March 10, 2023

The State of Illinois FY2024 budget proposed by Illinois Governor JB Pritzker, reflects the State’s strong financial position following its economic recovery from the COVID-19 pandemic. The State has taken positive steps over the past several years to eliminate $4.5 billion in debt from the Unemployment Insurance Trust Fund, pay back $3.2 billion in federal Municipal Liquidity borrowing, pay down its bill backlog and make supplemental contributions to the State’s pension funds. The State has made contributions totaling $1.9 billion in FY2022 and FY2023 to its Budget Stabilization Fund (rainy day fund), which had been nearly empty for five years following the State budget impasse that took place from 2015 to 2017. An additional $138 million is estimated to be contributed to the rainy day fund based on a projected surplus at the end of FY2024. These steps to pay off liabilities and increase reserves were recognized as contributing factors to recent credit rating upgrades, including the most recent by S&P.

This blog post provides a brief summary of the Governor’s proposed FY2024 budget. The Civic Federation plans to release a full analysis of the budget later this spring ahead of the General Assembly’s final budget adoption. This blog also does not incorporate the updated revenue projections for FY2023 and FY2024 recently released by the Commission on Government Forecasting and Accountability.

FY2024 Proposed Budget

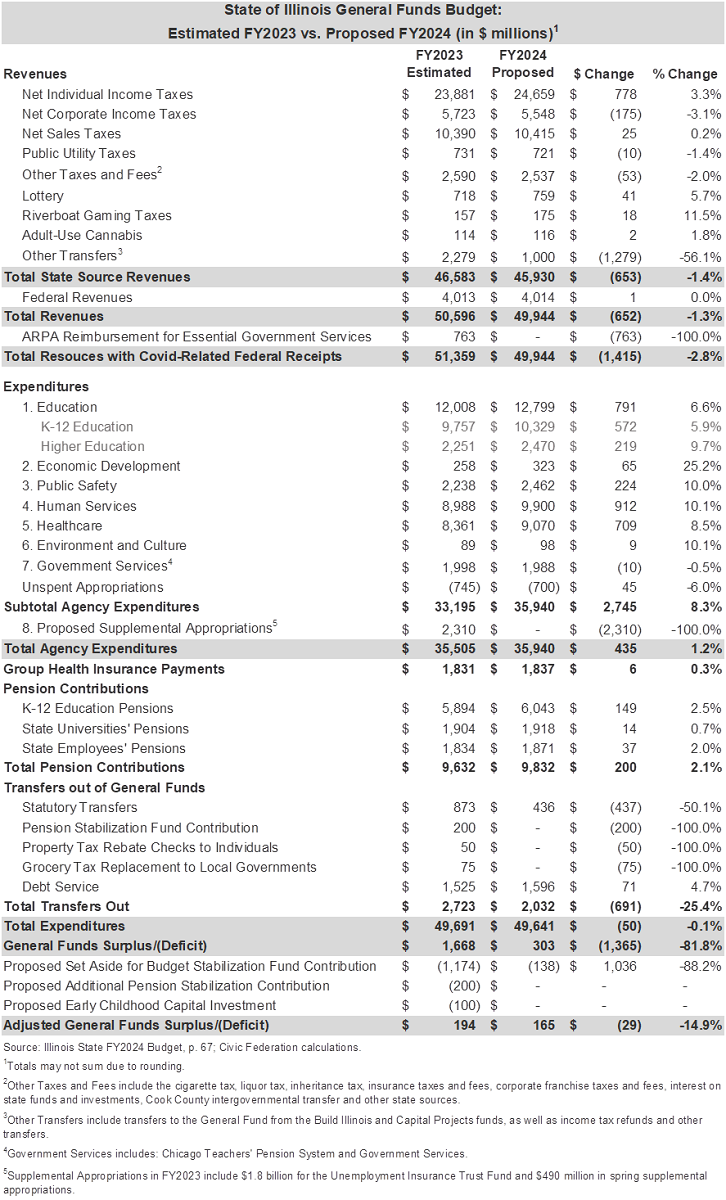

The Governor’s recommended General Funds operating budget introduced on February 15, 2023 proposes spending of $49.6 billion. This level of General Funds spending represents a very small overall decrease of $50 million, or 0.1%, compared to the estimated expenditures for the current 2023 fiscal year, which ends on June 30. Total proposed FY2024 expenditures include agency expenditures of $35.9 billion, employee healthcare expenditures of $1.8 billion, pension contributions of $9.8 billion and transfers out of the General Funds to other parts of the budget totaling $2.0 billion.

While total proposed FY2024 expenditures are nearly flat from the prior year, agency expenditures are actually proposed to increase from FY2023 by $2.7 billion, or 8.3%. With fairly conservative revenue projections for FY2024 anticipating a potential mild recession, a question going forward will be how sustainable these the proposals for increased agency spending are for future years.

