January 31, 2013

On January 23, 2013, the Chicago Public Schools (CPS) released its Comprehensive Annual Financial Report (CAFR) for the 2012 fiscal year. The fiscal year for CPS begins on July 1 and ends on June 30. According to the Board of Education, CPS experienced an unexpected increase in revenue at the end of its 2012 fiscal year, resulting in a net increase of $328 million in general operating fund balance over FY2011.[1] The approximately $344 million in additional revenue was budgeted to be received in FY2013, but came in earlier than expected from two sources: 1) 2012 Cook County property taxes and 2) block grant payments from the State of Illinois. It is important to understand that the $344 million is not new or additional revenue; it is revenue that was expected to be received in FY2013, but arrived earlier than anticipated, at the end of FY2012. Since the funds were received in FY2012, they had to be accounted for in the District’s FY2012 financial statements.

In 2012, for the first time in 33 years, Cook County’s second installment property tax bills were sent out on time, due on August 1, 2012. Therefore, payments were received earlier than in previous years. However, CPS’ most recent budget plan was based on previous years’ revenue patterns when the County’s second installment property tax bills were not completed until later in the calendar year, after the start of the District’s new fiscal year. As a result, CPS received $244 million in property tax revenue in FY2012 instead of in FY2013 as had been budgeted.[2]

Similar to the County, the State of Illinois has historically been behind in its revenue distribution to local governments and CPS has budgeted accordingly. The State of Illinois distributes block grant payments to the District in what should be roughly equal monthly installments of $50 million. However, the State fell behind by approximately six months, or $300 million, during FY2012. CPS anticipated receiving three months of backlog payments from the State by the end of FY2012, but in July, the State caught up to all but one backlogged payment. This added over $100 million to FY2012 revenues that were actually budgeted for FY2013.[3]

In both the proposed and amended FY2013 budgets, the District planned to appropriate $431.8 million of fund balance to help close its $665 million budget deficit. This included $349.0 million from the General Fund fund balance, or the entirety of the District’s anticipated unassigned fund balance. The District would additionally draw down $82.8 million of fund balance from the Special Revenues Fund. Since the revenue received at the end of FY2012 had been appropriated in the FY2013 budget as FY2013 revenue, it can be assumed that the inflated FY2012 fund balance – specifically, the $443.6 million of unrestricted, unassigned fund balance – will be appropriated in its entirety. By draining its General Fund reserves, the District has left itself with no identifiable plan to address its enormous financial challenges, which include a $338.2 million increase in its required pension contributions in FY2014.

Audited Fund Balance

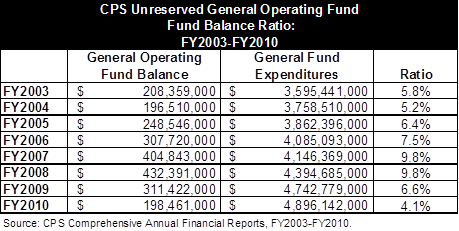

The exhibit below shows ten years of CPS’ general operating fund balance and its ratio to general fund expenditures. A complete ten-year trend analysis of the District’s fund balance ratio including the most recent FY2012 numbers is not possible because data for FY2011 and beyond has been classified differently. Post-FY2011 data reflects the implementation of GASB No. 54, which changed the guidelines for how governments should report fund balances.[4]

Prior to FY2011, the District categorized their unreserved fund balance into designated to provide operating capital and undesignated fund balance. A designation is a subset of the unreserved balance where a limitation is placed on the use of the fund balance by the government itself for planning purposes or to earmark funds.[5] A designation is a loose classification and can be changed by the government relatively easily. As such, when comparing unreserved fund balance levels, we examine both designated and undesignated fund balance. Between FY2003 and FY2010, the District’s unreserved fund balance fluctuated between a low of 4.1% in FY2010 and a high of 9.8% in FY2007 and FY2008.[6] In 2009 the fund balance ratio decreased significantly to an increase in general fund expenditures and a drawdown of fund balance. (Click to enlarge.)

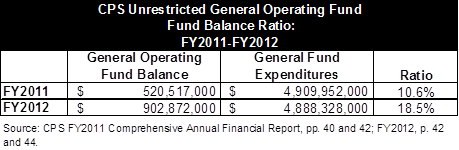

The following chart presents unrestricted fund balance for FY2011 and FY2012. In this exhibit, the District’s net resources including self-imposed constraints amount to $902.9 million, or 18.5% of general fund expenditures. These resources include those assigned for commitments and contracts ($110.4 million) and appropriated fund balance ($348.9 million). The unassigned portion of fund balance – the District’s net resources without constraints, self or externally imposed – amounts to approximately $443.6 million, or 9.1%, of general fund expenditures.[7] Since the unassigned portion of fund balance reflects the revenues budgeted for FY2013 but received at the end of FY2012, the entirety of the $902.9 million unrestricted fund balance will likely be appropriated in FY2013. (Click to enlarge.)

[1] Fund balance is a term commonly used to describe the net assets of a governmental fund and serves as a measure of financial resources. For more information about fund balance and recent changes to the way governments report fund balance per the issuance of GASB Statement 54, see the Civic Federation’s previous blog.

[2] Chicago Public Schools, FY2012 Comprehensive Annual Financial Report, p. 12.

[3] Chicago Public Schools, FY2012 Comprehensive Annual Financial Report, p. 12.

[4] For more information about fund balance and recent changes to the way governments report fund balance per the issuance of GASB Statement 54, see the Civic Federation’s previous blog.

[5] Gauthier, Steven, “Fund Balance: New and Improved,” Government Finance Review, April 2009.

[6] The General Operating Fund and General Fund both refer to the CPS primary operating fund. The audit uses the term General Operating Fund while the budget uses General Fund.

[7] CPS FY2012 Comprehensive Annual Financial Report, p. 103.