August 31, 2012

The State of Illinois’ bond rating was reduced again this week but despite being one of the lowest rated state credits it remains well above the level assigned to speculative debt.

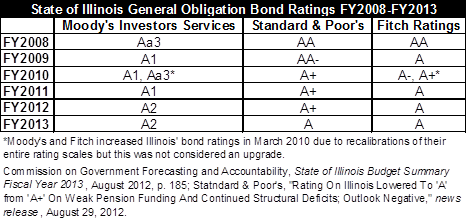

On August 29, 2012 Standard & Poor’s (S&P) reduced the State’s long-term General Obligation (GO) bond rating to A from A+ and issued a negative outlook. This was the third time S&P reduced the State’s bond rating since March 2009, when Illinois was downgraded to AA-. Prior to that downgrade, the State had been rated AA by S&P since at least 1997, according to the most recent budget summary from the Commission on Government Forecasting and Accountability.

The other two major rating agencies, Moody’s Investors Service and Fitch Ratings, have each downgraded the State four times over the same period. However, both increased the State’s bond rating in March 2010 due to recalibrations of their entire rating scales and then downgraded the State again in June 2010.

In the press release accompanying the most recent downgrade, S&P focused once again on the State’s weak pension funding levels and the General Assembly’s lack of action on pension reform during its August 17, 2012 special session. The agency also highlighted the partial sunset of the State’s income tax rates currently scheduled for January 2015, which could further erode Illinois’ operating budget.

When downgrading the State’s GO bonds over the past five years, the rating agencies highlighted several of the same problems facing Illinois. The State’s poor cash position, or lack of available revenue to pay its bills, the FY2010 and FY2011 budgets’ reliance on one-time revenue sources to pay for ongoing operational expenses, the growing imbalance in the operating budget and the State’s unfunded pension liabilities all factored negatively into the ratings. The agencies’ reports consistently question Illinois’ financial stability due to the long-term challenge of properly funding the retirement systems. The criticism centers on the increasing burden of pension contributions on the State’s operating resources as required annual contributions grow to make up for past underfunding and investment losses due to the recession.

Both Moody’s and Fitch have listed the outlook for the State as stable but S&P remains negative even after its downgrade, which could signal future reductions.

The following chart shows the ratings decline for the State’s GO bonds over the last five fiscal years compared to the current ratings.

Debt ratings are one of the factors that weigh heavily in determining the interest rate the State must pay to issue debt. Consequently, declines in the State’s rating lead to an overall increase in debt service costs for Illinois.

The downgrade from S&P comes as the State prepares to issue $50 million in capital bonds in September. The Governor’s FY2013 budget proposal estimates that Illinois will sell a total of $2.1 billion in bonds to support its ongoing capital spending in the current fiscal year. Each time a government entity sells bonds, it applies to one or more rating agencies for an opinion on the bonds. The rating agencies then provide an analysis of the creditworthiness of the government and a bond rating for the issuance. The rating agencies charge a fee for this service, which is part of the total cost of the bond sale.

Illinois’ GO bonds currently have the lowest rating of all 50 states by Moody’s. Ratings for the State’s debt from Fitch and S&P are the second lowest among states, ahead of California which is graded A- by both. California is one notch above Illinois according to the Moody’s scale. The majority of states are rated AA while roughly a dozen have a AAA rating from at least one agency.

However, despite the low ratings compared to other states, Illinois’ bonds are still considered investment grade. This means that investors can be assured of the government’s good credit and face little or no risk of default according to the agencies’ rating definitions. The State would need to be downgraded at least five more levels to be considered at risk of default by the issuer or a speculative grade credit.

Speculative grade bonds are sometimes referred to as junk bonds and typically pay much higher rates of interest to investors due to the additional risk of defaulting on the loans.

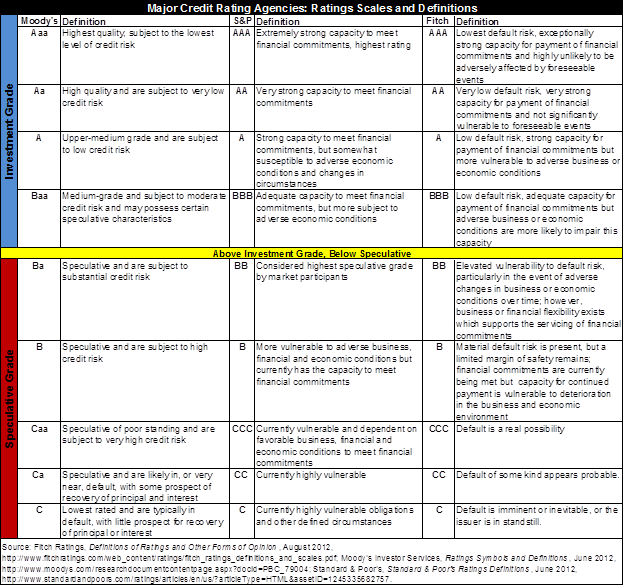

The chart below shows the letter ratings and definitions for each level of bond as described by each rating agency. Within each letter rating the agencies have three grades of credit. Both Fitch and S&P use a plus sign, no sign and minus sign to delineate where within a letter grade the credit stands. Moody’s system is slightly different and includes the numbers 1, 2 and 3 to show a credit’s stratification within a particular letter grade (1 being the highest quality and 3 the lowest).

The State of Illinois maintains a pledge of full faith and credit as part of the State Constitution for all of the GO Bonds. This means that it is legally required to pay the principal and interest that it owes to bond holders before any other expenses of the State. This legally binding commitment to pay bond holders may prevent investors from considering the State’s debt as speculative, despite budget challenges in any given fiscal year. For instance, in FY2012 the State received a total of $33.8 billion in General Funds revenues compared to paying a total of $2.9 billion in debt service for all GO bonds outstanding. Thus the State had more than 10 times the General Funds revenue needed to cover its current GO bond payments.

However, as explained in the Debt Section of the IIFS analysis of the Governor’s proposed FY2013 budget, current State debt levels have more than tripled since FY2002, resulting in a 153.2% increase in annual debt service. This added debt burden, complicated by the higher cost of borrowing, may not in itself present a default risk but it has significantly reduced available resources used to fund the annual cost of providing basic government services in Illinois.