Despite the large increase in agency expenditures, the overall General Funds expenditures in FY2024 only decrease slightly from FY2023. This is due to large supplemental appropriations the State will make in FY2023 totaling $2.3 billion to pay off debt. These supplemental appropriations include a payment of $1.8 billion to the Unemployment Insurance Trust Fund and $490 million in supplemental appropriations to be spent in spring 2023 on additional pension contributions and early childhood programs. The $1.8 billion payment to the Unemployment Insurance Trust Fund will pay down the remaining $1.3 billion federal loan balance from the pandemic, and $450 million will be placed into the Trust Fund as an interest-free loan.

There is a decrease in supplemental appropriations of $2.3 billion between FY2023 and FY2024 because supplemental appropriations are not made until after the annual budget is enacted, which partially balances out the agency spending increase of $2.7 billion.

The Governor’s proposal includes fairly conservative revenue projections based on assumptions that economic conditions will slow down following strong economic growth in FY2022 and FY2023. The FY2024 budget proposal projects total revenue of $49.9 billion, down 2.8%, or $1.4 billion, from FY2023 estimated total revenues of $51.4 billion. FY2024 revenues include $45.9 billion in State taxes and other sources and $4.0 billion in federal revenues. The FY2024 proposal does not include any federal American Rescue Plan Act (ARPA) revenue replacement funds, whereas FY2023 includes $763 million in ARPA revenue replacement within the General Funds.

The following table compares the Governor’s proposed budget plan for FY2024 with the estimated budget results for FY2023, including proposed supplemental appropriations.

Revenues

Total General Funds revenues in the Governor’s FY2024 proposal are projected to be $49.9 billion, a decrease of $1.4 billion, or 2.8%, from $51.4 billion in FY2023. Certain revenues are expected to increase in FY2024; in particular, individual income taxes are expected to perform better than the prior year by $778 million. However, revenues are expected to decrease overall due to a large decrease in Other Transfers into the General Fund from other funds such as Build Illinois and Capital Projects funds, a much larger than usual transfer from the Income Tax Refund Fund in FY2023, and the fact that no ARPA funding is budgeted as revenue in FY2024.

The FY2023 estimate for total revenues from state taxes, federal funding and transfers into the General Fund, but not including ARPA funding for essential government services, is projected to be $50.6 billion. This estimate is $4.9 billion above the FY2023 enacted budget and $1.2 billion above the Governor’s Office of Management and Budget forecast published in November 2022. This revised projection for FY2023 revenue is due to a larger than anticipated transfer in from the Income Tax Refund Fund, strong growth in revenue sources linked to economic activity such as income taxes and sales taxes, and the timing of a transfer of ARPA revenue replacement funds into the General Revenue Fund.

In addition to the $50.6 billion in revenue from state taxes, federal funding and transfers, the State will use $763 million in ARPA funding for essential government services in FY2023. As of FY2023, all of the State’s $8 billion ARPA funding has been allocated, although the State has until 2026 to spend the dollars.

Revenue from individual income taxes, the State’s largest tax source, is projected to be $24.7 billion in FY2024, an increase of $778 million, or 3.3%, above the current FY2023 estimate. This FY2024 projection accounts for a slowdown of economic activity. Corporate income tax revenue is projected to decline by 3.1% in FY2024, from the FY2023 estimate of $5.7 billion to $5.5 billion due to an anticipated weakening in corporate tax receipts following strong growth and high inflation in FY2023. Sales taxes are expected to generate $10.4 billion in FY2024, which represents a very small increase of $25 million from the FY2023 estimate. The sales tax estimate reflects slower inflation and smaller growth in General Funds receipts because of increased amounts of sales tax revenue being deposited into the Road Fund.

Most other sources of tax revenue are projected to remain fairly flat compared to the FY2023 estimate. Federal revenues are also expected to remain level between FY2023 and FY2024. Federal revenue declined in FY2023 due to the phasing out of enhanced federal Medicaid matching provisions and continuous enrollment requirements enacted during the pandemic.

Expenditures

The proposed total FY2024 General Funds spending of $49.6 billion represents a small decrease of $50 million, or 0.1%, from the FY2023 estimate of $49.7 billion.

The FY2023 estimated expenditures include $2.3 billion in supplemental appropriations approved by the General Assembly mid-year, which will be spent before the end of the current fiscal year on June 30. These include:

- A payment of $1.8 billion to the Unemployment Insurance Trust Fund, adopted through Public Act 102-1121, effective January 23, 2023; and

- $490 million in proposed spring supplemental appropriations for FY2023.

There is a large reduction in transfers out of General Funds. Transfers out will decrease by $691 million, or 25.4%, to $2.0 billion in FY2024.

Contributions to the State’s pension funds are projected to increase by $200 million, or 2.1%, for a total of $9.8 billion in pension contributions in FY2024. The FY2023 budget includes an additional $200 million above the required funding level to the Pension Stabilization Fund, plus another proposed $200 million. The FY2024 proposal does not make another $200 million contribution in the Governor’s proposed FY2024 budget. Pension contributions make up 19.5% of the State’s FY2024 General Funds budget.

Group Health Insurance payments, which are for employee healthcare benefits, will total $1.8 billion in FY2024, which is in line with the prior year.

