January 08, 2019

Click here to read the full report.

Click here to read the press release for this analysis.

AT A GLANCE

- This annual report compares estimated effective property tax rates in the six-county region of northeastern Illinois between 2007 and 2016, the last year for which data are available.

- Effective tax rates increased for all selected communities in the ten-year period analyzed.

MAJOR FINDINGS

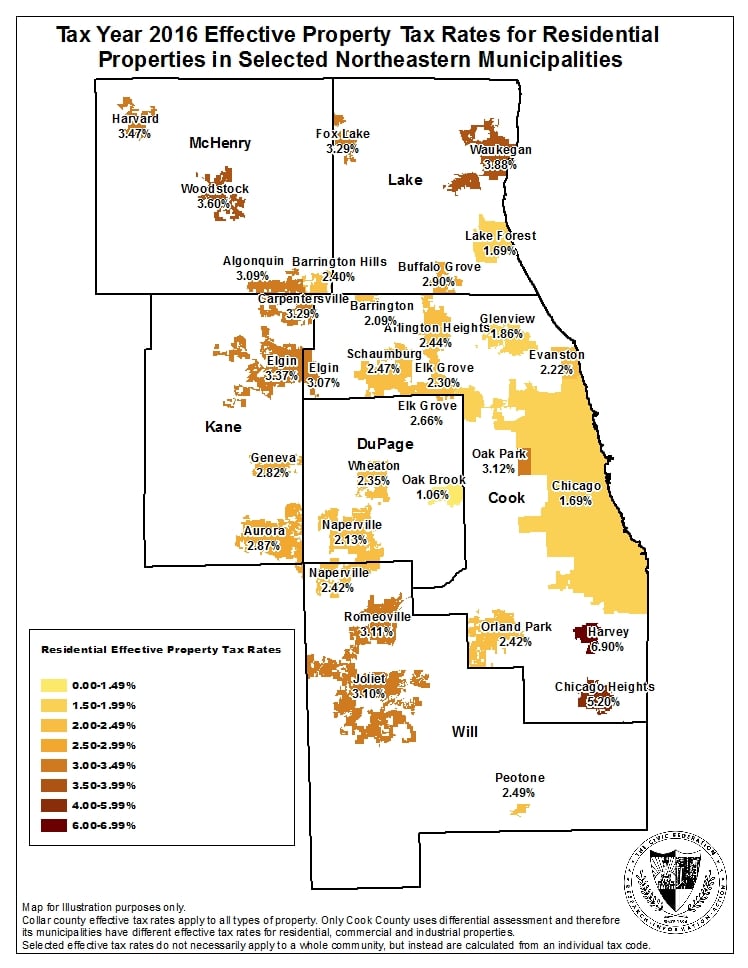

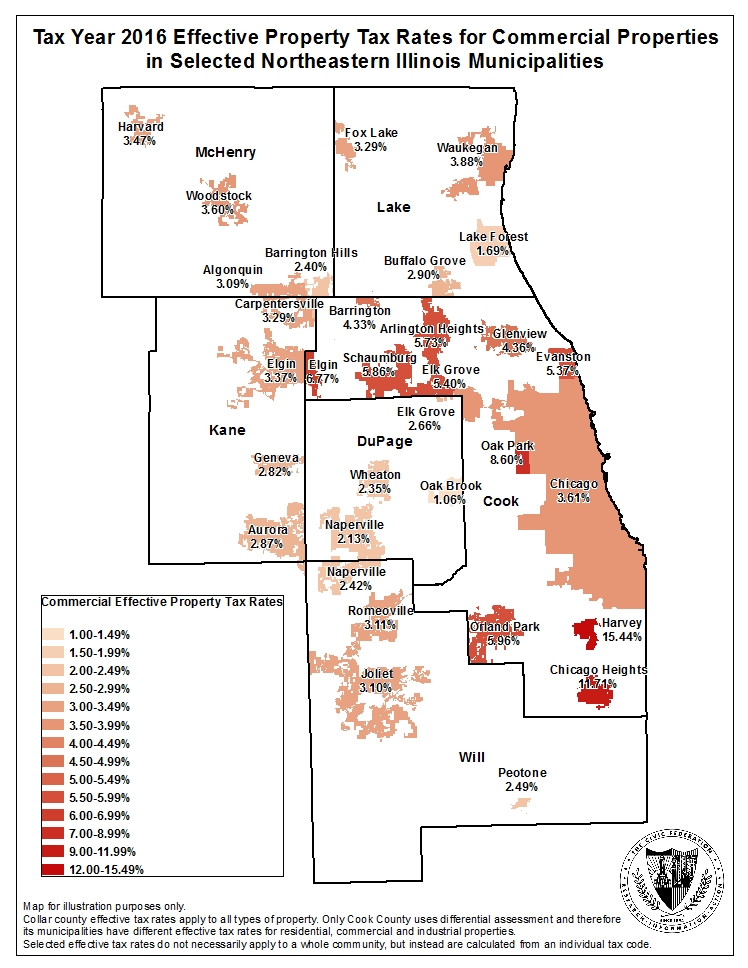

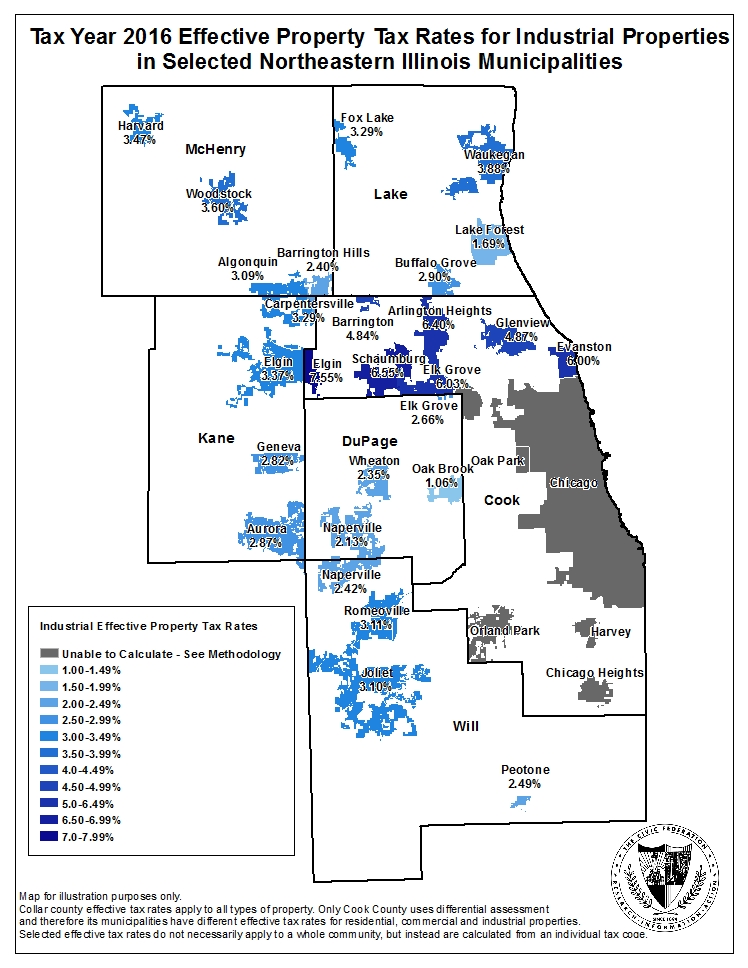

Effective property tax rates are a measure of property tax burden for homeowners and businesses. They translate the tax rates on property tax bills into rates that reflect the percentage of full market value that a property owed in taxes for a given year. This report, produced annually by the Civic Federation, estimates the tax year 2016 (taxes payable in 2017) effective rates for Chicago and 28 other selected municipalities in northeastern Illinois. Of the communities, 12 are in Cook County (including Chicago) and 19 are in the collar counties. There are three municipalities included in the study that are located in two counties: Elgin overlaps Cook and Kane Counties, Elk Grove Village overlaps Cook and DuPage Counties and Naperville overlaps DuPage and Will Counties.[1]

In Cook County, all but four communities– Chicago Heights, Orland Park, Arlington Heights and Elgin – experienced an effective property tax rate increase on residential property in tax year 2016 compared to the previous year. The City of Harvey’s residential effective property tax rate remained flat over the two-year period examined. Commercial property in Cook County experienced a decline across all 12 of the selected communities between tax year 2015 and 2016. Industrial property in the Cook County municipalities for which data were available also declined, with the exception of Evanston and Elk Grove Village, which increased over the two-year period.

There were not enough sales of industrial property in two of Cook County’s three assessment triads[2] in tax year 2016 for the Illinois Department of Revenue to conduct a statistical analysis of assessment to sales ratios. As a result, the Civic Federation was only able to calculate the 2016 estimated effective tax rates for Cook County industrial properties in the North Triad, and not the Chicago and South Triads (see Methodology). The Illinois Department of Revenue has not been able to calculate a median level of assessment for industrial properties in the south and southwest suburbs of Cook County since 2009.

