August 23, 2011

On Monday the Civic Federation released its analysis of Chicago Public Schools $5.9 billion FY2012 budget proposal. The Federation supports the proposal as it provides a reasonable short-term plan to fund the District’s core educational mission during its difficult, deepening financial crisis. However, the Civic Federation has major concerns about the long term fiscal health of the District due to the prospect of enormous budget shortfalls in the coming years, particularly with the end of a partial pension contribution holiday in FY2014.

The Civic Federation is also concerned about Chicago Public Schools’ plan to use $181.3 million of its General Fund balance and $59.8 million of restricted fund balance for a total of $241.1 million in reserves to help balance the budget. Occasional use of reserve funds may be reasonable, particularly if there is a severe economic situation or if a government has historically maintained an adequate cushion for contingencies or delayed revenues. However, it is not sound fiscal practice to consistently use a one-time resource such as reserve funds in lieu of recurring revenues. Such repeated use is a strong indicator of a structural deficit.

Fund Balance Variance at CPS

Legally, CPS must balance its budget annually, ensuring that expenditures are paid for with available resources. The resources available to meet the District’s spending goals include revenues from taxes, federal aid and state aid, as well as non-revenue sources such as fund balance, short-term borrowing and transfers from other funds. If appropriated expenditures exceed appropriated revenues, it indicates that the District expects to use fund balance or other resources to cover the gap between revenues and expenditures. If the District does not use resources such as fund balance to meet spending, it may close the gap by reducing its spending from the original appropriated amount. While it may be possible for the District to spend more than it receives in revenue for a few years, this is not a sustainable long-term practice because it ultimately drains reserve funds and other resources.

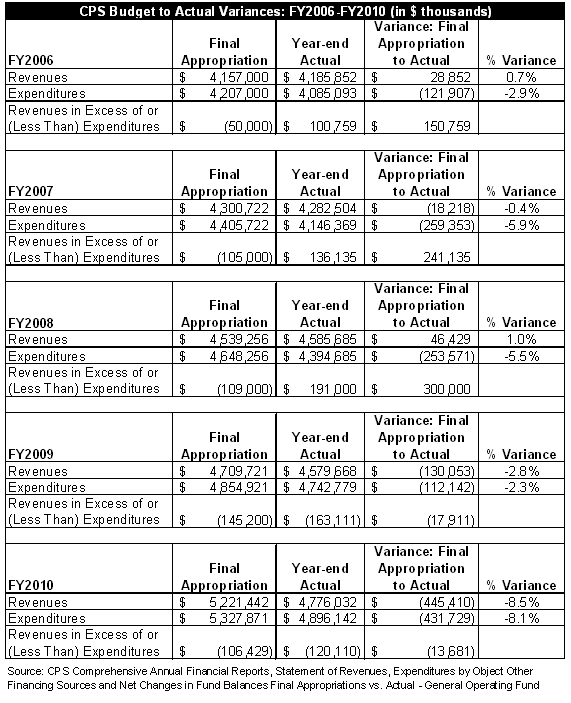

The exhibit below shows the variance between CPS General Operating Fund budgets and actual spending and revenue between FY2006 and FY2010. For each of the five years, the final appropriation expenditures exceeded revenues, meaning that the District had budgeted some other resource such as fund balance to make up the difference. In FY2006 through FY2008, CPS was actually able to finish the year with expenditures less than revenues—a positive outcome. It accomplished this primarily by reducing actual spending from the originally appropriated amount. The variance between the original expenditure appropriations to the amount actually spent ranged from -2.9%, or a reduction of $121.9 million, in FY2006 to -5.5%, or a reduction of $253.6 million, in FY2008. There also were small increases in revenue collections above original appropriations in FY2006 and FY2008 that helped to close the gaps.

In FY2009 and FY2010 the situation changed. CPS continued to spend less than was originally appropriated but revenues actually collected were much less than originally appropriated, reflecting reductions in federal aid, reductions and slow payment of State source revenues and the impact of slow economic growth on Personal Property Replacement Tax receipts and investment returns. In FY2009 actual revenues were $130.0 million, or 2.8%, less than appropriated. The next year, revenues were $445.4 million, or 8.5%, less than appropriated. Spending in these years was reduced as before, but the District still ended fiscal years 2009 and 2010 having spent $163.1 million and $120.1 million more, respectively, than it received in revenues. During those years, the District used non-revenue resources, primarily fund balance, to meet expenditures. In effect, CPS drew down its “savings account” or “rainy day” fund to pay for its spending obligations. As noted above, such a strategy is not sustainable in the long-term as fund balance is depleted.

The next exhibit graphically displays the difference described above between CPS revenues and expenditures from FY2006 through FY2010. In FY2009 and FY2010, end of year losses were greater than anticipated due to insufficient revenues, despite efforts made by the District to reduce spending. In those years, meeting actual expenditures required relatively large infusions of fund balance resources.

Please read the Civic Federation’s analysis of the FY2012 budget for detailed descriptions of the Federation’s concerns as well as elements of the District’s budget that the Federation supports.