February 20, 2013

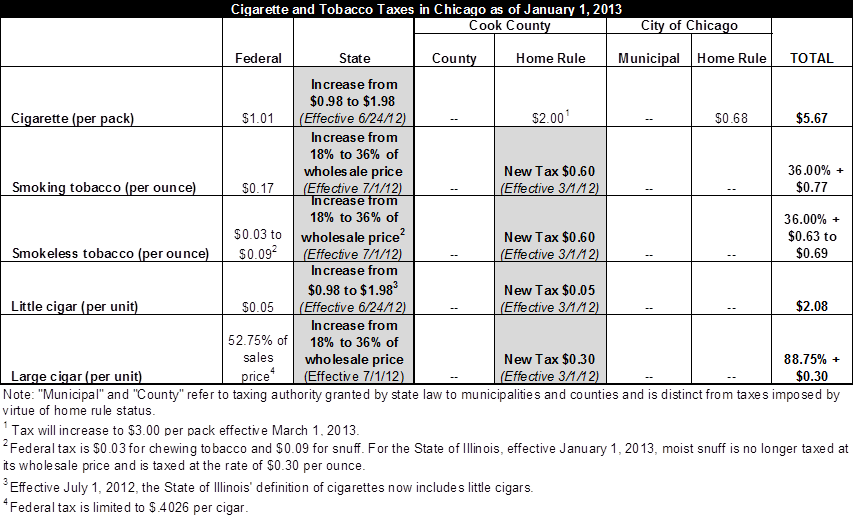

In the past year, Chicago residents have experienced several increases in the taxes imposed on cigarette and tobacco purchases. The new rates are shown in the following chart and are described in more detail below. (Click to enlarge.)

Cigarette Tax (per pack)

Cigarette packs have 20 cigarettes. State and local laws specify tax per cigarette, but per pack is used here for simplicity. On April 1, 2009, the federal tax on cigarettes increased by $0.62 to $1.0066 per pack. Effective June 24, 2012, the State of Illinois increased its cigarette tax by $1.00 from $0.98 per pack of cigarettes to $1.98. Effective July 1, 2012, the State also expanded its definition of cigarettes to include little cigars. See the IIFS blog for more information on the State’s cigarette and tobacco tax changes.

It should also be noted that the tax on cigarettes in Cook County will rise from $2.00 per pack to $3.00 per pack effective March 1, 2013, thereby increasing the composite cigarette tax in Chicago from $5.67 to $6.67 per pack. The increase was approved as part of the County’s FY2013 budget.

(26 USC Sec. 5701)

(35 ILCS 130/1ff and 35 ILCS 135/1ff)

(Code of Ordinances of Cook County, Illinois, Chapter 74, Article X)

(City of Chicago Municipal Code, Chapter 3-43)

Other Tobacco Taxes

Federal, state and local governments also tax other tobacco products. Cook County began taxing these products effective March 1, 2012. County taxes on tobacco include $0.60 per ounce of smoking tobacco and smokeless tobacco, $0.05 per little cigar and $0.30 per large cigar. These taxes were imposed as part of the County’s FY2012 budget, approved in November 2011. There is no City of Chicago municipal tax on other tobacco products.

The State of Illinois imposes a tax on the wholesale price for most non-cigarette tobacco products. Effective July 1, 2012, the State tax on the wholesale price for non-cigarette tobacco products increased from 18.0% to 36.0%. Effective August 1, 2012, roll-your-own cigarette machine operators will be required to pay an annual license fee of $250. While this fee is not a consumer tax, the additional cost may be passed onto consumers. Additionally, cigarettes sold by roll-your-own establishments are also subject to the State’s regular cigarette tax of $1.98 per pack. As of January 1, 2013, moist snuff tobacco products will be taxed at $0.30 per ounce. Previously, moist snuff was taxed at its wholesale price and categorized under smokeless tobacco.

Federal government taxes on tobacco products range from $0.03 per ounce for smokeless tobacco to $0.17 per ounce for smoking tobacco. Large cigars are taxed by the federal government at 52.75% of the sale price, up to approximately $0.40 per cigar.

(26 USC 5701)

(35 ILCS 143/10-1ff)

(Code of Ordinances of Cook County, Illinois, Chapter 74, Article X)

In the coming weeks, the Civic Federation will release its annual Selected Consumer Taxes in the City of Chicago report which includes additional information about the many other consumer taxes imposed on Chicago residents. Last year’s report can be accessed here.