April 29, 2021

The Civic Federation’s recently released Inventory of Local Governments in Illinois report identified a total of 8,923 units of local government in Illinois. This includes 2,826 general purpose governments and 6,097 special purpose governments.

In addition to providing a comprehensive list of local governments in Illinois, the report provides an overview of the different types of local governments in Illinois and their reliance on property taxes and other sources of revenue to fund operations. The report also provides population characteristics of local governments as well as a comparison of the number of local governments in Illinois to other selected states.

The Civic Federation used three primary sources of information to produce the most comprehensive list of local governments in Illinois. These include the Government Master Address File (GMAF) from the U.S. Census Bureau’s 2017 Census of Governments, the Illinois State Comptroller’s registry of local governments, and information provided to the Civic Federation by the Illinois Department of Revenue.

The Civic Federation’s total count of 8,923 local governments in Illinois is greater than the number of local governments reported by the Illinois State Comptroller (8,529), the U.S. Census Bureau (6,918) and the Illinois Department of Revenue (6,042), due to the methodology and the compilation of all three listings to create a composite count. The Federation’s list included in the report is purposefully as inclusive as possible so as to provide a comprehensive view of the totality of local governments in Illinois. The choice to be as inclusive as possible does not mean the other lists are wrong, they simply use different methodologies. You can read more about the differences between the three primary reporting agencies (Illinois Comptroller, U.S. Census Bureau and Illinois Department of Revenue) and the Civic Federation’s list of local governments here.

This blog will examine the municipal form of government in Illinois.

Of the 2,826 general purpose governments identified by the Civic Federation, which include counties, townships and municipalities, 1,298, or 45.9%, of those units are municipalities. All municipalities are either villages, cities or towns.[1]

Municipalities provide basic services such as police and fire, zoning and business regulation. However, not all municipalities provide the same services. Some municipalities provide park and recreation or library services to their residents rather than through a separately elected park or library district and some may operate their own fire department while others may have fire protection provided through a separately elected fire protection district.

Three quarters of municipalities in Illinois are villages. Cities, towns and villages all share the same legal powers and status and are recognized similarly by the State. However, the Illinois Municipal Code does distinguish rules of incorporation and governance for cities and villages.[2] Incorporation of a city or village depends on several things, such as the population of the potential municipality or the population of the county in which it would exist.

The Municipal Code includes general rules of election or appointment for public officials; the designation and number of each official may differ. For instance, the chief executive officer is called a mayor if they serve a city; they are a village president if they serve a village. Cities have aldermen and wards, with the number of aldermen increasing for a city with a higher population, although the number may be reduced by referendum. Villages have six trustees at incorporation, though a village can decrease this count to four if it has fewer than 5,000 residents. Generally, trustee elections do not include primary elections, yet this can be altered by referendum as well. Municipalities with fewer than 500,000 residents may petition to adopt a managerial form of government. Those with more than 5,000 residents and fewer than 500,000 may petition to adopt the strong mayor form of government.[3]

All municipalities have the authority to levy a variety of local taxes, including property taxes, and issue different types of bonds, depending on their home rule status.

Home Rule vs. Non-Home Rule

According to the Illinois Municipal League, there are a total of 217 home rule municipalities in Illinois. A home rule unit of government is permitted to do anything not expressly prohibited by the Illinois Constitution or statutes. Article VII of the Illinois Constitution designates a home rule unit of government as any municipality with a population greater than 25,000 residents. Municipalities with a population less than 25,000 residents can become home rule if approved by referendum. A county with a chief executive officer elected by the county electorate may also become home rule. Cook County is the only home rule county in Illinois. All special districts are non-home rule. Non-home rule units of government are allowed only to take actions explicitly permitted by the Illinois Constitution and statutes. Home rule municipalities may take any action so long as it is not forbidden by the Illinois Constitution or state law.[4] An example of a home rule tax is the City of Chicago’s Bottled Water Tax, which the City can impose because it is a home rule unit of government and because the State has not prohibited it. However, legislation has been enacted in recent years that also allows certain non-home rule municipalities to levy additional local taxes.[5]

