October 03, 2019

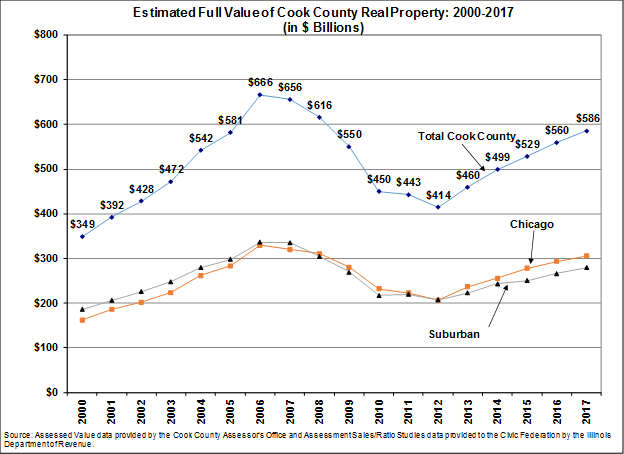

The Civic Federation recently released its annual estimate of the full value of property in Cook County. The 2017 estimated value of all Cook County real estate was $585.6 billion. The 2017 estimates represent the fifth year in a row in which real estate values in Cook County increased after six straight years of decline.

The 2017 total value estimate is an increase of $26.1 billion, or 4.7%, from the 2016 estimated full value. However, the 2017 full value of real estate is still $80.4 billion, or 12.1%, lower than it was at the peak of $666.2 billion in 2006. Between 2000 and 2006, property values in both Chicago and suburban Cook County increased each year, rising by a combined $317.3 billion or 90.9%. With the housing crisis in 2007, real estate values began to decline, hitting a low point of $414.4 billion in 2012. Since 2012, the estimated value of total real estate in Cook County has increased by $171.4 billion or 41.4%.

City of Chicago real estate has increased by 47.9% since 2012. The estimated value of real estate in Chicago has exceeded 2005 levels, but is still $23.4 billion below the 2006 peak. In the Cook County suburbs, the estimated value of real estate has increased by 34.8% and has almost recovered to 2004 levels.

This estimate of real estate in Cook County is calculated using two data sources: the total assessed value of property as reported by the Cook County Assessor’s Office and the median level of assessment reported by the Illinois Department of Revenue. The estimate does not include railroad properties or properties that are exempt from real estate taxes.

The Illinois Department of Revenue collects data on property sales and calculates the ratio of assessed values to sales values. That data is used to compute the median assessment-to-sales ratio, or the median level of assessment.

The Civic Federation estimates the full value of property by dividing the median level of assessment into the total assessed value of each class of property in Cook County. For those classes for which the Department of Revenue does not calculate a median level of assessment, the level set by County ordinance is used.