Agency expenditures are proposed to increase from $33.2 billion in FY2023 to $35.9 billion in FY2024, an increase of $2.7 billion, or 8.3%. The Governor’s FY2024 budget proposes initiatives to increase funding for education, human services and healthcare. These are discussed in further detail below.

Education

The Governor’s FY2024 budget proposes an increase in education appropriations of $791 million, or 6.6%, within the General Funds, totaling $12.8 billion. This includes $10.3 billion in K-12 education spending and $2.5 billion in higher education spending. K-12 education will increase by $572 million, or 5.9%, and higher education will increase by $219 million, or 9.7%.

Several of the Governor’s key education initiatives for FY2024 include:

- Early Childhood Education:

- Smart Start Illinois, providing $250 million in early childhood education. This program includes: $75 million for the Early Childhood Block Grant to increase preschool access; $130 million in federal funding for Childcare Workforce Compensation Contracts; an additional $40 million for Early Intervention programs; and $5 million to expand the Department of Human Services’ Home Visiting Program.

- Additional early childhood investments including: $100 million in capital funds for early childhood providers; $70 million for the Childcare Assistance Program; and $20 million for upgrades to the child care payment management system.

- K-12 Education:

- Additional funding of $350 million for the Evidence-Based Funding Formula.

- A $70 million appropriation for Teacher Pipeline Grants, which will provide formula-driven grants to 170 school districts with the greatest need to reduce unfilled teaching positions.

- An $86.4 million increase in grants for Mandated Categorical Programs which provide transportation and special education services.

- Higher Education:

- An increase of $100 million to Monetary Award Program (MAP) funding, which covers tuition and fees for low-income community college students and some public university students.

- An operational increase of $100 million (7%) for public universities and community colleges.

Human Services

Proposed General Funds appropriations for human services increase by $912 million, or 10.1%, to $9.9 billion in FY2024 from estimated expenditures of just under $9 billion in FY2023. One of the Governor’s major human services initiatives is Home Illinois, which will target homelessness prevention and services. This program proposes funding of $350 million from the Department of Human Services and other agencies for homelessness-related programs. The Governor also proposes an increase of $200 million for support services for people with developmental disabilities, a $50 million increase to Temporary Assistance for Needy Families, and a $27.4 million increase for the Community Care Program through the Department on Aging.

Healthcare

Healthcare expenditures, which encompass Medicaid spending, are proposed to increase by $709 million, or 8.5%, from $8.4 billion to $9.1 billion in FY2024. This increase for the Department of Healthcare and Family Services is mostly due to the phase-out of enhanced federal Medicaid match revenue and the end of the Medicaid continuous enrollment requirement beginning in spring 2023.

Other healthcare initiatives include an investment of $450 million over multiple years to preserve and grow the healthcare workforce, especially in underserved areas of the State, as well as $25 million for increases in reimbursement rates to healthcare providers.

Public Safety

Public Safety expenditures will increase by $224 million, or 10%, to a total of $2.5 billion in the proposed FY2024 budget. Among other priorities, the FY2024 budget provides funding of $17.5 million to support two cadet classes to graduate 200 additional sworn troopers and a $155 million increase for personal services to staff the 28 correctional facilities across the State and the recently operational Joliet Inpatient Treatment Center.

Budget Surplus

The State anticipates a year-end FY2023 surplus of $1.7 billion, and proposes to direct $1.2 billion of that surplus to the rainy day fund to build up the State’s reserves, $200 million to additional pension stabilization contributions, and $100 million to early childhood capital investments. If enacted, the additional spending would reduce the FY2023 surplus to $194 million.

The Governor’s proposed budget anticipates that with revenues of $49.9 billion and expenditures of $49.6 billion, the State will end FY2024 with a $303 million surplus. After accounting for a transfer of $138 million to the Budget Stabilization Fund, or rainy day fund, the State anticipates ending the year with a surplus of $165 million.

Bill Backlog

In recent years, substantial progress has been made in reducing the State’s bill backlog of accounts payable and short-term borrowing. As of the Governor’s budget introduction, the backlog of unpaid bills has been mostly eliminated. This is significant progress since the height of the bill backlog totaling $16.7 billion, which occurred in 2017 due to the State budget impasse. The backlog was $8 billion as of 2019 and improved further to $1.4 billion as of December 31, 2022. The Governor’s budget projects that there will be $1 billion in outstanding accounts payable and short-term debt as of June 30, 2023, consisting primarily of bills with a due date of under 30 days and transfers to other state accounts.

The reduction in outstanding bills has also reduced State spending on late payment interest penalties. The State Prompt Payment Act imposes a 1% per month interest penalty on bills that remain unpaid by the State after 90 days, which is an annual rate of 12%. Additionally, late payments for certain healthcare services under the State Employees Group Insurance Program accrue an interest rate of 9% annually after a bill payment is delayed by 30 days or more. Late interest payments reached a high of $981 million in 2018, which has been reduced to just $8 million year-to-date in FY2023.