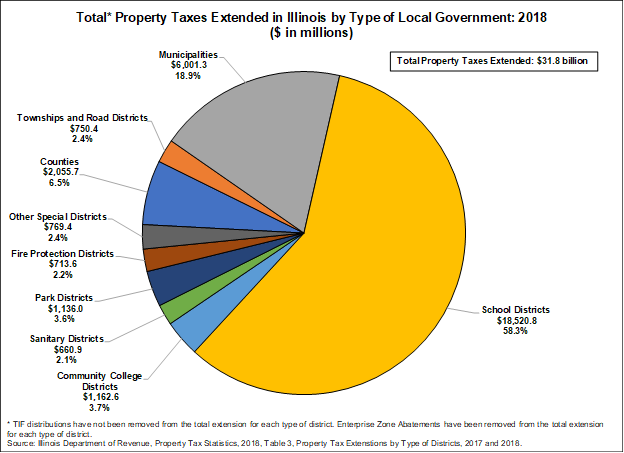

Property Taxes by Type of Local Government in Illinois

The following chart provides an overview of the amount of property taxes levied by type of local government throughout the entire State in 2018. The data in this chart was obtained from the Illinois Department of Revenue’s Property Tax Statistics webpage. When removing the enterprise zone abatements[6]—$35.4 million statewide—from the total extensions statewide, municipalities accounted for $6.0 billion, or 18.9%, of the $31.8 billion in property taxes extended statewide. School districts’ property tax extensions of $18.5 billion accounted for 58.3% of the total taxes levied. Counties levied $2.0 billion, or 6.5%, of the total taxes levied statewide. Townships and road districts accounted for 2.4%, or $750.4 million in taxes levied. All other types of governments included in the chart are special purpose governments and account for $4.4 billion, or 14.0% of the total taxes levied statewide. Of these special districts, community colleges levied the greatest amount at $1.2 billion, or 3.7%, of the $31.8 billion in total property taxes levied statewide.

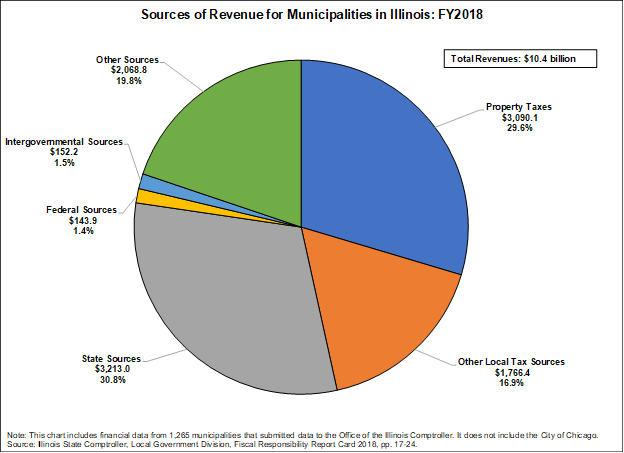

Sources of Revenue for Municipalities in Illinois

The next chart provides an overview of the various sources of revenue that municipalities in Illinois rely on to fund operations. The data included in this chart was obtained from the Illinois Comptroller’s FY2018 Fiscal Responsibility Report Card.

Excluding the City of Chicago and municipalities delinquent in filing their financial reports with the Illinois Comptroller, municipalities in Illinois collected $10.4 billion in revenue in FY2018. Municipalities collected $4.7 billion in local taxes, with $3.1 billion, or 29.6%, from property taxes. State revenues contributed $3.2 billion or 30.8%. State sources of revenue include shared revenues such as the state income tax and local share of the state sales tax, taxes on gaming, motor fuel and the state replacement tax.[7] Intergovernmental revenues, which are funds received by a local government from another non-federal government, such as a jointly-funded program with another local entity, made up 1.5% of municipal revenues with $152.2 million. Other sources, which includes fines, fees, permits, and other miscellaneous revenues accounted for the remaining 19.8% of revenues at just over $2.0 billion. Municipalities received only 1.4% of their funding from federal sources.

