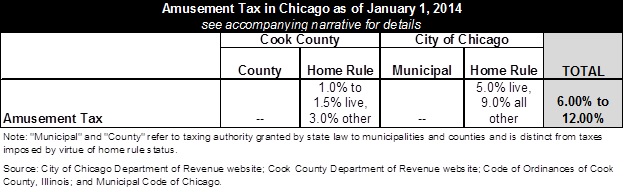

The table below shows the composite amusement tax rate for Chicago consumers. Neither the federal government nor the State of Illinois imposes an amusement tax.

Amusement Tax Revenues for the City of Chicago

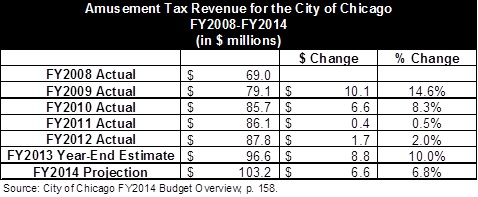

The following chart shows the City’s revenues from the amusement tax for FY2008 through FY2014. The City projects $103.2 million in amusement tax revenues for FY2014, which reflects a $6.6 million, or 6.8%, increase from the FY2013 year-end estimate of $96.6 million. The increase is largely due to the reduction in the partial exemption from the tax for cable companies discussed above. Since FY2008 the highest increase in amusement tax revenues occurred in FY2009, where revenues grew by $10.1 million, or 14.6%. This was due to the 1% increase in the amusement tax rate for live performances and other events that went into effect in 2009, which is also discussed above.

According to the City’s budget books, amusement tax revenues received a bump in FY2013 due in part to the Blackhawks’ championship and the Bulls’ playoff run, the increase in season ticket rates by some sports teams, Lollapalooza ticket sales and a general increase in local tourism.

[1] City of Chicago Municipal Code, Chapter 4-156-020(J)