In the collar counties, the effective property tax rate for all property decreased across all of the selected communities between tax year 2015 and 2016, with the exception of the City of Lake Forest, which increased 0.9% over the two-year period.

In the ten-year period between tax years 2007 and 2016, the effective tax rates increased in all of the selected communities including in Chicago, Cook County and the collar counties.

City of Chicago

- The City of Chicago had an effective residential tax rate of 1.69% in 2016, the lowest of the 12 selected Cook County communities for residential properties.[3] The rate increased from 1.66% the prior year.

- The City’s effective tax rate for commercial properties remained at 3.61% in 2016, the same rate as the prior year. The City’s 2016 commercial rate was the lowest effective tax rate of the 12 selected Cook County communities. As noted above, the Civic Federation was not able to calculate an effective tax rate for industrial properties in Chicago in 2016.

- Over the ten-year period between 2007 and 2016, the residential effective tax rate in Chicago increased by 35.3% from 1.25% to 1.69% of full market value.

- The commercial effective tax rate increased by 63.6% between 2007 and 2016, from 2.20% to 3.61% of full market value.

Suburban Cook County: Selected Communities (11)

- Harvey had the highest 2016 effective tax rates among the eleven selected suburban communities, at 6.90% for residential and 15.44% for commercial properties. Harvey’s commercial effective tax rate decreased by 13.5% compared to the prior year from 17.84% in 2015 to 15.44% in 2016.

- Four of the selected suburban Cook County communities experienced a decrease in effective property tax rates for residential properties between 2015 and 2016: Chicago Heights, Orland Park, Arlington Heights and Elgin. The remaining seven communities saw increases in effective residential rates, with the exception of Harvey, which remained flat over the two-year period examined.

- All eleven of the selected Cook County suburban communities experienced decreases in commercial effective tax rates between 2015 and 2016.

- All of the selected suburban Cook County communities experienced an increase in residential effective tax rates over the ten-year period between 2007 and 2016. The increases in the effective tax rates ranged from a 21.7% increase in Arlington Heights to a 98.0% increase in Chicago Heights.

- Among selected north suburban communities for which an industrial estimated effective property tax rate could be calculated, Elgin had the highest estimated effective industrial tax rate at 7.55% and Barrington had the lowest at 4.84%. An estimated effective property tax rate for communities in the south suburbs could not be calculated as there were not enough sales of industrial property for the Illinois Department of Revenue to compute industrial median levels of assessment.

- The north suburban community with the highest estimated ten year increase in industrial tax rates was Elk Grove Village, whose effective rate increased by 88.2% or from 3.2% in 2007 to 6.03% in 2016. All of the selected north suburban communities experienced an increase in industrial effective tax rates over the ten-year period.

Collar Counties: Selected Communities (19)

- Waukegan had the highest effective tax rate among the 19 selected collar county communities in 2016 at 3.88%, which was an 11.4% decrease from Waukegan’s tax rate the prior year.

- Oak Brook had the lowest 2016 effective property tax rate among the selected collar county communities at 1.06%, compared to 1.13% the prior year.

- All but one of the 19 selected collar county communities experienced decreases in effective property tax rates from 2015 to 2016. Lake Forest was the sole community that saw a slight increase.

- Over the ten-year period from 2007 to 2016, all 19 collar county selected communities experienced increases in effective tax rates. The largest increase occurred in Carpentersville, an increase of 55.4% from 2.11% in 2007 to 3.29% in 2016. Naperville (in Will County) had the smallest increase over the ten-year period, rising by 17.4% from 2.06% in 2016 to 2.42% in 2016.

The following maps illustrate the estimated effective property tax rates for residential, commerical and industrial property in selected northeastern Illinois communities in tax year 2016.

RELATED

Calculate Your Community’s Effective Property Tax Rate

School Districts and Property Taxes in Illinois

The Final 2017 Cook County Equalization Factor is 2.9627

Click here to read the full report.

Click here to read the press release for this analysis.

[1] These overlapping municipalities were chosen to enable the reader to examine differentials in tax rates that occur in one community.

[2] Cook County is divided into three districts (or “triads”) for the purpose of property assessment: City of Chicago, north/northwest suburbs and south/southwest suburbs.

[3] In this report, “residential” refers to Class 2 properties, which are single family homes, condominiums, cooperatives, and apartment buildings of up to six units. Larger apartment buildings (Class 3) are not included for the purposes of this report. As discussed later in the report, the estimated residential rate is without homeowner exemptions, which would lower the rate.