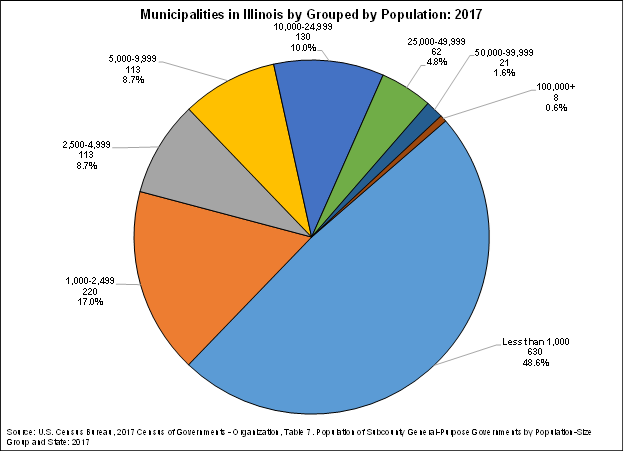

Population Characteristics of Municipalities in Illinois

According to the U.S. Census Bureau’s 2017 Census of Governments, there are 1,297 municipalities in Illinois. Nearly half, or 630 of the municipalities in Illinois have fewer than 1,000 residents. There are 220 municipalities with a population between 1,000 and 2,499 residents. There are 113 municipalities with a population between 2,500 and 4,999 residents and 113 with a population between 5,000 and 9,999. A total of 130 municipalities in Illinois have a population of between 10,000 and 24,999 residents, and 62 municipalities have a population between 25,000 and 49,999 residents. There are only 8 municipalities in Illinois that have more than 100,000 residents. Chicago has the largest population with approximately 2.7 million residents, followed by Aurora with approximately 200,000 residents, and Joliet, Naperville and Rockford all with approximately 147,000 residents. On the other extreme, there are 49 municipalities in Illinois that have fewer than 100 residents.

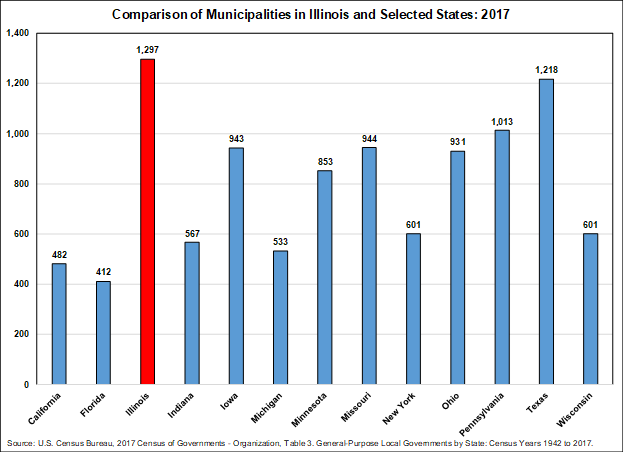

Comparison of Municipalities in Illinois and Selected States

This chart compares the number of municipalities in Illinois and selected states. The data in this chart were obtained from the U.S. Census Bureau’s 2017 Census of Local Governments. Illinois has the greatest number of municipalities in all 50 states at 1,297, according to the U.S. Census Bureau’s 2017 Census of Governments. Texas and Pennsylvania have the second and third highest number of municipalities in all 50 states at 1,218 and 1,013, followed by Missouri and Iowa at 944 and 943, respectively. Of the selected states, Florida has the fewest number of municipalities with 412, followed by California with 482 and Michigan with 533. The number of municipalities in other selected states range from 567 in Indiana to 931 in Ohio.

Related Links:

An Inventory of Local Governments in Illinois

An Inventory of Local Governments in Illinois: Differences Among Reporting Agencies

An Inventory of Local Governments in Illinois: Counties

An Inventory of Local Governments in Illinois: Townships

The Multiplicity of Local Governments in Northeastern Illinois

School Districts and Property Taxes in Illinois

[1] The Town of Cicero in Cook County, Illinois is unique in that it incorporated as a Town rather than a village or city, an option that no longer exists in Illinois statute. Both township and municipal functions are governed by a single board and there is not a separate municipal and township levies.

[2] Any new municipality would be called a village or city. “Town” is no longer used for new municipalities.

[3] 65 ILCS 5.

[4] James M. Banovetz, “Illinois Home Rule: A Case Study in Fiscal Responsibility,” The Journal of Regional Analysis & Policy, 2002, p. 83.

[5] This includes local sales taxes on goods and merchandise as well as a local motor fuel tax, but may only be used for limited purposes.

[6]An enterprise zone is an economic development tool used by local governments to spur development and economic growth. One component of the enterprise zone program is the ability for the increase in assessed value related to improvements made to properties within the enterprise zone to be abated (reduced) by a certain amount. Therefore, the Civic Federation does not include the abated taxes in the data presented.

[7] Illinois State Comptroller, Local Government Division, Fiscal Responsibility Report Card 2018, pp. 20-23.